Follow the Pundits

Tag: Funanc1al Edge

PCG Remains Daniel Loeb’s Top Pick. Could “PCG” Stand for Purchase, Cashflow, Grow?

Third Point made PCG its top holding. Undergrounding miles are stacking, rates are easing, and management guides 9%+ EPS growth into 2030. We break down the upside, the wildfire risk, and the rerating math—Fun + Smart style.

Institutions & Hedge Funds Are Buying and The Stock Is on a Tear. Will Robinhood (HOOD) Keep Stealing the Show?

Robinhood isn’t just stealing trades — it’s stealing headlines. With institutions buying, hedge funds betting, and analysts raising targets, HOOD is on a tear. But can the show go on? 🎟️🔥

OpenAI Likes Etsy. Renaissance, Elliott, and AQR Do Too. Should You?

Etsy’s stock soared after OpenAI’s “Buy it in ChatGPT” debut—plus Wall Street whales are piling in. Here’s why Etsy might be a handmade bargain with AI sparkle.

Activist Hedge Fun: Engine Capital Takes 3% Stake in Acadia Healthcare (ACHC). Buy the Dip—or Value Trap?

Activist Engine Capital wants a board shake-up at Acadia Healthcare (ACHC). With shares down 71% but activist pressure building, is it a deep value play—or just a value trap?

Will Billionaire Investor Ron Baron's Investment in Figs, Inc. (FIGS) Finally Bear Fruit?

Billionaire investor Ron Baron is doubling down on Figs, Inc. (FIGS) 🧵—the scrubs brand he calls the “Lululemon of healthcare.” With 94% institutional ownership, growing global expansion, and strong financials, could FIGS finally bear fruit 🍇? Or will competition and lofty valuation trip it up? Here’s the breakdown—fun, funny, and icon-filled.

Finance of America Companies (FOA): When Leon Cooperman Bets, Do You Fetch?

Leon Cooperman doubled down on Finance of America (FOA), betting big on its reverse mortgage growth story. Profits are back, institutions are circling, and the stock trades at just 3.7x earnings. Is this the start of a Rocky-style comeback — or another value trap waiting to snap shut?

John Paulson Is Loading Up on Perpetua Resources. Should You?

John Paulson knows a good discount when he sees one—and he just grabbed another $100M worth of Perpetua Resources (PPTA). But what is this gold-and-antimony play really about? From Idaho mines to strategic minerals and a wink at squirrel invasions, we break it all down.

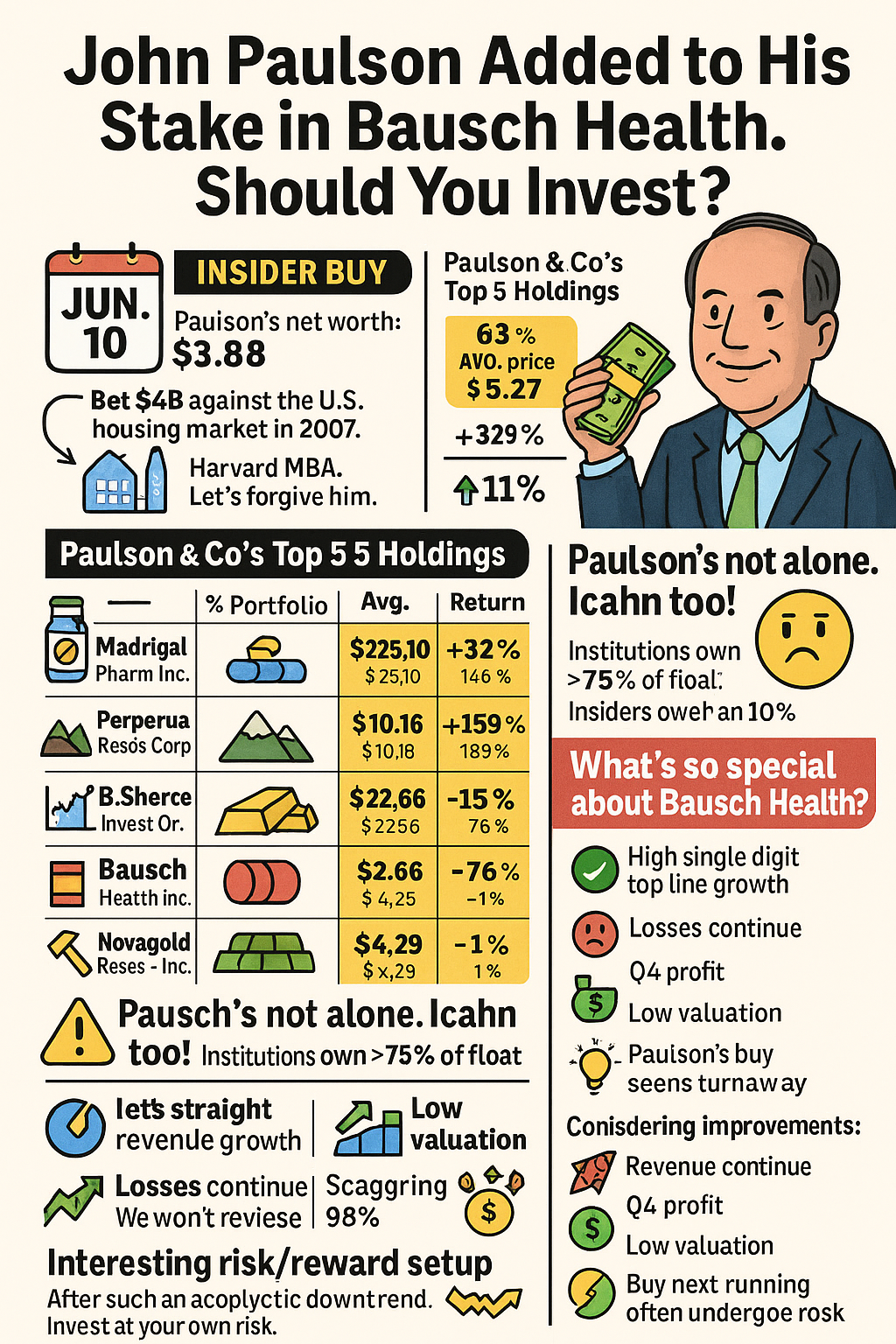

Bausch Health: Paulson Doubles Down, Stock Breaks Out, Recovery Accelerates

Bausch Health ($BHC) is back in the spotlight as legendary investor John Paulson adds millions more in shares, fueling a breakout rally. With Q2 earnings showing revenue growth, profit rebound, and debt repayment plans, could BHC be staging its long-awaited comeback?

Apple Remains Warren Buffett’s Top Stock — Should You Still Bite?

Buffett’s got $60 billion riding on Apple. Services are booming. iPhone addiction remains. But is it still worth your bite — or should you wait for a sweeter dip? 🍏🤔

Daniel Loeb Still Thinks PG&E Stands for Purchase, Grab & Enjoy

PG&E has gone from fiery headlines to financial footing—and Daniel Loeb’s Third Point is all-in. With 14% of his portfolio riding on PCG, a growing customer base, and wildfire risks contained (for now), is this survivor stock worth a second look?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.