Insider Purchases: Inside the Buy

Tag: Turnaround Stocks

CarMax (KMX): Where Insiders Keep Buying — And Cars Keep Driving Off (Mostly the Lot)

Insiders and institutions are revving up for CarMax’s comeback — even as used car sales slow and margins tighten. With shares 70% below their peak and a major digital overhaul underway, this could be the turnaround ride of the year. 🚘📉 Or just another trip to the mechanic.

Eastman Kodak (KODK): Insider Buys, Debt Drama & a Pivot to Pills?!

Eastman Kodak insiders are snapping up shares, with CEO Jim Continenza leading the charge. But Kodak’s finances are shaky, its debt heavy, and its pivot to pharmaceuticals uncertain. High risk, high reward — or just a faded picture?

Not Everybody Likes Hunting, But Insiders Preyed On Sportsman's Warehouse's Stock

Sportsman's Warehouse (SPWH) may be wounded, but insiders are on the prowl. With CEO and directors buying stock, and a valuation that screams “cheap,” is this outdoor retailer staging a comeback? Time to load up—or duck?

Magnera: Insiders Keep Buying… Should You?

Magnera’s boardroom is buying diapers—literally. With insiders piling in and free cash flow returning, this specialty materials firm might be worth more than just its wipes. But don’t forget the debt and diaper jokes.

Can Sweetgreen’s Stock Get Any Less Bitter?

Sweetgreen just served up its first insider buy since IPO—should investors take a bite? The fast-casual salad giant keeps growing but hasn’t turned a profit. We chop into the numbers, spice it up with fun, and toss in all the risks. 🥗📉

Xerox Holdings: This Company Still Exists—To Be or Not To Be... In Your Portfolio?

Xerox might feel like yesterday’s news, but insiders and institutions clearly disagree. With executives loading up on shares and a reinvention strategy underway, this classic name could be more than a relic—it might just be your next contrarian play. 📠💥

Can V.F. Corporation Face North and Land More Than Timber?

Insiders are buying, the CEO’s betting big, and the stitches are finally tightening at V.F. Corp. With a turnaround in motion and brands like Vans and Timberland in the mix, could this stock step back into fashion?

Penn Entertainment: A Double-Down That’s Finally Paying Off?

Penn Entertainment ($PENN) is showing signs of life — insiders are doubling down, revenues are climbing, and digital bets are growing fast. With shares rebounding, is it time to follow the high-rollers or step back from the table? 🎰📈

Repay Holdings: Time to Reward the Patient Holder?

Insider buying is heating up at Repay Holdings. With over 200 institutions on board and a bargain-bin valuation, this fintech underdog might be getting ready to repay patient investors—with upside.

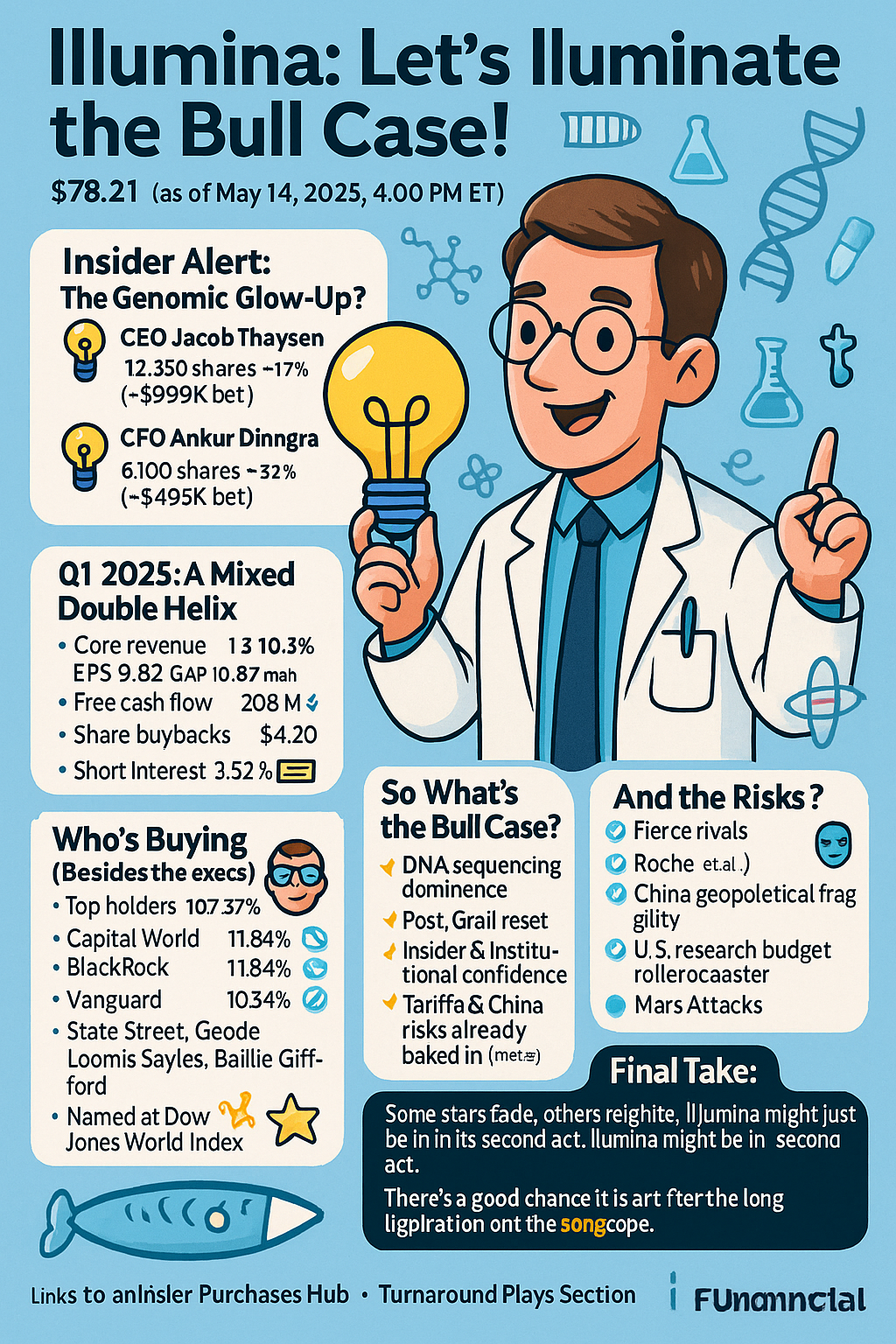

🔬 Illumina (ILMN): Let’s Illuminate the Bull Case!

After losing nearly 80% of its value since 2021, Illumina (ILMN) may be ready for a glow-up. CEO Jacob Thaysen and CFO Ankur Dhingra just bought big, and institutional holders are still hanging on. What do they see—and should you see it too?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.