Insider Purchases: Inside the Buy

Tag: Biotech Investing

Biohaven Just Went Through Hell — But Its CEO and Directors Still See an Angel

Biohaven’s stock plunged after a brutal FDA rejection — but insiders didn’t blink. They bought millions of dollars’ worth of shares, doubled down on their pipeline, and kickstarted a leaner, more focused strategy. Bold turnaround play or biotech heartburn waiting to happen? Here's the FUNanc1al deep dive.

Absci: When AI Meets Antibodies — and Insiders Can’t Resist Buying More!

AI is designing drugs, and Absci is leading the charge — with insider confidence, top-tier partners, and a cash runway through 2028. Still pre-revenue but packed with promise, this biotech might just be the next NVIDIA of antibodies.

CEO Bought Shares of Vertex Pharmaceuticals (VRTX) A Bit Higher Back in August: Great Biotech At A Fair Price. Wait For Additional Pull-Back?

Vertex is more than cystic fibrosis drugs. With gene editing, pain relief, and even a potential T1D cure, the CEO’s insider buy raises one question: buy now or wait for additional pullback?

Novocure (NVCR): From Electric Fields to Fighting Cancer — and Maybe Lifting Portfolios?

Novocure is zapping cancer cells with Tumor Treating Fields — and maybe giving investors a shock of opportunity. With insiders and institutions piling in, can NVCR rebound 94% from its crash? ⚡📈

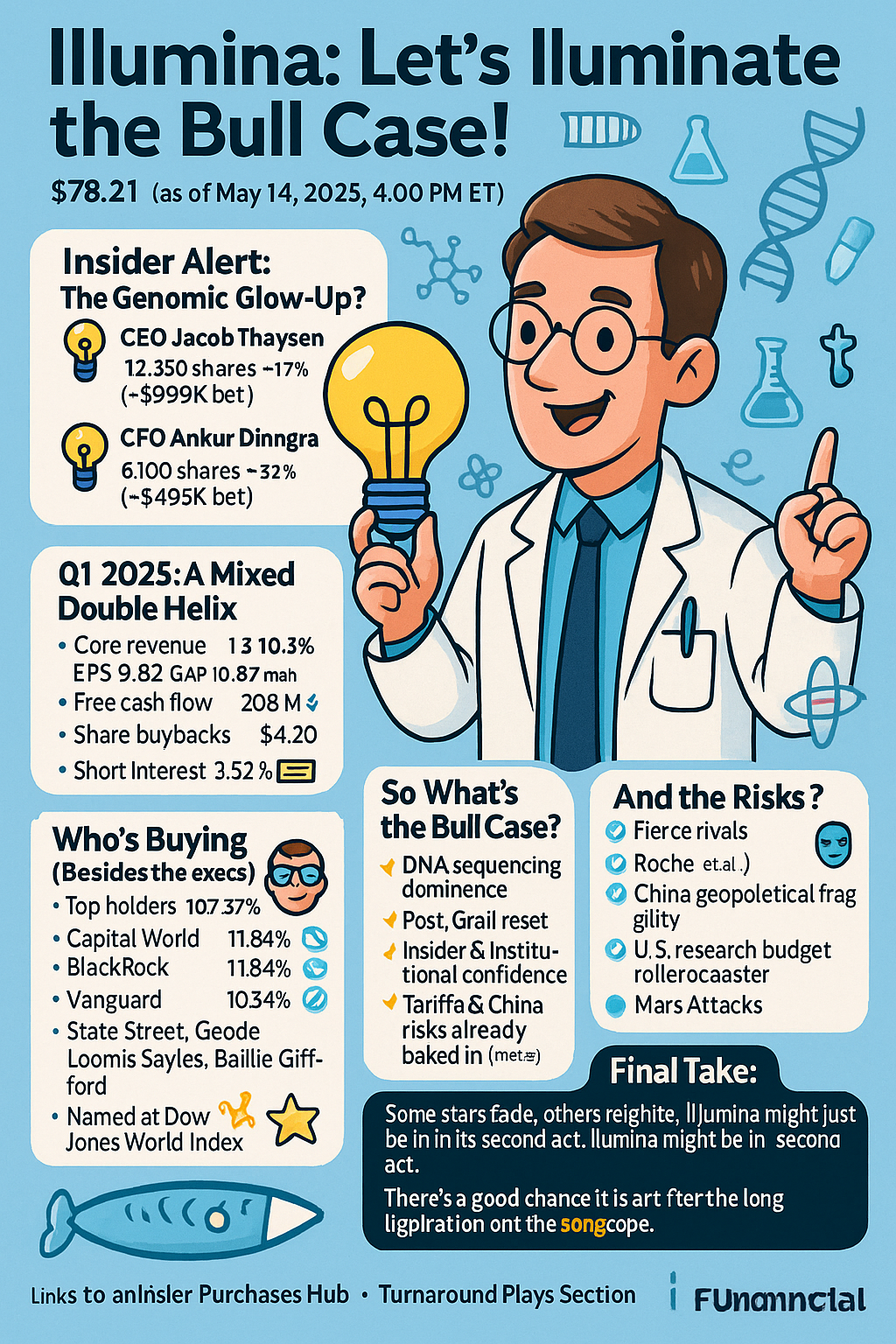

🔬 Illumina (ILMN): Let’s Illuminate the Bull Case!

After losing nearly 80% of its value since 2021, Illumina (ILMN) may be ready for a glow-up. CEO Jacob Thaysen and CFO Ankur Dhingra just bought big, and institutional holders are still hanging on. What do they see—and should you see it too?

🏰 KKR: Kingdom of Capital and... Real Estate, Biotech, Semiconductors, Grocery Stores, and Also Probably Your Mom’s Soup Recipe?

KKR isn’t just a firm—it’s a capital empire. And when several directors shell out millions of dollars for shares, you take notice. From fee-rich earnings to a stake in just about everything that breathes profit, here's why KKR might deserve a seat in your portfolio—and your heart. 💼❤️ Director Robert Scully just bought big into KKR—and he’s not alone. With $664B in assets under management and a deal machine that never sleeps, KKR might just be the king of kings in capital. Here's our fun (and slightly ridiculous) take on whether it deserves a spot in your portfolio.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.