Insider Purchases: Inside the Buy

Tag: Share buybacks

Ex-Morgan Stanley CEO Gorman Buys Disney: Time For Wonderland — or Better Questions?

Ex-Morgan Stanley CEO James Gorman just bought Disney stock — and institutions are quietly increasing exposure. Shorts are gone, cash flow is up, buybacks are back. Is the magic really returning? 🎬✨

Insiders Have Been Buying Shares of Middleby: Is Something Cooking… or Is It All Baked In?

Middleby insiders are buying. Institutions are stacked. The company is spinning off, slimming down, and cooking up shareholder value. Is MIDD finally ready to serve investors a real meal—or is everything already priced in? 🔥🍽️

Can Tidewater Become a Tsunami? Insider Says Yes!

Director Robotti keeps loading up on Tidewater stock—and he’s not alone. With over 100% institutional ownership, strong free cash flow, and improving margins, TDW may be ready to roar. Is a tsunami coming? Funanc1al dives in.

Can Lyft Ever Lift Off or Will It Forever Uber-Underwhelm?

CEO David Risher has been scooping up Lyft shares like surge-priced burritos—and with record rides, rising cash flow, and a $750M buyback plan, the bullish case is stronger than ever. But can LYFT finally fly—or is Uber still driving the narrative?

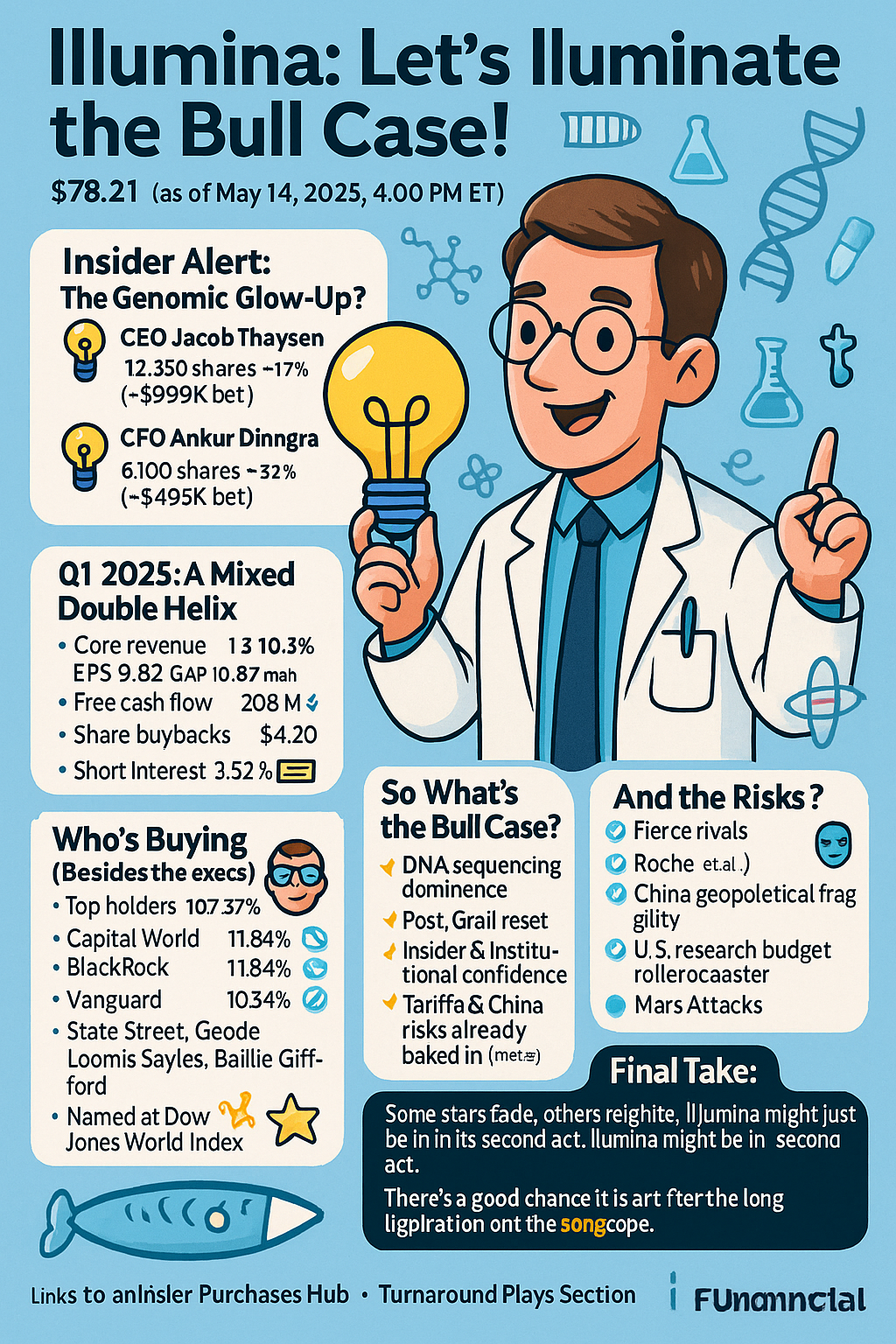

🔬 Illumina (ILMN): Let’s Illuminate the Bull Case!

After losing nearly 80% of its value since 2021, Illumina (ILMN) may be ready for a glow-up. CEO Jacob Thaysen and CFO Ankur Dhingra just bought big, and institutional holders are still hanging on. What do they see—and should you see it too?

🏰 KKR: Kingdom of Capital and... Real Estate, Biotech, Semiconductors, Grocery Stores, and Also Probably Your Mom’s Soup Recipe?

KKR isn’t just a firm—it’s a capital empire. And when several directors shell out millions of dollars for shares, you take notice. From fee-rich earnings to a stake in just about everything that breathes profit, here's why KKR might deserve a seat in your portfolio—and your heart. 💼❤️ Director Robert Scully just bought big into KKR—and he’s not alone. With $664B in assets under management and a deal machine that never sleeps, KKR might just be the king of kings in capital. Here's our fun (and slightly ridiculous) take on whether it deserves a spot in your portfolio.

Ulta Beauty (ULTA): The Stock That’s Too Pretty to Ignore 💅💰

Ulta Beauty's stock (ULTA) offers investors growth potential and financial stability, thanks to its robust customer loyalty program and impressive balance sheet. CEO Kecia Steelman’s recent share purchase signals confidence in the company’s future.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.