Topgolf Callaway Brands: Can Investors Score a Double Eagle?

Ticker: MODG ⛳

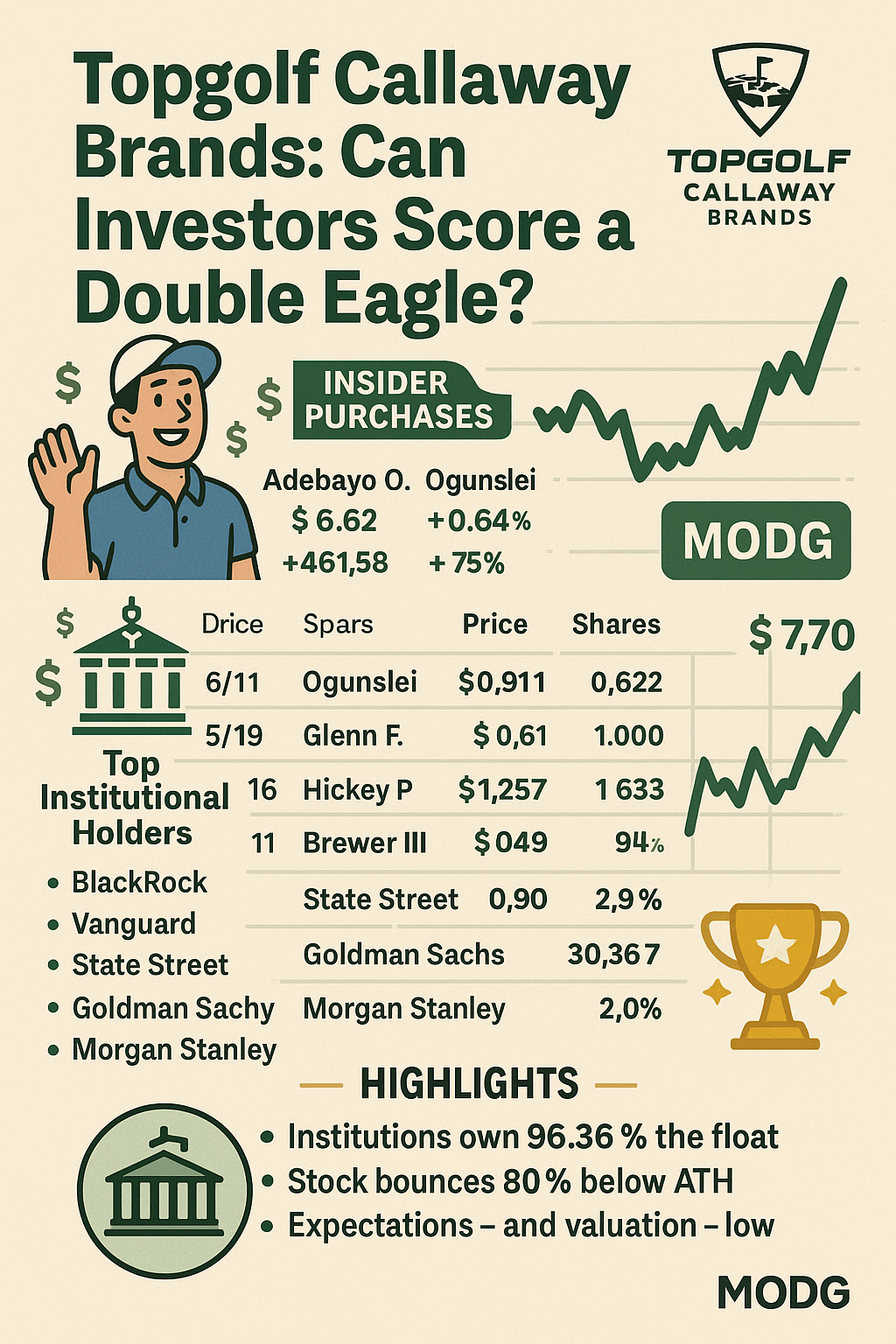

Price: $7.70 (+4.19%, as of June 10, 2025)

Trigger: 📌 Multiple insider purchases, institutional support, and signs of a business turnaround.

📥 Big Insider Buys = Big Belief?

