Insider Purchases: Inside the Buy

Tag: DIrector Buying

Insiders Are Buying ConocoPhillips. Should You?

Insiders are drilling into COP shares—and they're not alone. With a $10B return plan, strong reserves, and a smart buyout of Marathon Oil, ConocoPhillips might just be the contrarian pick of the year. Here's the fun, smart breakdown.

Can Robinhood Still Steal the Show?

Robinhood’s got a new backer — and it’s no amateur. Christopher Payne (ex-DoorDash, Tinder, eBay) just went all in with a bold $2M+ insider buy. Add in huge crypto growth, a string of acquisitions, and global ambitions… and suddenly Robinhood doesn’t just look ready — it looks legendary. Is $HOOD still a buy? Let’s break it down.

Vera Bradley: The Bags Are Pretty; the Financials? Not So Much

The bags? Still adorable. The stock? Still near record lows. With insiders finally buying and a CEO exit underway, is Vera Bradley set for a stylish rebound — or is it still stuck in the clearance bin?

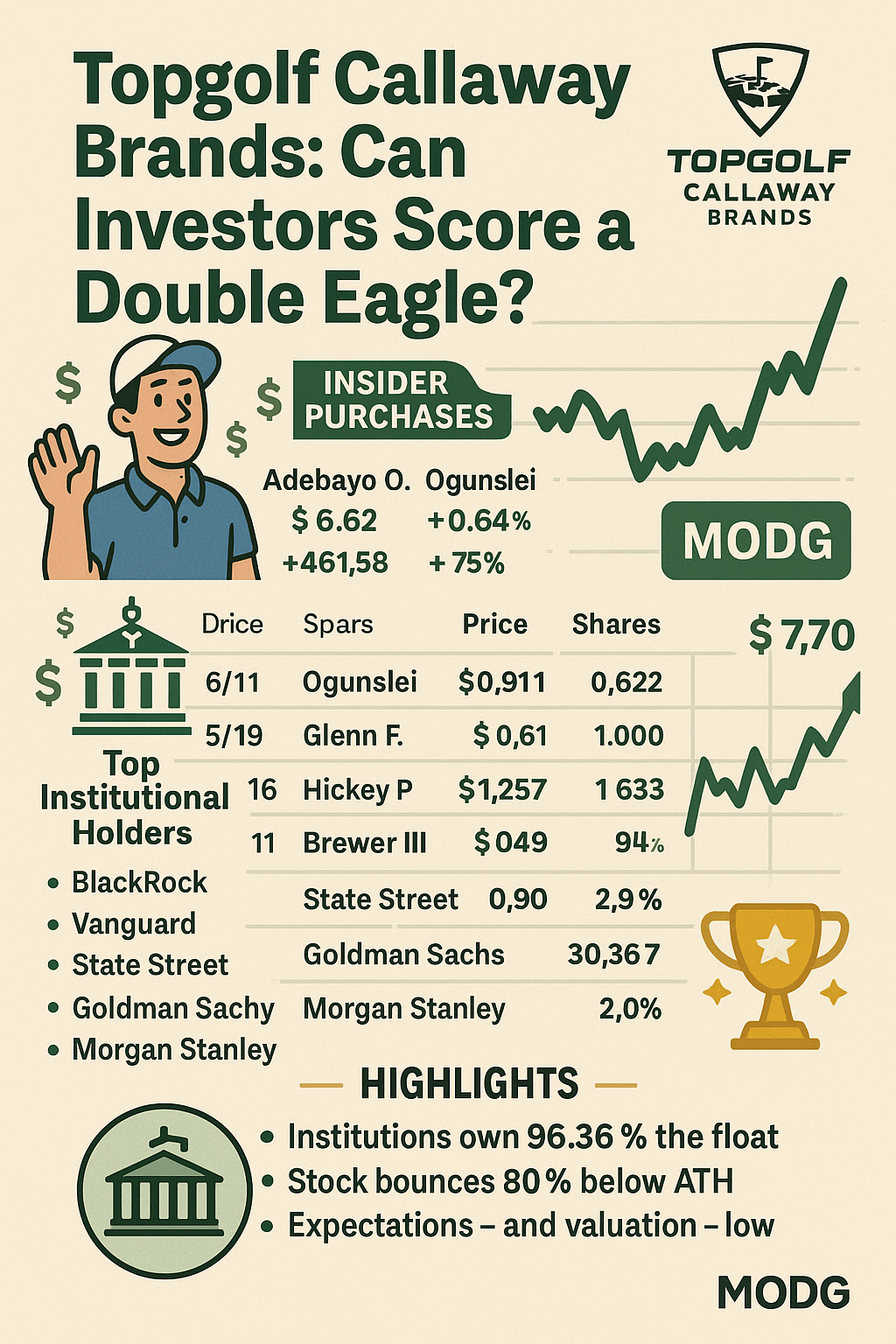

Topgolf Callaway Brands: Can Investors Score a Double Eagle?

Topgolf Callaway may be down 80% from its highs, but insider buys, institutional backing, and a turnaround plan suggest the comeback tour could be real. ⛳📊

Can Sweetgreen’s Stock Get Any Less Bitter?

Sweetgreen just served up its first insider buy since IPO—should investors take a bite? The fast-casual salad giant keeps growing but hasn’t turned a profit. We chop into the numbers, spice it up with fun, and toss in all the risks. 🥗📉

🥞 Pra Group: No Fun to Get Their Call But Fun to Call Their Stock!

They buy bad debt for pennies, chase it like bounty hunters, and sometimes spin a tidy profit from society’s financial skeletons. But is PRA Group (PRAA) a hidden gem—or a value trap in disguise? We dig deep into this curious case.

Weatherford (WFRD): When Oil Tech Drops, and a Board Member Buys a Bucketload 🧃🥇🚀

Oilfield tech firm Weatherford just got a $500K vote of confidence from a seasoned director—while big funds already own the sandbox. With a 2.4% dividend and a P/E under 7, could WFRD be a deep-value dark horse? Or an energy stock mirage?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.