Insider Purchases: Inside the Buy

Tag: InstitutionalOwnership

Eastman Chemical (EMN): Insider Chemistry at Work

Insiders from CEO to CFO are scooping up Eastman Chemical shares. With institutions owning 92% of the float and dividends flowing, is this a value play worth a reaction? 🧪📈

MaxCyte (MXCT) — Insiders Load Up While Cash Burns

MaxCyte insiders are shopping biotech shares like it’s Black Friday 🛒💉. With revenue slipping, cash burning, but institutions holding, is MXCT a comeback spark ⚡ or a treadmill burn-out 🔥?

International Flavors & Fragrances Inc. (IFF): Insiders Buy Big, CEO Doubles Down, and the Scent of Value Is in the Air

Insiders at International Flavors & Fragrances (IFF) are loading up on shares—CEO included. With a $500M buyback, big-name institutional holders, and portfolio reshaping, the stock could be brewing a comeback. But is it perfume… or still a whiff of trouble?

PVH: Fashion. Fundamentals. CEO Buying. Doesn't the $500M Share Buyback Scream Deep Value?

CEO Stefan Larsson just bought $1M worth of PVH stock—and he’s not alone. With iconic brands like Calvin Klein and Tommy Hilfiger, institutional support over 100%, and a massive share buyback underway, PVH may be a classic turnaround play. But is it fashionably early… or just fashionably risky?

Insiders Are Buying ConocoPhillips. Should You?

Insiders are drilling into COP shares—and they're not alone. With a $10B return plan, strong reserves, and a smart buyout of Marathon Oil, ConocoPhillips might just be the contrarian pick of the year. Here's the fun, smart breakdown.

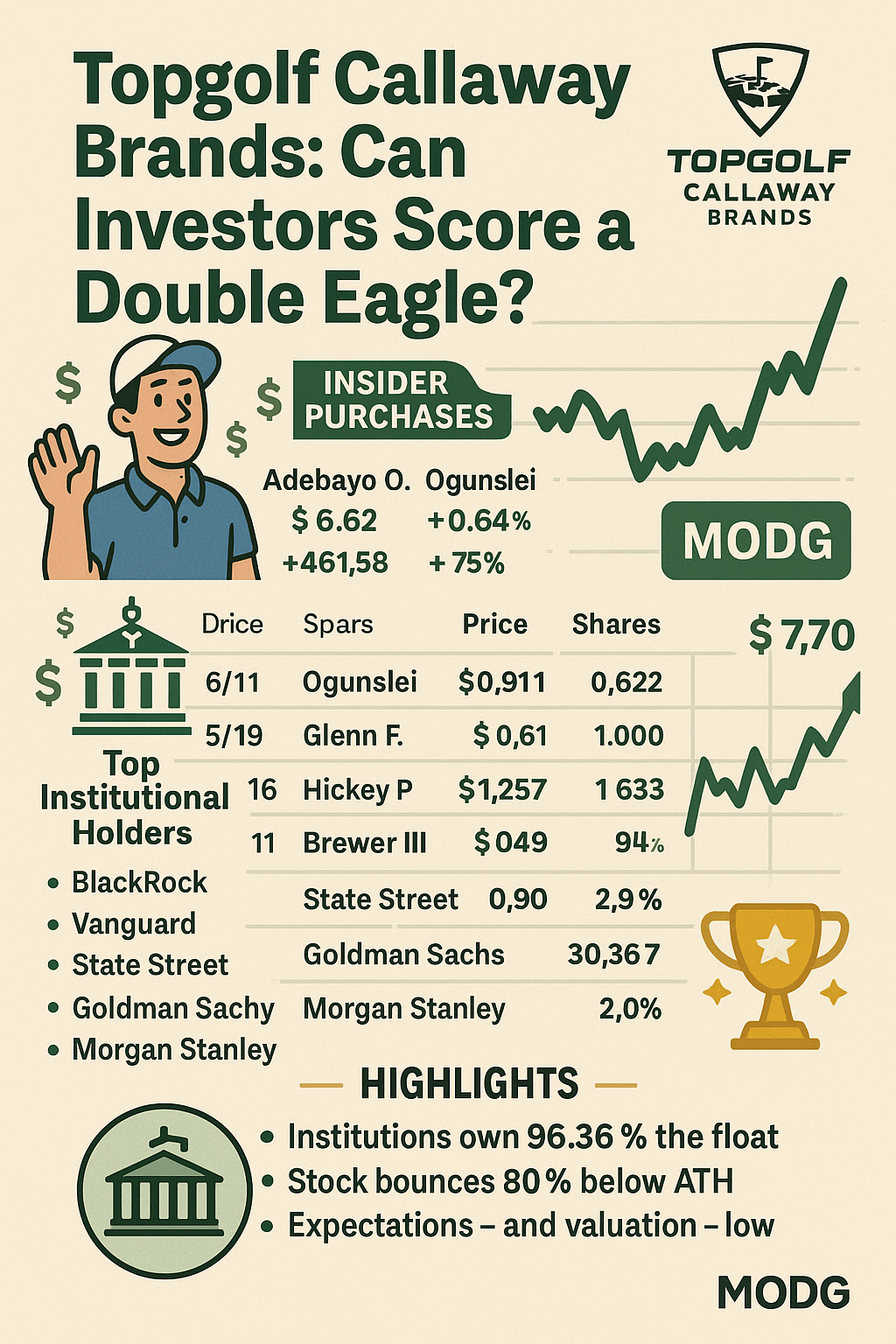

Topgolf Callaway Brands: Can Investors Score a Double Eagle?

Topgolf Callaway may be down 80% from its highs, but insider buys, institutional backing, and a turnaround plan suggest the comeback tour could be real. ⛳📊

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.