Follow the Pundits

Tag: Funanc1al Turnaround Plays

Lionsgate Studios: Insiders Are Buying. Should the Stock Get the Lion's Share of Your Portfolio?

🦁 Liberty 77 Capital, led by ex-Treasury Secretary Steven Mnuchin, bought over 8 million shares of Lionsgate Studios (NYSE: LION). Revenues are up, insiders are bullish, and the studio is freshly split from Starz. Is it showtime—or a risky sequel?

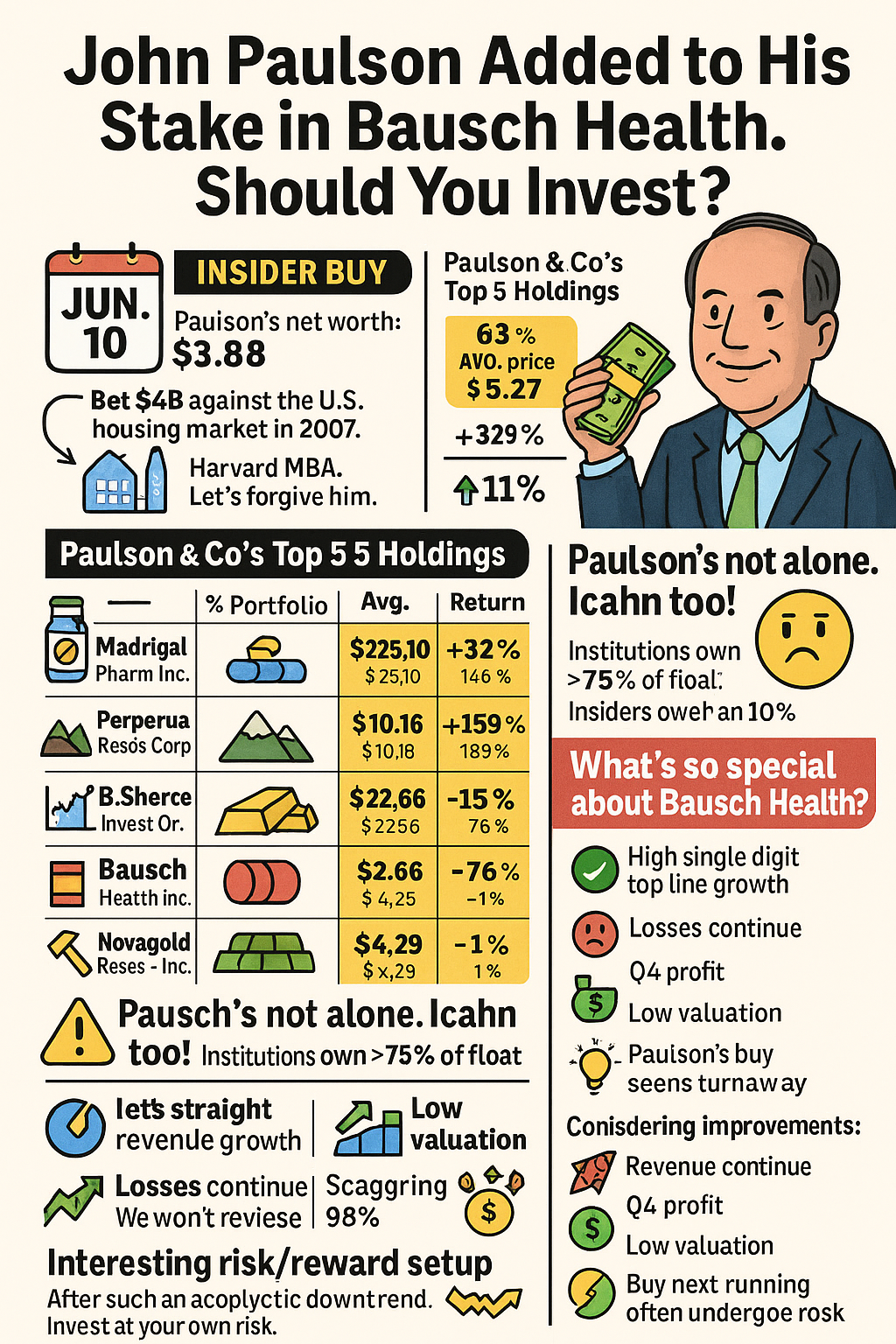

Bausch Health: Paulson Doubles Down, Stock Breaks Out, Recovery Accelerates

Bausch Health ($BHC) is back in the spotlight as legendary investor John Paulson adds millions more in shares, fueling a breakout rally. With Q2 earnings showing revenue growth, profit rebound, and debt repayment plans, could BHC be staging its long-awaited comeback?

Daniel Loeb Still Thinks PG&E Stands for Purchase, Grab & Enjoy

PG&E has gone from fiery headlines to financial footing—and Daniel Loeb’s Third Point is all-in. With 14% of his portfolio riding on PCG, a growing customer base, and wildfire risks contained (for now), is this survivor stock worth a second look?

If Madison Square Garden Entertainment Keeps John Rogers Entertained, Maybe You Should Grab a Seat Too

MSGE isn’t just concerts and Christmas Spectaculars—it’s quietly profitable, backed by top funds, and has the attention of Ariel Investments’ John Rogers. But is the show just starting—or already halfway through?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.