Bausch Health: Paulson Doubles Down, Stock Breaks Out, Recovery Accelerates

Ticker: $BHC 💊

Price: $7.17 (+2.43% as of Aug-13-2025, 4:10 PM ET)

🚀 Breakout Update (Aug 2025)

1) Paulson at it again.

John Paulson — yes, that John Paulson of “Big Short” fame — just added another 3.24M shares of Bausch Health at $6.56, worth a cool $21.3M. His total ownership is now over 36M shares, up 10%. When Paulson keeps loading up, you take notice.

2) Stock up 30% since last month.

That’s right — since our original piece in June, BHC has rallied 30%. From a contrarian “fallen angel” to a rising phoenix? Maybe.

3) Q2 2025 Results: Recovery on Track.

-

Revenue: $2.53B (+5% YoY)

-

GAAP Net Income: $148M (big improvement from prior losses)

-

Adj. EBITDA: $842M (+6% YoY)

-

Ex-Bausch + Lomb: 9th straight quarter of growth

-

Debt: ~$900M repayment coming, using cash on hand

-

M&A: Acquiring DURECT Corp., bringing in late-stage treatment for alcohol-induced hepatitis

The recovery story is intact, fundamentals are improving, and the technicals suggest BHC may have completed a multi-year (triple) bottom. Add in Paulson, Icahn, and GoldenTree on board, and you’ve got one heck of a turnaround cocktail. 🍸

👉 Original June article below for the full background:

Ticker: BHC 💊

Price: $5.51 (+3.38%, as of Jun 12, 2025)

Trigger: 📌 Insider Buy — and not just any insider...

💰 Who’s Buying? The Big Short Legend Himself

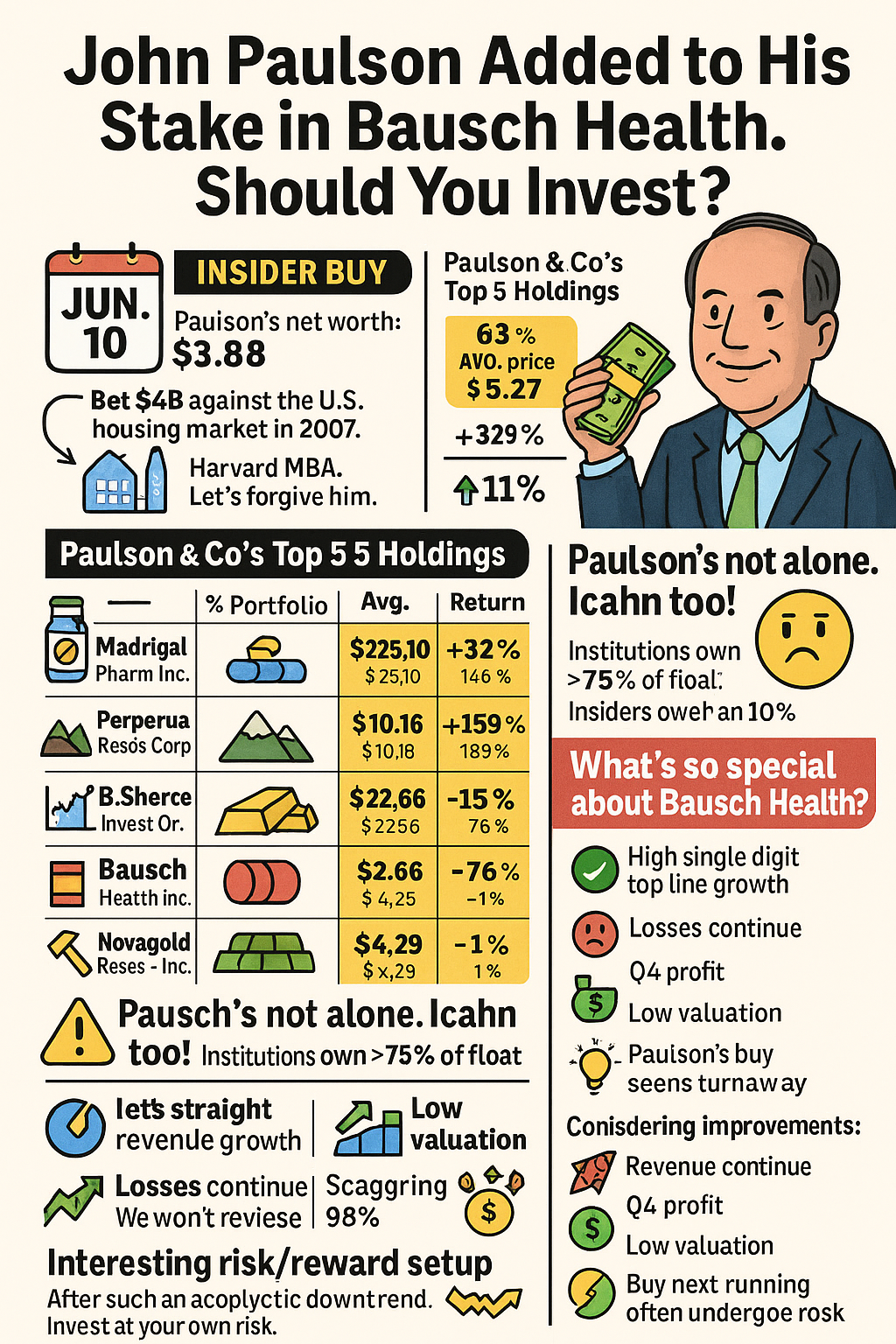

John Paulson — hedge fund billionaire, Harvard MBA, and the guy who shorted the housing market and made $4 billion — just added 2.79 million shares of Bausch Health to his personal shopping cart.

🧾 Trade Date: June 10, 2025

💵 Buy Price: $5.27

📈 New Total Stake: 29.2M shares

💸 Cost of Entry: $14.7 million

Paulson knows a good discount when he sees one. So… should retail investors follow?

🧠 Paulson’s Portfolio Priorities (Before This Buy)

Top 5 Holdings in Paulson & Co’s Portfolio:

| Stock | % Portfolio | Avg Buy Price | Current Price | Return |

|---|---|---|---|---|

| 🧬 Madrigal Pharma | 33.5% | $225.10 | $297.21 | +32% |

| 🪙 Perpetua Resources | 17.4% | $5.38 | $13.12 | +144% |

| 💼 BrightSphere | 12.6% | $10.16 | $26.34 | +159% |

| 💊 Bausch Health | 7.8% | $22.66 | $5.51 | -75.7% |

| 🔄 NovaGold | 6.3% | $4.29 | $4.34 | +1.2% |

Yup — Bausch is still deep in the red for him. But he added anyway. That’s conviction. Or something.

🔍 For full Institutional Ownership breakdown, see here.

🏛️ Smart Money Check-In

You’re not alone if you’re curious. Bausch Health is stacked with heavyweight investors:

-

🧔 Carl Icahn — 34.7M shares (9.4%)

-

💰 GoldenTree Asset Mgmt — 30.2M shares

-

💸 Paulson & Co — 29.2M shares

-

🧳 Nomura — 23.4M shares

-

🏥 Ontario Pension Plan — 13M shares

-

🏦 Vanguard — 11.75M shares

Big names, big stakes. But what’s so special about this company?

👁️ So What Does Bausch Do?

Bausch Health develops and sells treatments for:

-

Stomach and liver stuff 🍽️

-

Mental health and neurology 🧠

-

Skin and smiles 🧴🦷

-

Eyes (via its Bausch + Lomb stake) 👁️

-

Beauty (Solta Medical 💉)

-

Plus, some global pharma arms 🌍

It’s a diversified health and wellness cocktail. But how’s the mix performing?

📊 Q1 2025 Results: Mixed Bag, But Building Momentum

-

Revenue: $2.26B (↑5% YoY)

-

Adjusted EBITDA: $661M (flat)

-

Net Loss: $58M (yikes)

-

✅ Ex-Bausch + Lomb: 8th straight quarter of revenue and EBITDA growth

-

🔄 Completed $7.9B refinancing

-

⚖️ Legal win vs FDA

-

🎯 Reaffirmed 2025 guidance

The non-GAAP picture looks... not awful.

🔁 2024 Full-Year Recap: The Recovery Continues

-

Revenue: $9.63B (↑10%)

-

Adjusted EBITDA: $3.31B (↑10%)

-

Net Income: $93M (Q4); Loss of $46M for full year

-

✅ All segments grew

-

💊 Solta sales ↑33% organically YoY

-

🧠 Aplenzin (depression treatment) shows promise

-

💡 Q4 profit was a hopeful sign

👉 Want the full picture? Dive into Bausch Health’s financials here.

📉 But Let’s Talk Risks

-

⚠️ Still not consistently profitable

-

📉 Stock is down 98% (!) from its $263 ATH (2015)

-

💼 Bill Ackman got burned — and bailed

-

🏋️♂️ Debt remains hefty despite recent refinancing

-

⚖️ Regulatory pressure, pricing risks, and macro jitters remain

Interested in another investment idea?

Check our take on UnitedHealth Group.

📈 Why Paulson Might Be Right This Time

-

Revenue growth across segments

-

Solta’s 33% jump is no joke

-

Recent profitability hints at a turning tide

-

Shares are cheap: Forward P/E = 1.52 | Price/Sales = 0.21 (whoa!)

-

🧠 Smart money says yes (Paulson, Icahn, Tananbaum)

🤔 Final Take: Contrarian or Catastrophe?

Is BHC a screaming buy or a mirage in a lab coat?

We don’t know. But if you like turnarounds, drama, and billionaire shadowing, Bausch Health might just be your next guilty pleasure.

Just... don’t go all-in like it’s 2015.

Or perhaps do - your call!

🧴 Disclaimer

We might not be doctors, but we’ve definitely used eye drops.

This is not financial advice — just a spicy look at the markets.

💥 Invest at your own risk. And maybe keep a Band-Aid handy.

🧭 Want More Like This?

👉 Browse our Insider Purchases Center

👉 Explore our Follow the Pundits Hub: When Big Bets Matter

👉 Check out our Young Guns & Turnaround Stocks

👉 Dive into Stock Market Humor & Serious-ish Plays

👉 International Investment Opportunities and value plays await here.

👉 For even older brands on new missions, explore our Corporate Resurrection Series. Nope, doesn't exist anymore.

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: