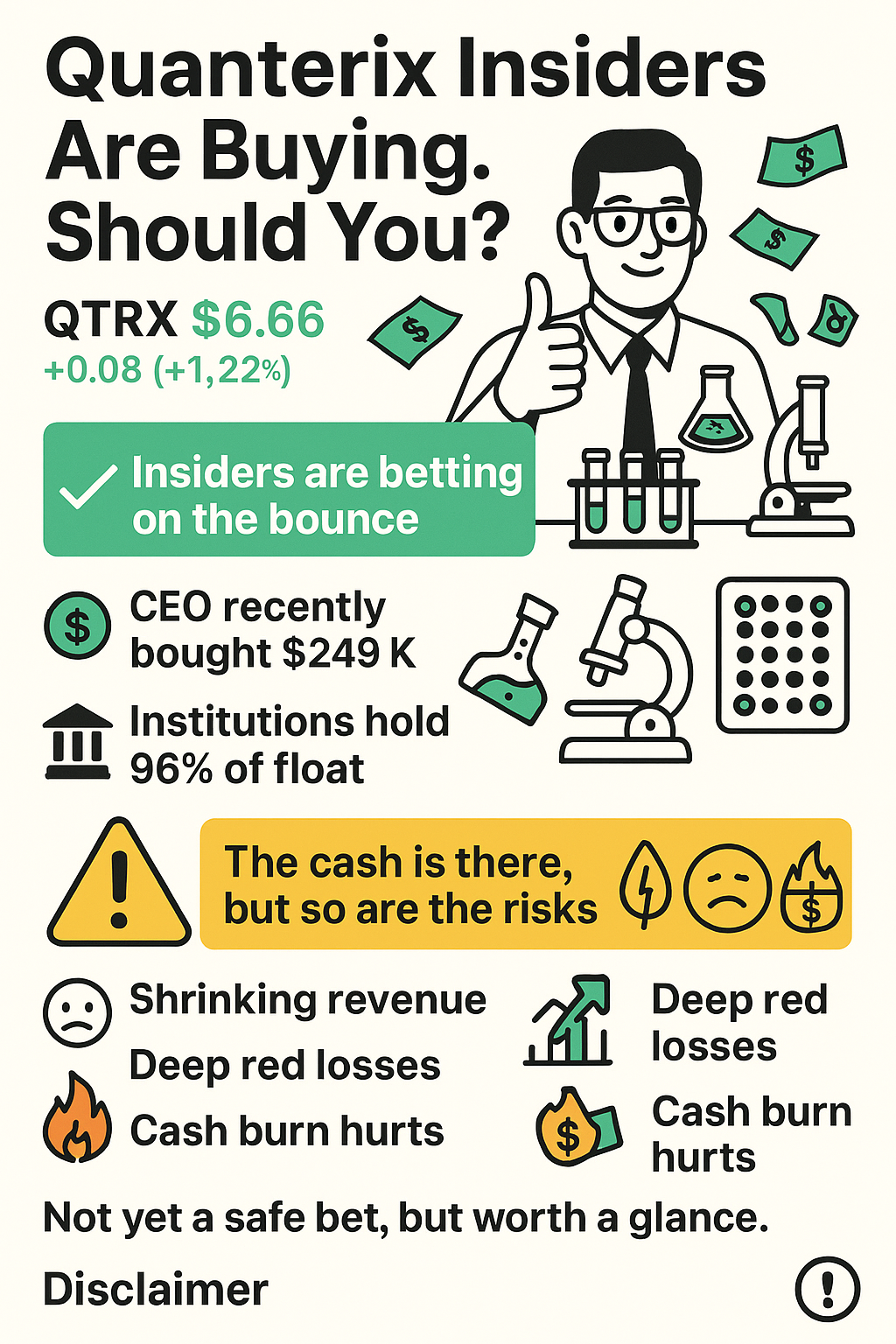

Quanterix Insiders Are Buying. Should You?

Ticker: QTRX 🧬

Price: $6.66 (+1.22%, as of June 11, 2025)

Trigger: 📌 CEO + directors loading up on shares = eyebrows raised.

📥 Insider Activity: Loading Up on the Dip

-

🧪 Masoud Toloue (CEO): Bought 45,900 shares → +10% position

-

🧠 David R. Walt (Director): Scooped 210,000 shares → +14%

-

💼 William Donnelly (Director): Bought 93,113 shares → +203% increase

🚨 That’s real money hitting the table — not just pocket change. Total: over $1.8M invested in less than a week.

🧱 Institutional Support: Strong Like a Protein Bond

Institutions own a whopping 96.77% of the float.

Top holders include:

-

Ameriprise (9.57%)

-

BlackRock (7.91%)

-

Portolan, Vanguard, UBS, and William Blair also in the mix

🔍 For full Institutional Ownership breakdown, see here.

The smart money seems intrigued. But why?

🔬 What Does Quanterix Actually Do?

Quanterix builds futuristic-sounding machines to detect proteins at ultra-low concentrations. Think:

-

🧫 HD-X, SR-X, SP-X platforms (because biotech can’t resist cool names)

-

🧪 Services like sample testing, “homebrew” assay development (not beer), and diagnostics

-

🧠 Focus areas: neurology, oncology, immunology, inflammation

It's science-y. It’s complex. It’s headquartered in Billerica, Massachusetts. Of course it is.

📉 Q1 Financial Highlights (aka: not the good part)

-

Revenue: $30.3M (↓ 5%)

-

GAAP gross margin: 54.1%

-

Adjusted gross margin: 49.7%

-

Net loss: $20.5M (vs. $11.2M last year)

-

Cash on hand: $269.5M

-

Adjusted cash burn: $9M for the quarter (but $22M including acquisition/legal spend)

🔻 Still bleeding, but at least the wallet’s not empty.

🧾 2025 Outlook: Still in the Red, But With a Plan

-

Projected Revenue: $120M–$130M (↓ 5% to 13%)

-

Adjusted cash burn for year: $35M–$45M

-

Gross margin goal: 50–54%

-

💡 Positive cash flow projected… in 2026 (well, at least that's the hope) with a 💰 Cash balance of $100M+

Management also renegotiated the Akoya Biosciences merger:

-

Deal value slashed 67%

-

QTRX ownership now 84% post-close → could be good

And yes, they’ve launched a cost-cutting plan targeting $30M/year in savings. 🪓

👉 Want the full picture? Dive into Quanterix’s financials here.

😬 The Risks (Because It’s Not All Assays & Acquisitions)

-

Top-line erosion — revenue shrinking, not expanding

-

Net losses are growing — not shrinking

-

Cash burn is real and ongoing 🔥💸

-

External pressure — research funding cuts, biopharma slowdown, and tariffs

-

Execution risk — Will Akoya integration help or distract?

🧪 Final Take: Curious, But Handle With Gloves

✅ Pros:

-

Insiders are buying big

-

Institutions are still in

-

Positive cash balance

-

Proactive cost-cutting

-

Akoya renegotiation looks more favorable now

❌ Cons:

-

Burning cash like a Bunsen

-

Revenue decline is no joke

-

2026 cash flow goal feels far away

-

Complex tech with gear sounding like space tech (HD-X, SP-X, SR-X), but it has yet to take on the world

Verdict? Start small if you must — or just wait. Watch for momentum to improve. No need to rush the pipette.

Interested in another investment idea?

Check our take on UnitedHealth Group.

🧬 Disclaimer

We love to have fun — but losing money is not one way to do it.

🧪 This is not financial advice. Just molecular-level speculation wrapped in science-sprinkled sarcasm.

Invest at your own risk.

🧭 Want More Like This?

👉 Browse our Insider Purchases Center

👉 Explore our Follow the Pundits Hub: When Big Bets Matter

👉 Check out our Young Guns & Turnaround Stocks

👉 Dive into Stock Market Humor & Serious-ish Plays

👉 International Investment Opportunities and value plays await here.

👉 For even older brands on new missions, explore our Corporate Resurrection Series. Nope, doesn't exist anymore.

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: