Insider Purchases: Inside the Buy

Tag: Director Insider Buying

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Progress Software CEO Buys In — Maybe It’s More Than Just... Progress?

Progress Software's CEO and a director are buying shares, signaling confidence as the company posts strong earnings and raises guidance. With institutional investors owning over 121% of the float, is this under-the-radar compounder set for a rerating?

New CEO Buys In at Dave & Buster’s ($PLAY). Who Doesn’t Like a Little PLAY in Their Portfolio — or Life?

New CEO Tarun Lal takes the reins—and a big slice of $PLAY stock. With insiders buying, institutions overloaded, and sales trends improving, could this be the next comeback classic of the “entertainment” era?

Simmons Bank: Insider Buys, 116 Years of Dividends, and a Footlong Public Offering

Simmons Bank has paid dividends for over a century—and insiders just went on a buying spree. 📉 Stock’s dipped, 🔍 valuation isn’t screaming cheap, but with improving net income and institutional support, SFNC might be worth a second look. If not exciting, at least it’s… dependable?

Will Profits From Marriott Vacations (VAC) Help You Unwind?

Insiders are buying, institutions are lounging, and dividends are flowing. Marriott Vacations Worldwide (VAC) might be your next profitable getaway — with a 3.9% yield and room to grow. But are there risks under the palm trees?

Insiders Are Buying ConocoPhillips. Should You?

Insiders are drilling into COP shares—and they're not alone. With a $10B return plan, strong reserves, and a smart buyout of Marathon Oil, ConocoPhillips might just be the contrarian pick of the year. Here's the fun, smart breakdown.

Moderna: Messenger RNA Medicines Powerhouse Sends A New Message — “Discount!”

Insiders dropped $6M on Moderna stock. With a massive mRNA pipeline and deep-pocketed backers, is this biotech beast ready to roar again?

Can Robinhood Still Steal the Show?

Robinhood’s got a new backer — and it’s no amateur. Christopher Payne (ex-DoorDash, Tinder, eBay) just went all in with a bold $2M+ insider buy. Add in huge crypto growth, a string of acquisitions, and global ambitions… and suddenly Robinhood doesn’t just look ready — it looks legendary. Is $HOOD still a buy? Let’s break it down.

Vera Bradley: The Bags Are Pretty; the Financials? Not So Much

The bags? Still adorable. The stock? Still near record lows. With insiders finally buying and a CEO exit underway, is Vera Bradley set for a stylish rebound — or is it still stuck in the clearance bin?

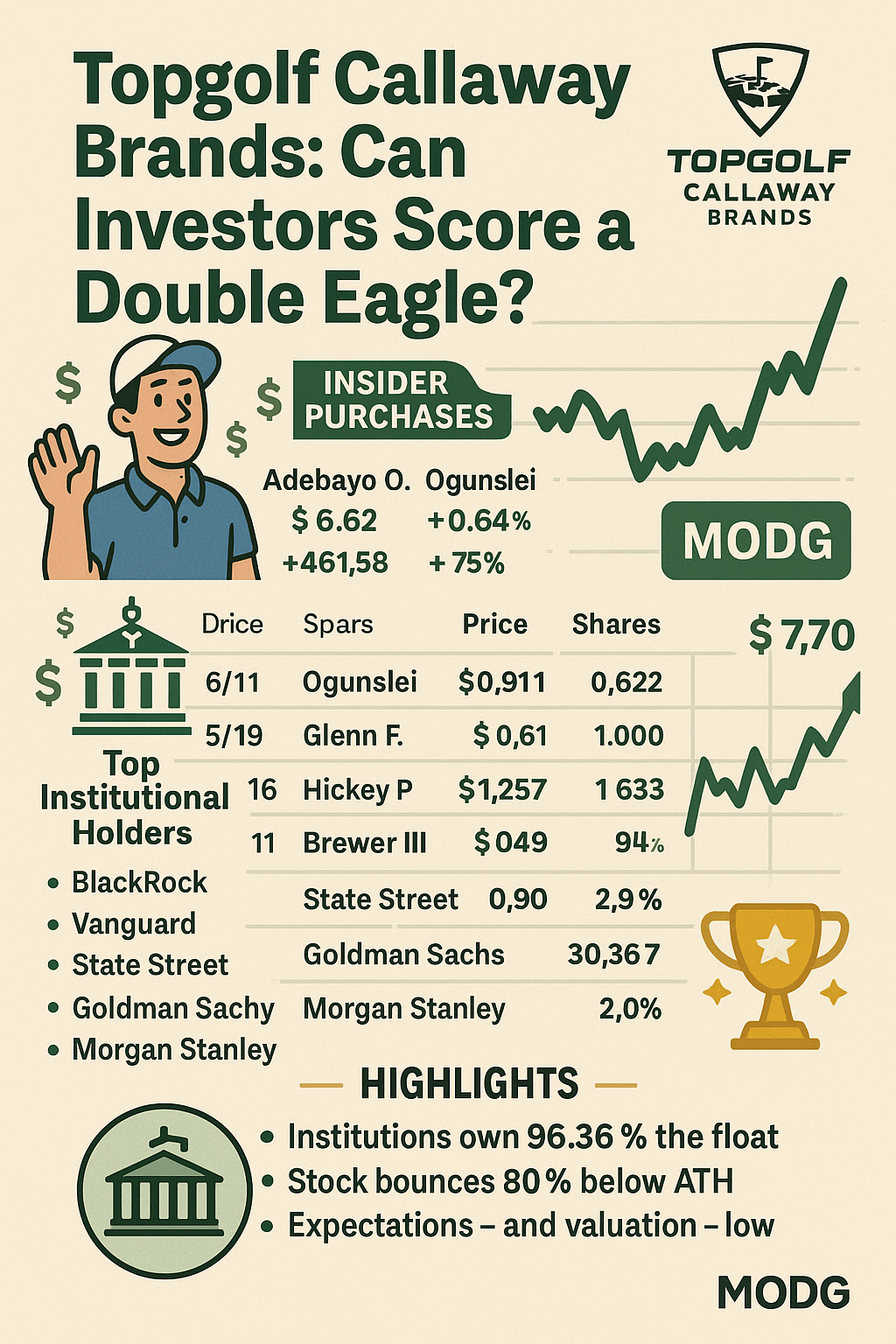

Topgolf Callaway Brands: Can Investors Score a Double Eagle?

Topgolf Callaway may be down 80% from its highs, but insider buys, institutional backing, and a turnaround plan suggest the comeback tour could be real. ⛳📊

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.