Insider Purchases: Inside the Buy

Tag: Funanc1alEdge

Elite Buys Ely: Should You Buy Lilly’s Stock Too?

Eli Lilly insiders are opening their wallets after the company crushed Q2 2025 — revenue up 38%, EPS up 92%, and blockbuster drugs Zepbound and Mounjaro fueling a raised guidance. Institutions are all-in, the pipeline is buzzing, but the valuation is sky-high. Is LLY worth chasing at $639, or is patience the better prescription?

Centene (CNC): CEO Buys at $25, Earnings Bleed Red, and the Stock’s on Life Support — Bargain or Bust?

Centene (CNC) just got a shot in the arm from its CEO and a director buying nearly $740K worth of stock near decade lows. But with Q2 earnings bleeding red, rising Medicaid costs, and valuation sliced in half, is this a bargain-bin opportunity or just a patient in the ICU?

International Flavors & Fragrances Inc. (IFF): Insiders Buy Big, CEO Doubles Down, and the Scent of Value Is in the Air

Insiders at International Flavors & Fragrances (IFF) are loading up on shares—CEO included. With a $500M buyback, big-name institutional holders, and portfolio reshaping, the stock could be brewing a comeback. But is it perfume… or still a whiff of trouble?

How Many Insider Buys Will It Take for The Bull in Enphase Energy to Re-energize?

After a brutal drop, Enphase Energy’s CEO is buying big. Institutions are all in. Margins hold strong. Could this be the spark the solar bull needs?

COO Goes Shopping: Is Molina Healthcare (MOH) a Healthy Buy or Just a Check-Up?

When the COO of Molina Healthcare spends $1.56M on stock, investors notice. With Wall Street titans on board and shares at major support, is this a healthy buy — or a risky patient?

Figma (FIG): Directors Buy In — Should You Collaborate?

🎨 Figma stock exploded out of the IPO gate, hitting highs nearly 5x insider purchase prices. With no profits, big Bitcoin bets, and stiff competition, is this design darling still worth the hype? Let’s sketch it out—icons, jokes, and all.

Arrow Electronics: A Straight Arrow, But the CEO Sees a Bullet

Arrow Electronics CEO Sean Kerins just bought nearly $1M of ARW stock. Is this undervalued tech distributor about to rebound, or just cruising under the radar? We take a shot at the bullseye—with puns and charts.

MSCI Keeps Winning — and the CEO Keeps Buying In

MSCI delivers world-class data tools for investors—and its CEO just bought in big. With soaring revenue, recurring subscriptions, and loyal institutions, is this still a buy? Or has the stock outpaced its fundamentals?

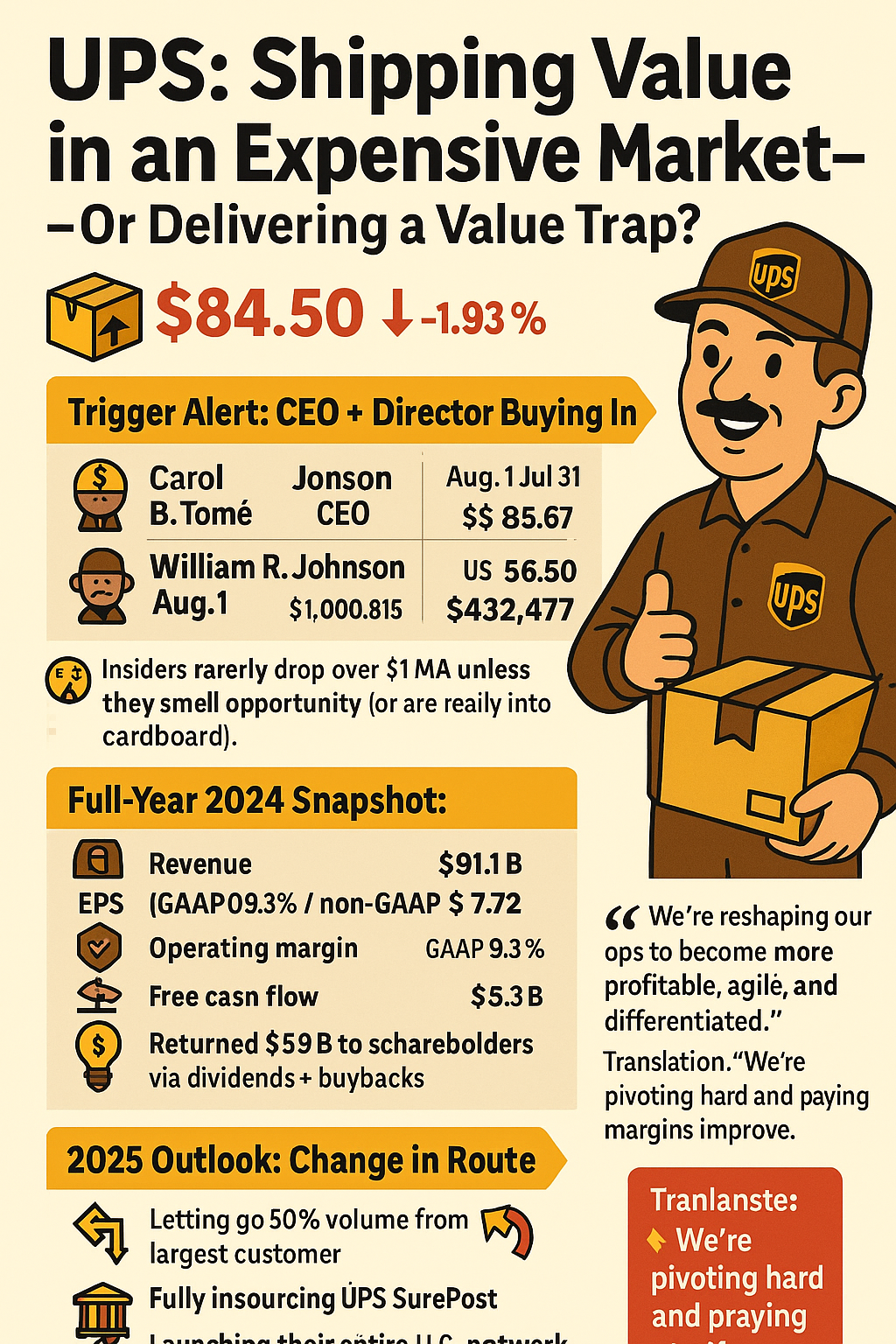

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Does Align Technology’s Recovery Plan Have Teeth? The CEO Thinks So.

Align Technology insiders are smiling—because they’re buying. With a CEO purchase nearing $1M and Wall Street holding more shares than exist, ALGN may be regaining its shine. But should you sink your teeth into it now?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.