Follow the Pundits

Tag: Funanc1alStocks

Rapid7 (RPD): Slow Growth, But Jana Sees Value & Institutions Are All In

Rapid7 (RPD) just caught hedge fund JANA Partners’ eye with a $15M insider buy. Institutions are piling in, but growth remains slow. Is this a value gem in cybersecurity or just another trap? We break it down with humor, icons, and insights.

Bill Ackman’s Pershing Square Still Noshes on Restaurant Brands International (QSR). Should You?

Restaurant Brands International ($QSR) is cooking up dividends, international growth, and a massive Burger King reset. Bill Ackman’s Pershing Square still owns a super-sized stake—should you follow suit, or wait for a dip before ordering?

Bill Ackman’s Pershing Square Still Hearts Brookfield (BN)

Bill Ackman still loves Brookfield, his top Pershing Square bet—now up 39%! But at nearly $68 per share, has the value vanished? We dig into insider buying, institutional interest, financial highlights, and whether this former bargain is still a buy. 💼📈

Paul Tudor Jones Loves IWM. Should You?

Paul Tudor Jones is going heavy on small caps—and maybe prepping for AI-induced doom. With 1,350+ positions and an options playbook that could fill a library, what’s his real bet? And more importantly: should you follow? Read on, but don’t YOLO.

ACADIA Pharmaceuticals: Biotech Powerhouse Baker Bros Still Believes. Should You Buy In?

Biotech heavyweight Baker Bros still owns over 25% of ACADIA Pharmaceuticals (ACAD), and the stock is heating up. With expanding revenue, a rich CNS pipeline, and smart money backing it, is this the comeback story investors have been waiting for?

Lionsgate Studios: Insiders Are Buying. Should the Stock Get the Lion's Share of Your Portfolio?

🦁 Liberty 77 Capital, led by ex-Treasury Secretary Steven Mnuchin, bought over 8 million shares of Lionsgate Studios (NYSE: LION). Revenues are up, insiders are bullish, and the studio is freshly split from Starz. Is it showtime—or a risky sequel?

John Paulson Is Loading Up on Perpetua Resources. Should You?

John Paulson knows a good discount when he sees one—and he just grabbed another $100M worth of Perpetua Resources (PPTA). But what is this gold-and-antimony play really about? From Idaho mines to strategic minerals and a wink at squirrel invasions, we break it all down.

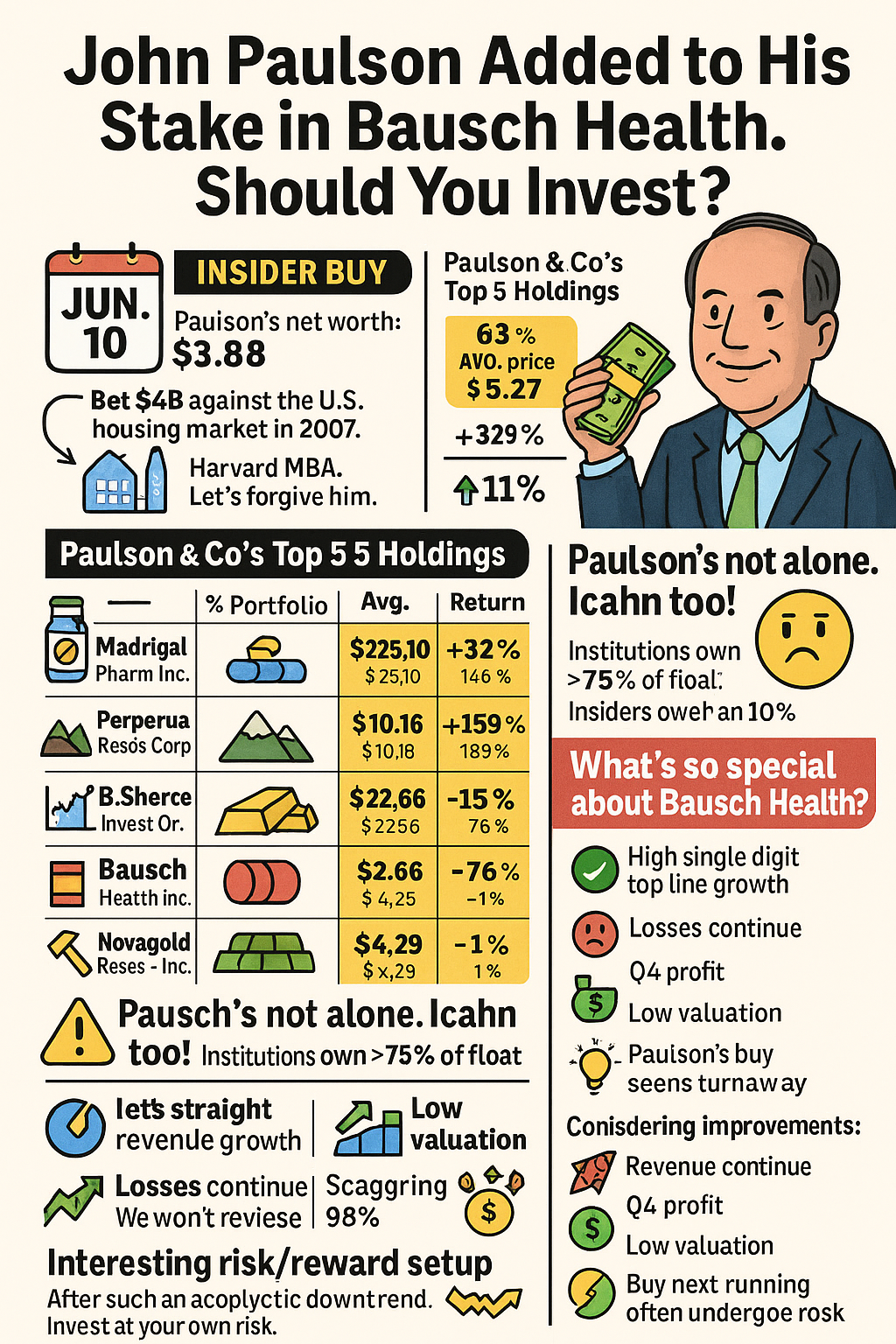

Bausch Health: Paulson Doubles Down, Stock Breaks Out, Recovery Accelerates

Bausch Health ($BHC) is back in the spotlight as legendary investor John Paulson adds millions more in shares, fueling a breakout rally. With Q2 earnings showing revenue growth, profit rebound, and debt repayment plans, could BHC be staging its long-awaited comeback?

Apple Remains Warren Buffett’s Top Stock — Should You Still Bite?

Buffett’s got $60 billion riding on Apple. Services are booming. iPhone addiction remains. But is it still worth your bite — or should you wait for a sweeter dip? 🍏🤔

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.