Insider Purchases: Inside the Buy

Tag: Institutional Ownership

Insiders Had Bought Shares of Elanco Animal Health (ELAN); Turns Out They Were Right — And It May Only Be the Beginning!

Insiders bought millions of Elanco shares under $15 — and they were right. Now, with JP Morgan’s upgrade and revenues rising, this stock might be a hidden gem in the animal health world. 🐾

Absci: When AI Meets Antibodies — and Insiders Can’t Resist Buying More!

AI is designing drugs, and Absci is leading the charge — with insider confidence, top-tier partners, and a cash runway through 2028. Still pre-revenue but packed with promise, this biotech might just be the next NVIDIA of antibodies.

CarMax (KMX): Where Insiders Keep Buying — And Cars Keep Driving Off (Mostly the Lot)

Insiders and institutions are revving up for CarMax’s comeback — even as used car sales slow and margins tighten. With shares 70% below their peak and a major digital overhaul underway, this could be the turnaround ride of the year. 🚘📉 Or just another trip to the mechanic.

Can Olin Cock Its Stock? Insiders Say Yes (Lock, Load, and Maybe Profit)

Olin ($OLN) insiders are loading up on shares while institutions already own 94% of the float. Profits are weak, ammo is hot, and bleach is… bleach. Can this 132-year-old company cock its stock for a rebound?

Elite Buys Ely: Should You Buy Lilly’s Stock Too?

Eli Lilly insiders are opening their wallets after the company crushed Q2 2025 — revenue up 38%, EPS up 92%, and blockbuster drugs Zepbound and Mounjaro fueling a raised guidance. Institutions are all-in, the pipeline is buzzing, but the valuation is sky-high. Is LLY worth chasing at $639, or is patience the better prescription?

Centene (CNC): CEO Buys at $25, Earnings Bleed Red, and the Stock’s on Life Support — Bargain or Bust?

Centene (CNC) just got a shot in the arm from its CEO and a director buying nearly $740K worth of stock near decade lows. But with Q2 earnings bleeding red, rising Medicaid costs, and valuation sliced in half, is this a bargain-bin opportunity or just a patient in the ICU?

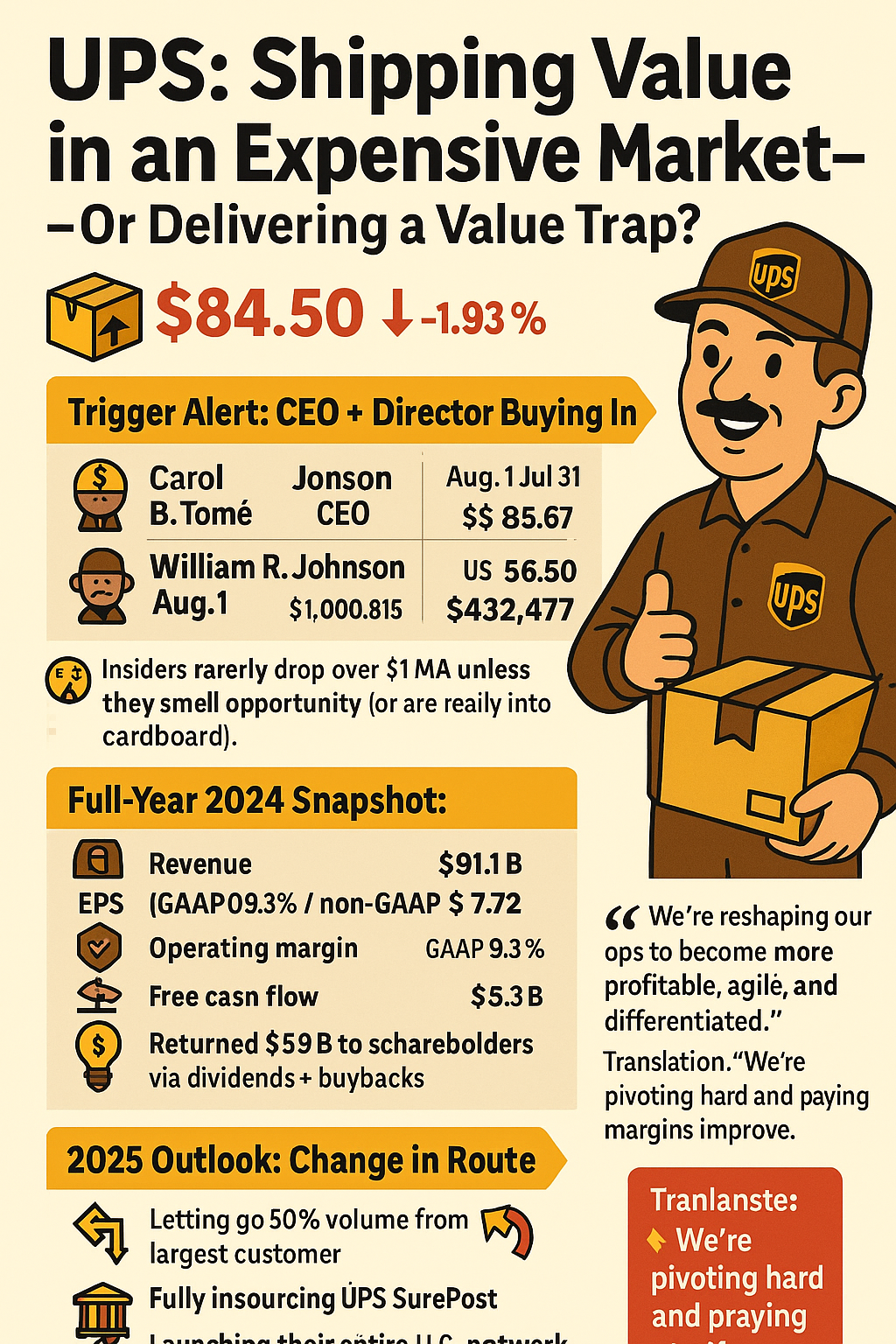

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Does Align Technology’s Recovery Plan Have Teeth? The CEO Thinks So.

Align Technology insiders are smiling—because they’re buying. With a CEO purchase nearing $1M and Wall Street holding more shares than exist, ALGN may be regaining its shine. But should you sink your teeth into it now?

Will Profits From Marriott Vacations (VAC) Help You Unwind?

Insiders are buying, institutions are lounging, and dividends are flowing. Marriott Vacations Worldwide (VAC) might be your next profitable getaway — with a 3.9% yield and room to grow. But are there risks under the palm trees?

Magnera: Insiders Keep Buying… Should You?

Magnera’s boardroom is buying diapers—literally. With insiders piling in and free cash flow returning, this specialty materials firm might be worth more than just its wipes. But don’t forget the debt and diaper jokes.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.