Adebayo Ogunlesi (Director) just doubled down like a Tour pro:

-

June 6: +461,583 shares @ $6.62 = $3.06M

-

June 4: +383,701 shares @ $6.47 = $2.48M

Other insiders joining the clubhouse: -

🏌️♂️ Glenn Hickey (EVP): 10,000 shares

-

👔 CEO Oliver Brewer: 20,000 shares

-

🧢 Director Russell Fleischer: 30,000 shares

These aren't putt-putt purchases. This is a serious bet on the company's direction. 🤑

🏦 Institutional Power Play

Institutions hold 96.36% of the float. That includes:

-

BlackRock (12%)

-

Providence Equity (11.5%)

-

Vanguard (7.9%)

-

Goldman Sachs, Morgan Stanley, and more.

When the big guys stay on the green, retail investors might want to bring their clubs. 🏌️♀️📊

🔍 For full Institutional Ownership breakdown, see here.

📊 Q1 2025 Results: A Mixed Bag, But Signs of Stabilization

-

💰 Net revenue: $1.09B (down 4.5% YoY — but above expectations)

-

📈 Adjusted EBITDA: $167.3M (+4.0%)

-

🧾 Non-GAAP EPS: $0.11 (vs. $0.08 in Q1 2024)

-

💳 Available liquidity: $805M (up 12%)

-

🎯 Jack Wolfskin sale in progress, Topgolf separation planned

CEO Chip Brewer: “We met or beat plan in all segments.” Translation? ⛳ Better than feared.

🚨 Segment Breakdown

Topgolf:

-

Revenues down 12% at same venues

-

Losses reduced via cost cuts

-

Separation on deck = 🔄 strategic reset

Golf Equipment:

-

Revenue down slightly due to FX & fierce competition

-

💥 Operating income up $19.5M thanks to cost control & margin improvement

-

🏆 Elyte Driver winning awards

Active Lifestyle:

-

Revenues down due to Wolfskin resizing in Europe

-

💪 Operating income up $5.9M, China still growing

👉 Want the full picture? Dive into Topgolf Callaway Brands’s financials here.

📉 Still Below Par… But Value in the Rough?

Let’s not sugarcoat it:

-

📉 Shares are down 80% from the $37.75 ATH (2021)

-

🧾 Net income this quarter = $2.1M

-

🏚️ Still rebounding from a massive $1.45B goodwill write-off in 2024

-

💸 Price/Sales: 0.32 | Price/Book: 0.56 | EV/Revenue: 0.94 → That’s… cheap.

The company may be described as mid-swing in a turnaround.

⛳ 5 Bullish Signals

-

Insider Buying: Consistent, large, and confident

-

Institutional Support: Wall Street’s still playing this round

-

Turnaround Strategy: Cost cuts, asset sales, separation of Topgolf

-

Liquidity Is Up: $805M available = breathing room

-

Valuation: Deep value metrics… if results improve

😬 5 Risks to Keep in Play

-

Revenues & profits still under pressure

-

Consumer softness + tariffs = headwinds

-

Restructuring not yet done

-

Growth story unclear until Topgolf separation lands

-

Insider bets don’t always pay off 🃏

Interested in another investment idea?

Check our take on UnitedHealth Group.

🦅 So... Can MODG Score a Double Eagle?

A double eagle (albatross) is a near-mythical golf score: 3 under par on one hole.

And while MODG shares might not hit that miraculous shot anytime soon…

A birdie? Maybe.

An eagle? Why not?

At these levels, a swing might be worth it — especially with the pros betting behind the scenes.

🏌️⚖️ Disclaimer

We don’t play much golf.

Last time we tried, it turned into a hike.

Do your own research. Score your own game.

Invest at your own risk. 💼⛳

🧭 Want More Like This?

👉 Browse our Insider Purchases Center

👉 Explore our Follow the Pundits Hub: When Big Bets Matter

👉 Check out our Young Guns & Turnaround Stocks

👉 Dive into Stock Market Humor & Serious-ish Plays

👉 International Investment Opportunities await here.

👉 For even older brands on new missions, explore our Corporate Resurrection Series. Nope, doesn't exist anymore.

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: