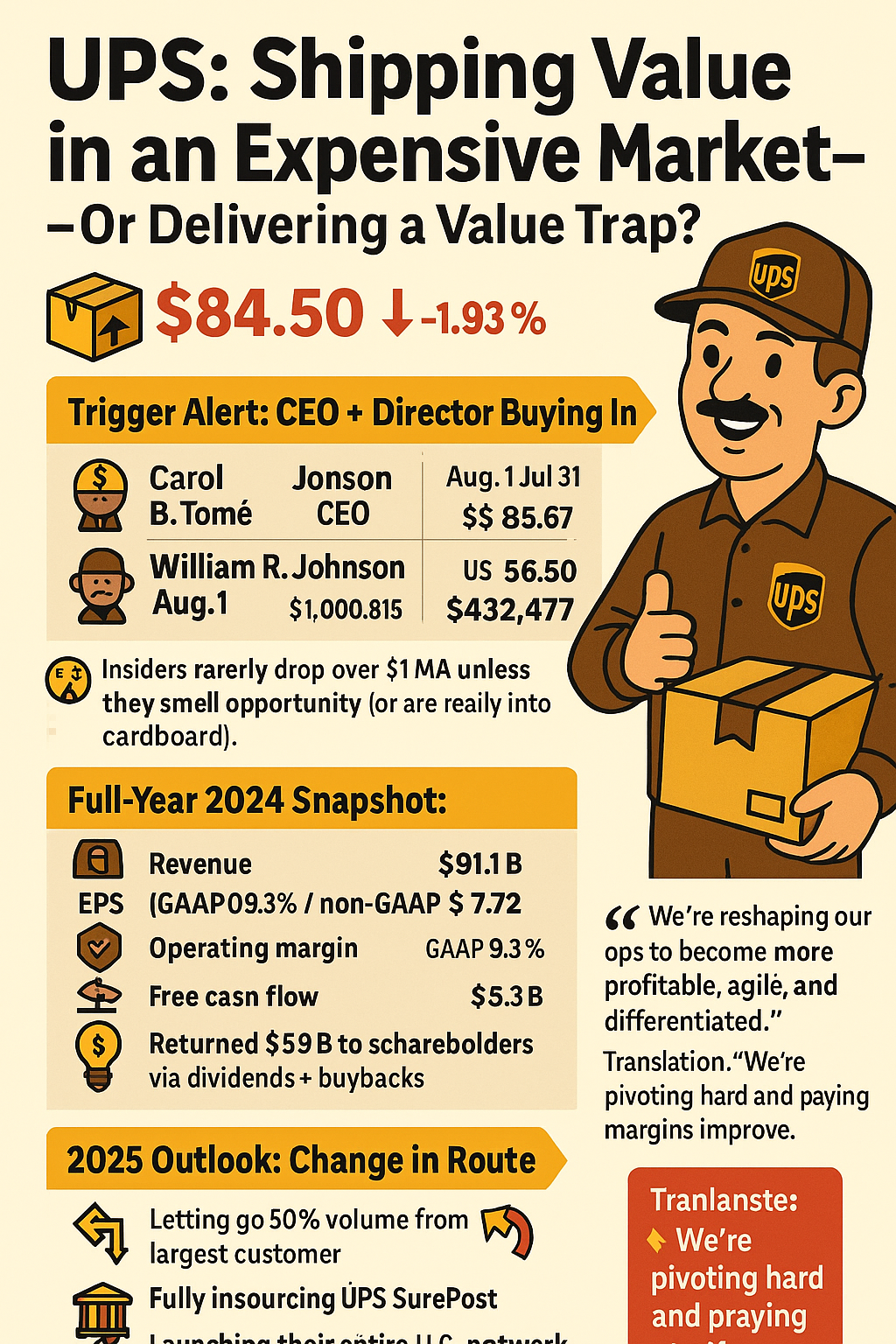

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

📦 $84.50

🟥 Down -1.93% on Aug-01-2025

📉 But up to something behind the scenes...

🚨 Trigger Alert: CEO + Director Buying In

| Insider | Title | Trade Date | Price | Qty | Value |

|---|---|---|---|---|---|

| 🧑✈️ Carol B. Tomé | CEO | Aug 1 | $85.67 | 11,682 | 💰 $1,000,816 |

| 📦 William R. Johnson | Director | Jul 31 | $86.50 | 5,000 | 💵 $432,477 |

👀 Insiders rarely drop over $1M unless they smell opportunity (or are really into cardboard).

🏦 Institutions Also Onboard (with Room in the Truck)

-

🧠 70.43% of shares held by institutions

-

🏛️ Top holders include: Vanguard, Blackrock, State Street, JPMorgan, and even... Bank of America

-

✅ Yet insiders hold only 0.03% — a curious imbalance

🔍 For UPS's Institutional Ownership breakdown, see here.

💵 Full-Year 2024 Snapshot:

-

Revenue: $91.1B

-

EPS: $6.75 (GAAP) / $7.72 (non-GAAP)

-

Operating Margin: 9.3%

-

Free Cash Flow: $6.3B

-

🪙 Returned $5.9B to shareholders via dividends + buybacks

🥇 That dividend yield? A delicious 7.6% 🍩

📦 2025 Outlook: Change in Route

UPS isn’t just loading boxes. They’re reloading strategy:

📉 Letting go of 50% volume from their largest customer

📦 Fully insourcing UPS SurePost

🔧 Reconfiguring their entire U.S. network

💡 Launching “Efficiency Reimagined” to save 💲1 billion

"We’re reshaping our ops to become more profitable, agile, and differentiated," says CEO Carol Tomé.

🙃 Translation: We’re pivoting hard and praying margins improve.

📊 2Q 2025 Earnings Highlights:

-

Revenue: $21.2B

-

Operating Margin: 8.6%

-

EPS: $1.51

-

✂️ Still on track with cost-saving goals

-

📉 Growth? Flat. Maybe flatter than a run-over package.

👉 Want the full picture? Dive into UPS's financials here.

🔍 Valuation Metrics: Cheap or a Trap?

| Metric | Value |

|---|---|

| 🧮 P/E | 12.57 |

| 📈 Forward P/E | 13.09 |

| 📊 PEG (5yr) | 1.42 |

| 💰 Price/Sales | 0.80 |

| 📚 Price/Book | 4.54 |

📦 UPS might look like a bargain bin blue chip — but will it deliver?

💥 Bull Case: It’s Not Dead Weight

-

✅ Still profitable

-

✅ CEO just bought in

-

✅ Strong dividend = income machine

-

✅ Transformation plan could pay off

-

✅ Institutional vote of confidence

🐻 Bear Case: Might Be a Trap

-

🚫 Growth? Basically in reverse.

-

🔥 Operating margins under pressure

-

🌍 Global uncertainty, trade risks, tariff tantrums

-

🚚 Freight demand? Meh.

-

📉 Potential for more downside if the economy worsens

💡💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

🧠 Bottom Line:

UPS might be shipping value — or quietly packing disappointment.

You’re betting on:

-

The restructuring plan succeeding

-

The dividend staying juicy

-

The market not getting uglier

If you're looking for income and patient value, it might be worth the weight (pun intended). But if you want growth, this truck may be stuck in traffic.

📬 Invest wisely. Or risk getting delivered… pain.

⚠️ Disclaimer:

We’re not financial advisors. We’re FUNancial advisors.

We laugh, we analyze, we meme — we do not provide investment advice. It’s just a second opinion — and yes, we’re billing your sense of humor. 🎪💸

Invest at your own risk, always DYOR, hold the FOMO, and don’t invest what you can’t afford to lose.

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 See the world differently and check out more international market picks and fun takes. Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.)

- 📈 Biotech Bets & Innovation Radar (Problem is we can't detect the Radar)

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Even Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: