Insider Purchases: Inside the Buy

Tag: Value Trap

Western Union (WU): Cash Transfers, CEO Buys, and Maybe a Stock Rebound?

💸 Western Union’s CEO and CFO just wired big money into their own stock. Institutions already hold 95% of the float, but growth is flat, competition is fierce, and risks abound. Is this a bargain play — or a value trap in disguise?

Eastman Kodak (KODK): Insider Buys, Debt Drama & a Pivot to Pills?!

Eastman Kodak insiders are snapping up shares, with CEO Jim Continenza leading the charge. But Kodak’s finances are shaky, its debt heavy, and its pivot to pharmaceuticals uncertain. High risk, high reward — or just a faded picture?

Insiders Are Buying Shares of Applied Optoelectronics. Should You?

Applied Optoelectronics (AAOI) insiders—including the CEO—are buying big while revenue growth accelerates and losses shrink. Institutions already own two-thirds of the stock. But with dilution risk, short sellers circling, and heavy competition, is AAOI a comeback kid—or just another speculative fiber bet?

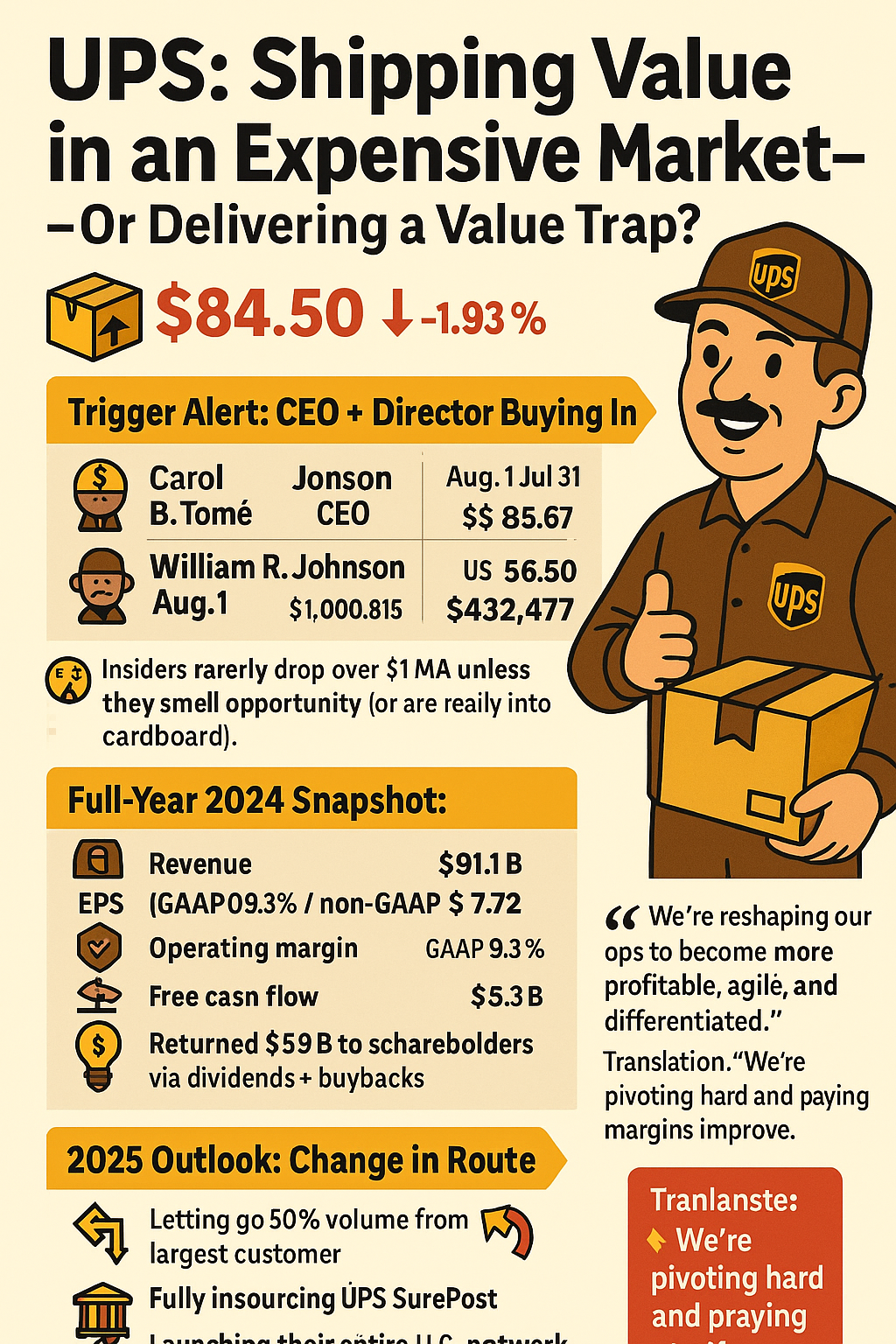

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.