Insider Purchases: Inside the Buy

Tag: CEO insider buying

Can Elevance Reach Higher Elevations? The CEO Thinks So

📉 After falling nearly 50% from its highs, Elevance Health just got a $2.4M vote of confidence from its CEO. Is this the cure—or just another symptom? 🏥 Dive into the numbers, the risks, and the potential rewards. And yes, there will be icons. 📊💊📈

Helen of Troy (HELE) — Insider Buys, CFOs Turned CEOs, and a Falling Knife You Might Want to Catch (Carefully)

The CEO and CFO of Helen of Troy just bought shares as the stock plunges 90%. Are we looking at a tragic tale, or a comeback for the ages? We dig into the numbers, leadership shuffle, and Wall Street signals—with humor and historical flair.

Will Profits From Marriott Vacations (VAC) Help You Unwind?

Insiders are buying, institutions are lounging, and dividends are flowing. Marriott Vacations Worldwide (VAC) might be your next profitable getaway — with a 3.9% yield and room to grow. But are there risks under the palm trees?

PVH: Fashion. Fundamentals. CEO Buying. Doesn't the $500M Share Buyback Scream Deep Value?

CEO Stefan Larsson just bought $1M worth of PVH stock—and he’s not alone. With iconic brands like Calvin Klein and Tommy Hilfiger, institutional support over 100%, and a massive share buyback underway, PVH may be a classic turnaround play. But is it fashionably early… or just fashionably risky?

Not Everybody Likes Hunting, But Insiders Preyed On Sportsman's Warehouse's Stock

Sportsman's Warehouse (SPWH) may be wounded, but insiders are on the prowl. With CEO and directors buying stock, and a valuation that screams “cheap,” is this outdoor retailer staging a comeback? Time to load up—or duck?

Asana's Exiting CEO Keeps Buying Shares. Will the New One Deliver?

💼 Exiting billionaire CEO Dustin Moskovitz just bought another $1.1M in Asana shares — on top of many millions more in 2025 alone. With a new CEO taking the reins and the company showing signs of financial progress, could this be a contrarian play worth watching?

Oxford Industries’s Tommy Bahama and Lilly Pulitzer Rock: Should You Emulate Insiders and Buy More Than the Brands?

Oxford Industries owns some of the most recognizable lifestyle brands—Tommy Bahama, Lilly Pulitzer, and Johnny Was. Sales are soft, but margins hold, insiders are buying, and the dividend is sweet. Time to sip a piña colada—and check the stock price?

Moderna: Messenger RNA Medicines Powerhouse Sends A New Message — “Discount!”

Insiders dropped $6M on Moderna stock. With a massive mRNA pipeline and deep-pocketed backers, is this biotech beast ready to roar again?

CEO Bought Shares: Is Full House Worth Betting the House?

Full House Resorts is growing fast—but still bleeding cash. The CEO’s massive insider buy may hint at a turnaround, but with debt looming and expansion plans on the table, is FLL worth a gamble? We break it down—odds, icons, and all.

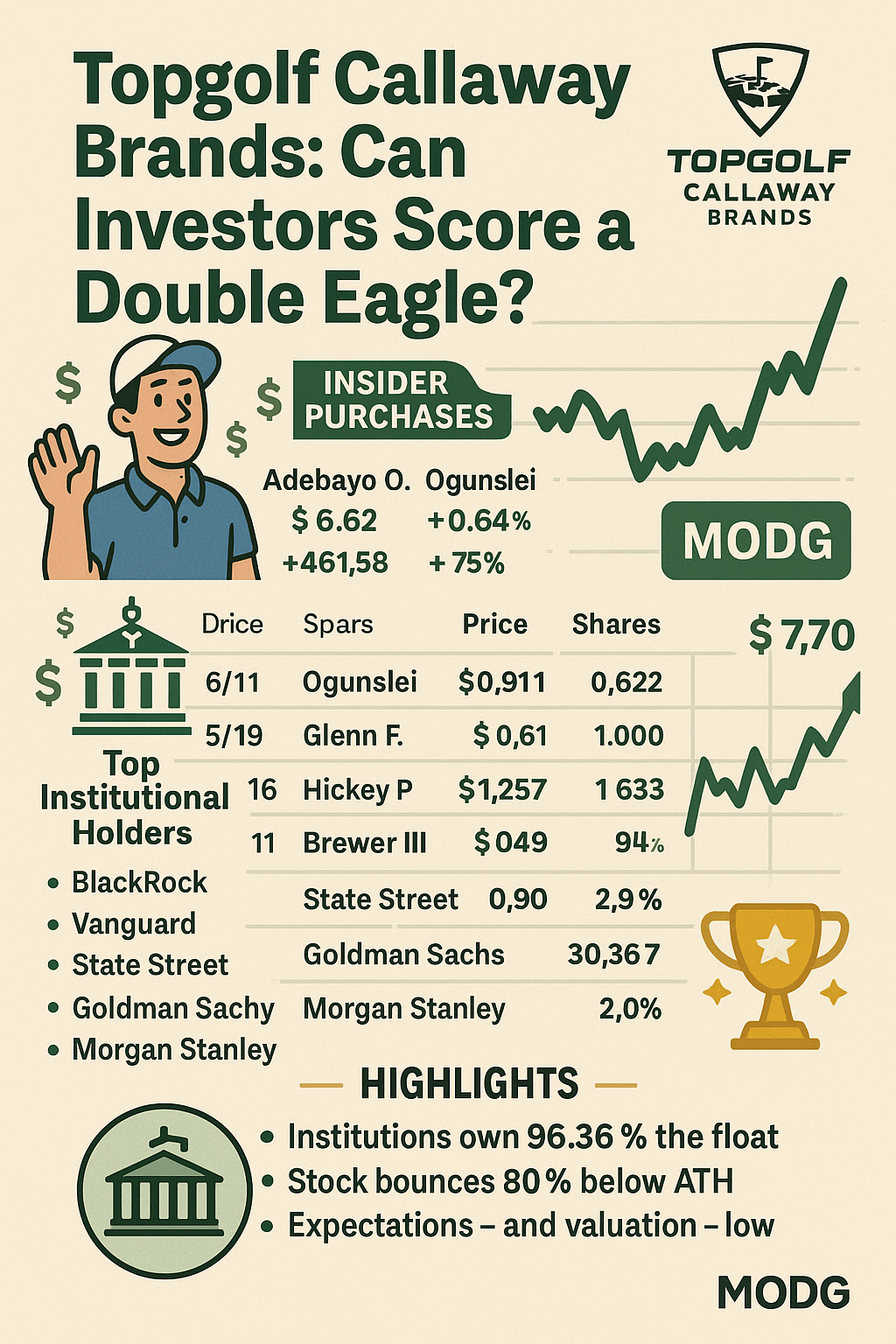

Topgolf Callaway Brands: Can Investors Score a Double Eagle?

Topgolf Callaway may be down 80% from its highs, but insider buys, institutional backing, and a turnaround plan suggest the comeback tour could be real. ⛳📊

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.