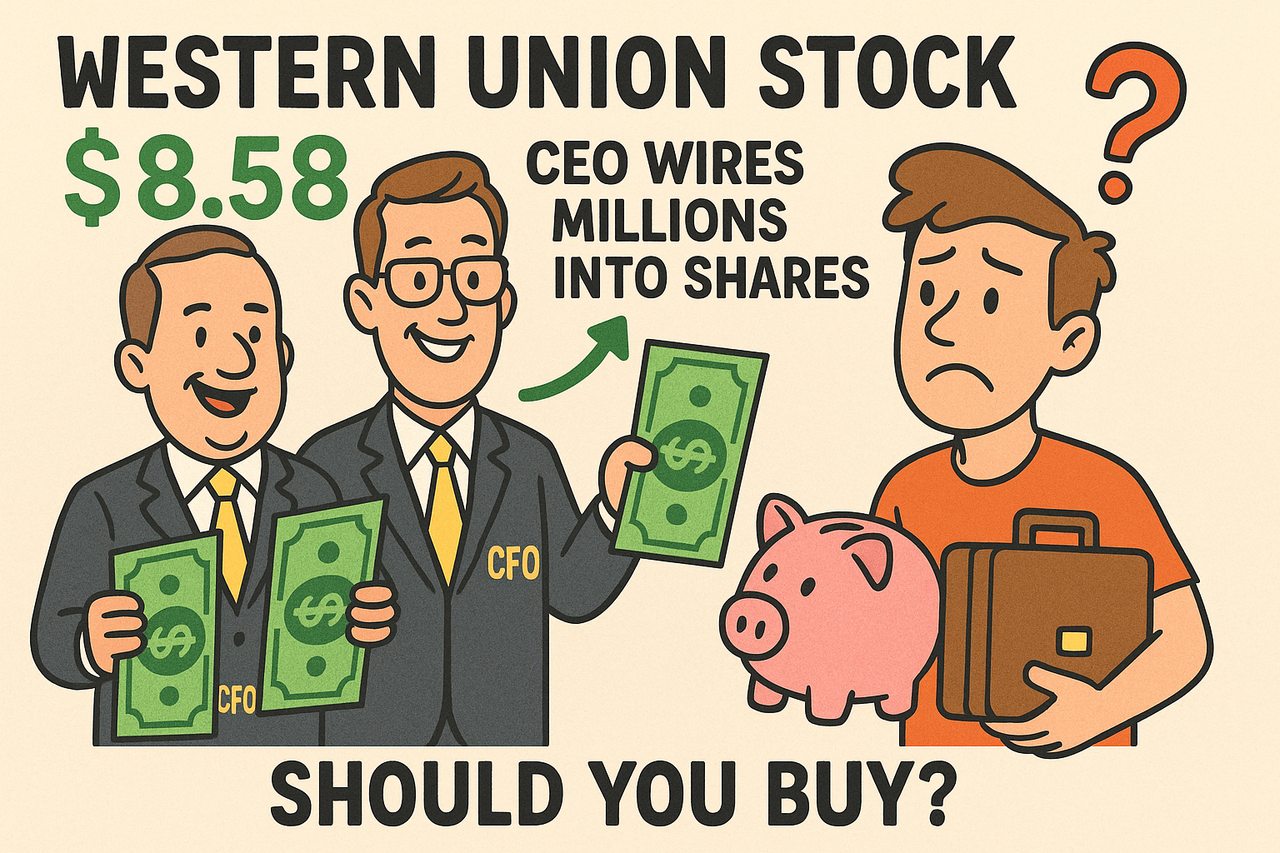

Western Union (WU): Cash Transfers, CEO Buys, and Maybe a Stock Rebound?

Price: $8.58 (+1.66%) as of Aug-26-2025 💸

🚨 Trigger: Insider Purchases (Follow the Money)

Western Union’s CEO and CFO are literally wiring money… into their own stock.

-

CEO Devin McGranahan bought 176,470 shares at $8.49 (+$1.5M).

-

CFO Matthew Cagwin bought 17,500 shares at $8.36 (+$146K).

-

Even a director was in on it last year at higher prices ($12.85).

That’s commitment — unless they accidentally hit “send” to themselves instead of Aunt Rosa in Argentina. 🏦😂

🏦 Institutions Onboard

Insiders aren’t alone:

-

Vanguard: 35.8M shares

-

BlackRock: 31M shares

-

State Street: 13.6M shares

In total, 95% of the float is held by institutions. Translation: Wall Street thinks WU is still worth more than just nostalgic yellow kiosks in airports.

Not everyone’s buying, though: short interest is 9.67%. Some traders clearly expect more “Western Downion.” 📉

For Western Union (WU)'s Institutional Ownership breakdown, 🔍 see here.

📊 Business & Financials

2024 Results

-

Revenue: $4.2B (down 3% reported, flat adjusted)

-

GAAP operating margin: 17% (vs 19%)

-

EPS: $2.74 GAAP, $1.74 adjusted

-

Returned $496M to shareholders (dividends + buybacks)

2025 Outlook

-

Revenue: $4.1–$4.2B (flat, but hey, at least not crashing)

-

EPS: $1.54–$1.64 GAAP; $1.75–$1.85 adjusted

Q2 2025 Snapshot

-

Revenue: $1.03B (down 4%)

-

Branded digital: +6% revenue, +9% transactions

-

EPS: $0.37 GAAP, $0.42 adjusted

So: stable, profitable, but not exactly setting Zelle on fire. 🔥

👉 Want the full picture? Dive into Western Union (WU)'s financials here.

💰 Valuation: Cheap or a Trap?

Some numbers are so low they look like typos:

-

P/E: 3.25 trailing, 5.0 forward (🤯)

-

Price/Sales: 0.70 (bargain bin)

-

EV/EBITDA: 2.99 (cheap-cheap)

-

Dividend Yield: ~11% (!!!)

But high Price/Book (3.14+) and weak growth suggest it might be cheap for a reason. 🧐

⚠️ Risks (a.k.a. Why It’s Not All Sunshine and Wire Transfers)

-

Declining growth: Top line is flat, profits sluggish.

-

Fintech invasion: Remitly, Wise, PayPal, and Cash App eat WU’s lunch.

-

Regulatory burdens: AML + global compliance = costly headaches.

-

Macro shocks: Currency swings, political crises → remittance drops.

In short: Western Union = safe for your money transfers, not guaranteed safe for your portfolio.

💡💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

🎯 The Funanc1al Take

WU is a value play: dirt cheap by valuation, still cash-flow positive, still paying a fat dividend. But it’s also a potential value trap if it can’t innovate past “money wiring, but yellow.”

So, should you invest?

-

Bull Case: CEO & CFO are buying, institutions are heavy holders, and valuation screams “bargain.”

-

Bear Case: Revenues declining, fintech rivals everywhere, and dividend cuts loom if profits slide.

👉 Western Union may still move your money — the question is whether it can also move its stock.

⚠️ Disclaimer:

We wire jokes, not financial advice.

We laugh, we analyze, we meme. We just sell jokes and opinions — and yes, we’re billing your sense of humor. 🎪💸

We’re not financial advisors. We’re FUNancial advisors.

Turbulence ahead? Invest at your own risk, always DYOR, hold the FOMO, and don’t invest what you can’t afford to lose.

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 See the world differently and check out more international market picks and fun takes. Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.)

- 📈 Biotech Bets & Innovation Radar (Problem is we can't detect the Radar)

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Even Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: