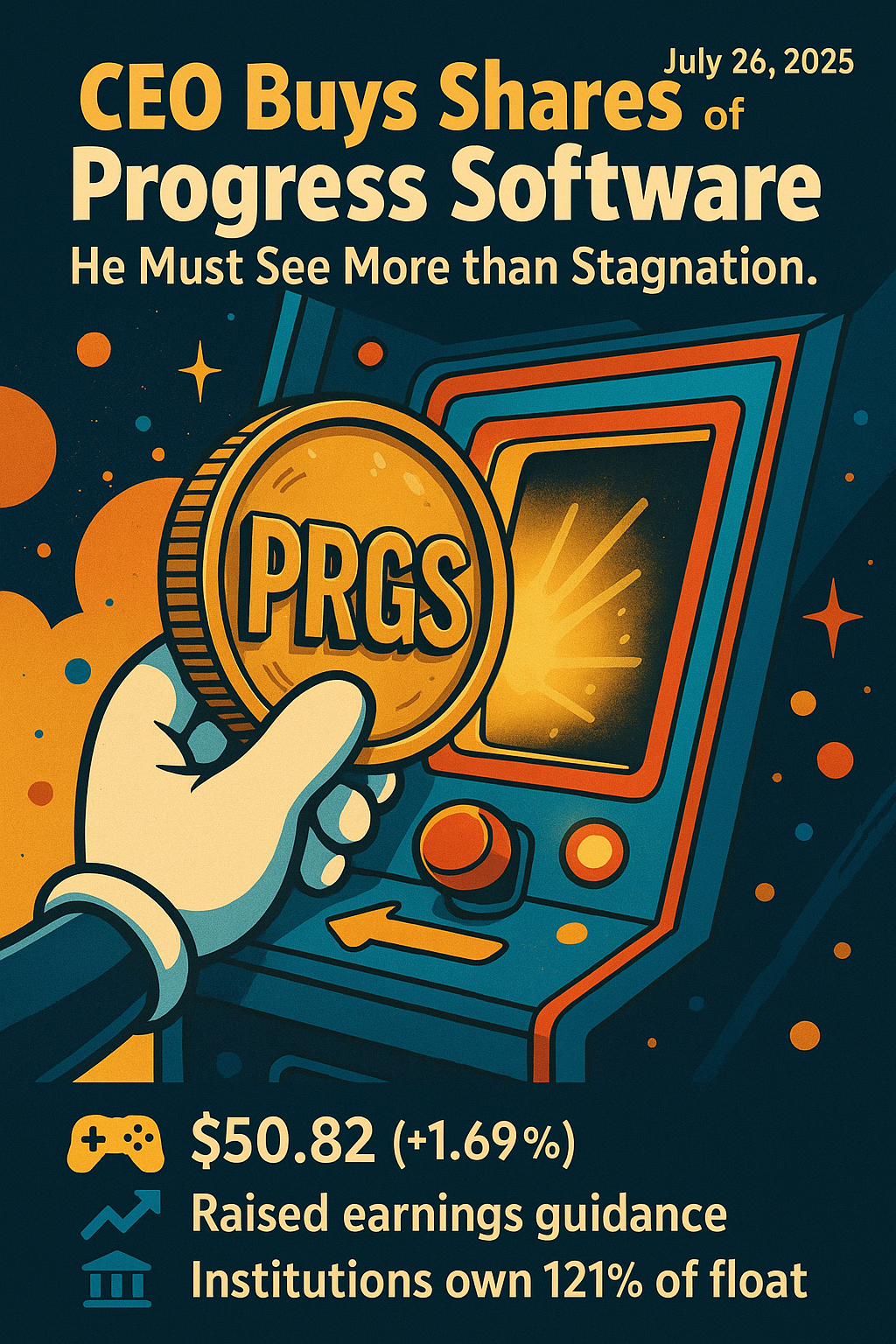

Progress Software CEO Buys In — Maybe It’s More Than Just... Progress?

🧠 Stock: Progress Software Corp 📈

💸 Ticker: NASDAQ: PRGS

🎯 Price (as of Jul 25, 2025): $50.82 (+1.69%)

📆 Insider Trigger: CEO & Director Buy Big

“Progress is slow,” they say. But the CEO just dropped $100K+ on shares. That’s more than coffee money — and way more than a casual 'meh' vote of confidence.

🕵️♂️ The Insider Moves:

| 📅 Date | 🧑 Insider | 💼 Title | 💵 Price | 🎯 Shares | 💰 Value |

|---|---|---|---|---|---|

| 2025-07-23 | Yogesh Gupta | CEO | $49.14 | 2,100 | $103,194 |

| 2025-07-23 | David Krall | Director | $48.90 | 5,125 | $250,613 |

🧲 That's $350K+ of real insider skin in the game — not Monopoly money.

🔬 What Is Progress Software, Really?

Think of Progress Software as your quiet, no-drama, enterprise tech friend who’s actually pulling in serious numbers while the flashy types hog the spotlight.

🧰 What they offer:

-

OpenEdge – Business-critical app development

-

MOVEit – Secure file transfers (yes, for grown-ups)

-

Kemp LoadMaster – Fancy name for load balancers

-

Sitefinity – Digital marketing magic

-

WhatsUp Gold – Network monitoring (not a hip-hop track)

-

Flowmon, Corticon, Semaphore... — 🧠 Sounds like superhero aliases, but they’re all legit software products for enterprise, automation, and AI

📍 Headquarters: Burlington, MA — not Silicon Valley, but they’re still pushing code and pulling profits.

💪 The Financials: Not Flashy, But Solid

📊 FY ‘24 (GAAP):

-

Revenue: $753.4M (+8%)

-

Operating Income: $124M (+12%)

-

Net Income: $68.4M (−3%)

-

EPS: $1.54

-

Cash from Ops: $211.5M (+22%)

✅ Margin holding steady at 16%.

❗ EPS dipped slightly — but not alarmingly.

🚀 Q2 '25: Stronger Than Expected

-

Revenue: $237M (+36% YoY)

-

ARR: $838M (+46% YoY)

-

GAAP EPS: $0.39 (+5%)

-

Non-GAAP EPS: $1.40 (+28%)

-

Operating Margin: GAAP 16%, Non-GAAP 40%

-

Acquired Agentic (RAG AI company) — that’s “Retrieval-Augmented Generation” AI, not a band.

🧃 Bottom line: The juice is flowing, and the margins are still tasty.

👉 Want the full picture? Dive into Progress Software (PGRS)'s financials here.

🏦 Institutions Are Hungry for Progress

Institutions own 121.12% of the float. Yes, more than 100%. Either math broke… or the pros are all-in.

🏢 Top Holders (Q1 2025):

| 🏦 Holder | 📈 % Out | 💰 Value |

|---|---|---|

| Blackrock | 16.3% | $356.8M |

| Vanguard | 13.5% | $296.6M |

| Boston Trust | 4.1% | $89.6M |

| State Street | 4.1% | $88.9M |

| Wellington | 3.2% | $68.9M |

That’s a who’s who of “Yes, please!” on Wall Street.

🔍 For Institutional Ownership breakdown, see here.

🧮 Valuation Check: Expensive? Maybe Not.

| 📐 Metric | 🔢 Value | 💬 Verdict |

|---|---|---|

| Trailing P/E | 39.09 | 😬 Pricey |

| Forward P/E | 10.02 | 🤔 Much better |

| Price/Sales | 2.60 | 💸 Fair |

| EV/Revenue | 4.12 | 👍 Fine |

| EV/EBITDA | 13.75 | 😏 Not outrageous |

| Price/Book | 4.84 | 📘 Acceptable |

💬 TL;DR: Not screaming cheap — but maybe whispering “undervalued.”

⚠️ The Risks: Progress... or Pause?

-

Organic Growth: Still finding its stride. Acquisitions (like ShareFile) have driven much of the recent uptick.

-

Competition: Facing giants (Microsoft, Oracle) and startups with rocket fuel.

-

Integration Risk: M&A ain’t always plug & play.

-

Leverage: Debt-to-equity at 3.54, current ratio under 0.5. That’s tightrope territory.

-

Cash Flow from Ops: Still healthy, but recently receded.

📉 And don’t forget: software may be eating the world, but some apps get heartburn.

💡💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

🧠 Final Take: Not Sexy, But Strong?

Progress Software isn’t the loudest stock in the room. But…

-

📈 It’s profitable.

-

📉 It’s off ~30% from its all-time highs.

-

🧑💼 Insiders are buying.

-

🧮 Institutions are stuffed full of PRGS.

-

🤖 They just bought an AI company (because, of course).

🎯 Could be a rerating candidate. Not a moonshot — but maybe a hopefully reliable compounder with a reasonable ETA.

👀 Our Verdict?

If you’re into quiet compounders, low-volatility tech, or insiders who actually buy instead of sell, then PRGS might just be... well, progress.

🚨 Disclaimer:

We like progress. But we love booming, skyrocketing, and 💥 mind-blowing rallies even more. This is NOT financial advice. It’s just a second opinion — and yes, we’re billing your sense of humor. 🎪💸

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 See the world differently and check out more international market picks and fun takes. Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.)

- 📈 Biotech Bets & Innovation Radar (Problem is we can't detect the Radar)

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Even Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: