Insider Purchases: Inside the Buy

Tag: dividend stocks

Directors' Thirst for Shares of Global Water Resources Seems Unquenchable. Should You Binge on Them?

Insiders are gulping up shares of Global Water Resources, betting big on Arizona’s thirst for growth. But while the company’s outlook is steady, its valuation might leave you parched. Sip wisely. 💧📈

Can LKQ Replace Bear Parts with Bull Run: Insiders Think So

Insiders are wrenching their way into LKQ stock, and institutions hold more shares than exist (!). With profits intact, dividends rolling, and valuation gauges flashing cheap, could this be the ultimate rebuild? Or is it just another jalopy on Wall Street’s lot? 🛠️📉➡️📈

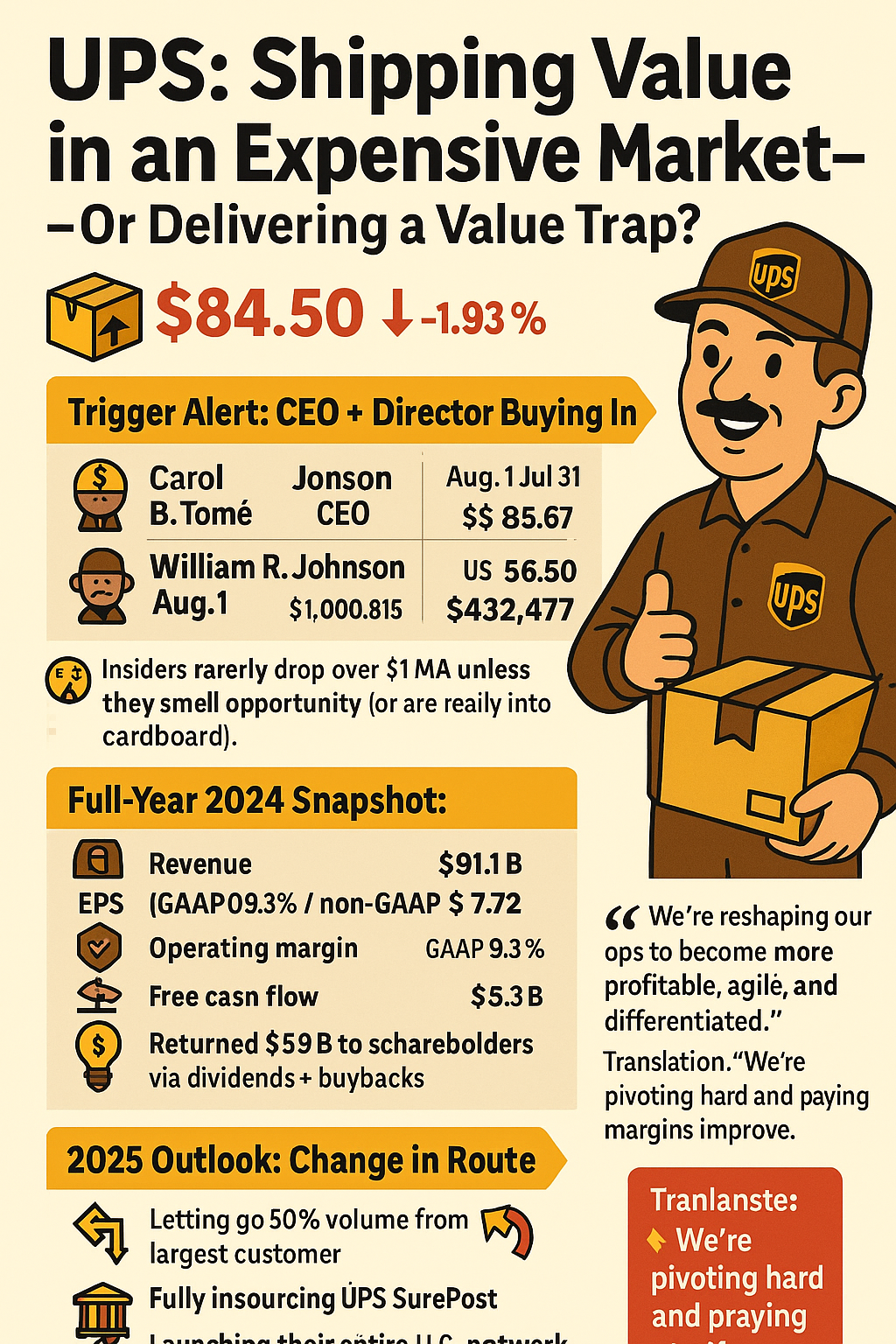

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Will Profits From Marriott Vacations (VAC) Help You Unwind?

Insiders are buying, institutions are lounging, and dividends are flowing. Marriott Vacations Worldwide (VAC) might be your next profitable getaway — with a 3.9% yield and room to grow. But are there risks under the palm trees?

🚛 Heartland Express: Back Up the Truck Before It’s Too Late!

Insiders are buying, the CEO owns 32 million shares, and the balance sheet's tightening up—even as losses persist. Is Heartland Express (HTLD) stuck in reverse or about to hit the gas?

Weatherford (WFRD): When Oil Tech Drops, and a Board Member Buys a Bucketload 🧃🥇🚀

Oilfield tech firm Weatherford just got a $500K vote of confidence from a seasoned director—while big funds already own the sandbox. With a 2.4% dividend and a P/E under 7, could WFRD be a deep-value dark horse? Or an energy stock mirage?

Global Water Resources (GWRS): Can This Thirsty Company Quench Your Investment Hunger? 💦

Looking for a steady investment with a splash of growth? Global Water Resources, Inc. (GWRS) may be just what you need. This Arizona-based water management company has shown growth despite risks, and insiders are making big buys. But is it the refreshing investment you’re hoping for, or is it more like sipping lukewarm water? Let’s dive in.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.