🔬 Illumina (ILMN): Let’s Illuminate the Bull Case!

Ticker: $78.21, -2.60% (as of May 14, 2025, 4:00 PM ET)

🧬 Funanc1al Insider Spotlight

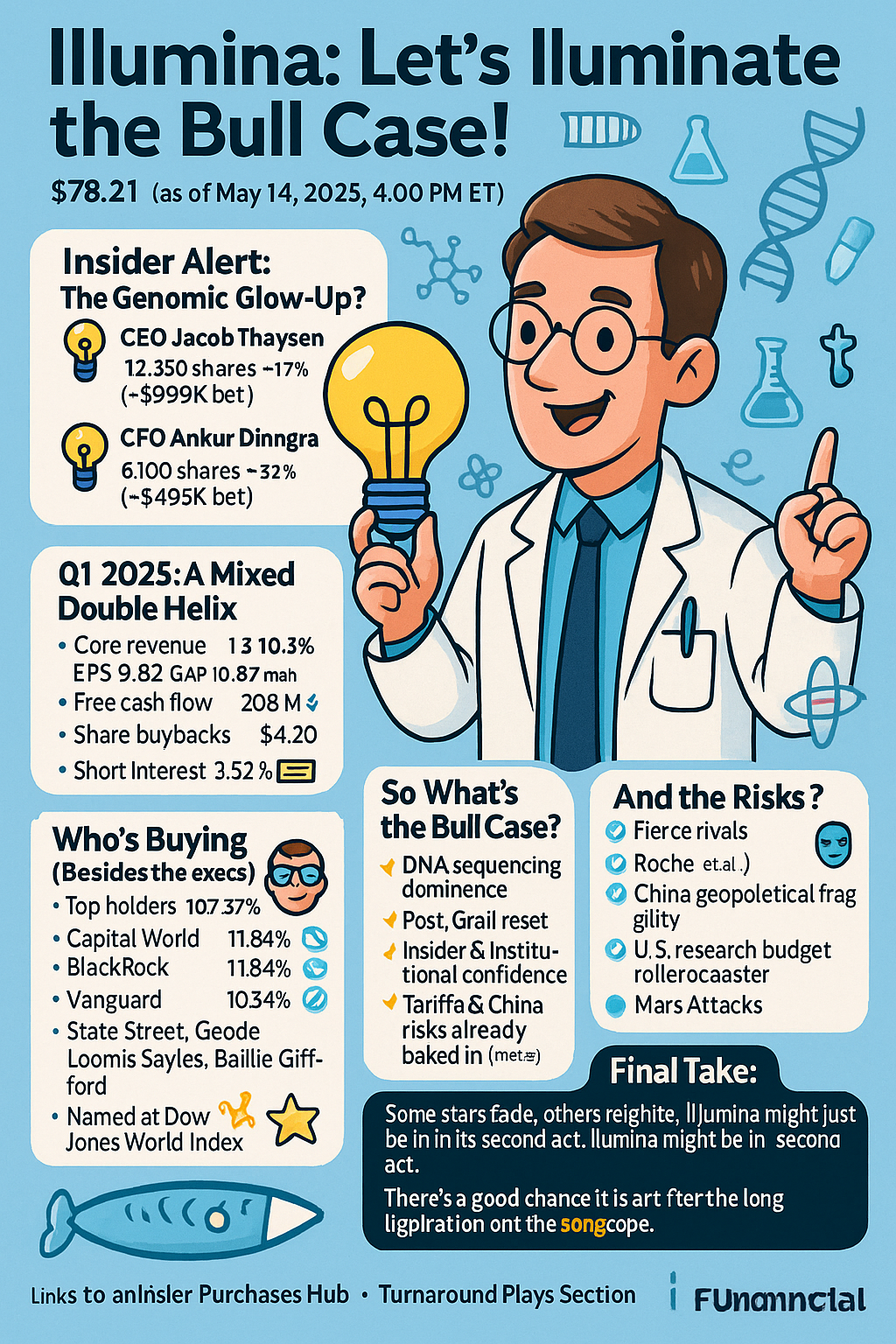

🎯 Insider Alert: The Genomic Glow-Up?

Two top execs just made a confident double helix twist into the stock:

-

🧑🔬 CEO Jacob Thaysen bought 12,350 shares @ $80.86 → +17% stake → ~$999K bet

-

💼 CFO Ankur Dhingra snagged 6,100 shares @ $81.21 → +32% stake → ~$495K bet

That’s not insider nibbling. That’s genomic-sized conviction. 🧬💰

🧬 What Is Illumina, Anyway?

Illumina is the godfather of DNA sequencing tech. If you're swabbing your cheek or peeking at your genes, odds are Illumina’s tech was behind it. Based in San Diego, it dominates the genomics universe with a suite of world-class sequencing platforms and next-gen data tools.

👩🔬 Think:

-

Genomic sequencing

-

Spatial transcriptomics

-

Single-cell wizardry

-

AI-driven clinical collabs

-

And a sprinkle of CRISPR sparkle ✨

📊 Q1 2025: A Mixed Double Helix

-

Core revenue: $1.04B (📉 -1% YoY; flat CC)

-

EPS: $0.82 GAAP / $0.97 non-GAAP

-

Free cash flow: $208M

-

Op margin: 15.8% GAAP / 20.4% non-GAAP

-

Share buybacks: $200M

🧾 FY 2025 Outlook (Revised)

-

Revenue expected to decline 1–3% (was: growth)

-

Tariff headwinds = -$0.25 EPS and 125bps margin hit

-

Adjusted EPS: $4.20–$4.30 (was ~$4.50)

So… growth? More like slow-mo glow. But still glowing.

💸 Who’s Buying (Besides the Execs)?

🧠 Institutional Ownership: 107.37% (Yes, you read that right.)

Top holders include:

-

Capital World (11.94%)

-

BlackRock (11.84%)

-

Vanguard (10.34%)

Other big names on board: State Street, Geode, Loomis Sayles, and Baillie Gifford.

🧪 That’s a lab coat full of believers.

For more on Illumina's Institutional Ownership profile, see the full breakdown here.

📉 Meanwhile, short interest is just 3.52%. Bears aren’t roaring.

Interested in investing in a leading-edge biotech?

How about Crispr Therapeutics (CRSP)?

Go ahead, check this out.

🌟 Big Moves, Bright Ideas

Recent highlights:

-

✅ $100M cost-cutting plan to offset China risks

-

🔬 250,000 genomes sequenced for AGD project

-

🧬 Spatial transcriptomics tech → gamechanger

-

🤝 Partnerships with Broad Institute & Tempus

-

💻 New AI-integrated workflows in clinical labs

-

🏆 Named to Dow Jones World Index (again)

Translation: They’re busy. They’re building. They’re biotech royalty 👑

💡 So What’s the Bull Case?

-

DNA Sequencing Dominance → Still leads a trillion-dollar revolution

-

Post-Grail Reset → Leaner, focused, smarter

-

Insider & Institutional Confidence → Skin (pardon, Genes) in the genome

-

Tariffs & China Risk? → Already baked in (mostly)

-

Shareholder-Friendly → $1.2B buyback plan = sweet helix candy 🍭

⚠️ And the Risks?

-

🧬 Fierce rivals (Roche, et al.)

-

🌏 China geopolitical fragility

-

💸 U.S. research budget rollercoaster

-

👽 And of course: Mars Attacks

Still, Illumina has already survived the great Grail mistake, a pandemic, and a brutal multi-year drawdown. (The stock has dropped ~80% from its 2021 high of $540.12.)

🔭 Final Take:

Some stars fade. Others reignite. Illumina might just be in its second act.

Insiders clearly see something bright ahead. And if the bull case is even partially right, the stock could see a double-digit glow-up—no microscope required.

📈 Want exposure to next-gen health, genomics, and AI-driven biology? This just might be your long bet on the human blueprint.

💡 Disclaimer: Light may cast shadows. Genomics is complex. Invest wisely and don’t sequence your retirement plan.

🧭 Want More Like This?

Check out our Insider Purchases Hub

Or browse our Turnaround Plays Section

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: