Insider Purchases: Inside the Buy

Tag: CEOBuyIn

How Many Insider Buys Will It Take for The Bull in Enphase Energy to Re-energize?

After a brutal drop, Enphase Energy’s CEO is buying big. Institutions are all in. Margins hold strong. Could this be the spark the solar bull needs?

Arrow Electronics: A Straight Arrow, But the CEO Sees a Bullet

Arrow Electronics CEO Sean Kerins just bought nearly $1M of ARW stock. Is this undervalued tech distributor about to rebound, or just cruising under the radar? We take a shot at the bullseye—with puns and charts.

MSCI Keeps Winning — and the CEO Keeps Buying In

MSCI delivers world-class data tools for investors—and its CEO just bought in big. With soaring revenue, recurring subscriptions, and loyal institutions, is this still a buy? Or has the stock outpaced its fundamentals?

Does Align Technology’s Recovery Plan Have Teeth? The CEO Thinks So.

Align Technology insiders are smiling—because they’re buying. With a CEO purchase nearing $1M and Wall Street holding more shares than exist, ALGN may be regaining its shine. But should you sink your teeth into it now?

Viatris: The CEO Just Bought Shares… Should You Pop a Pill or Press "Buy"?

When a CEO personally buys over half a million dollars of stock, it’s time to pay attention. Viatris (VTRS) may be undervalued, with insider confidence, institutional backing, and a promising drug pipeline. But big losses and high debt mean it’s not risk-free. Is now the time to nibble?

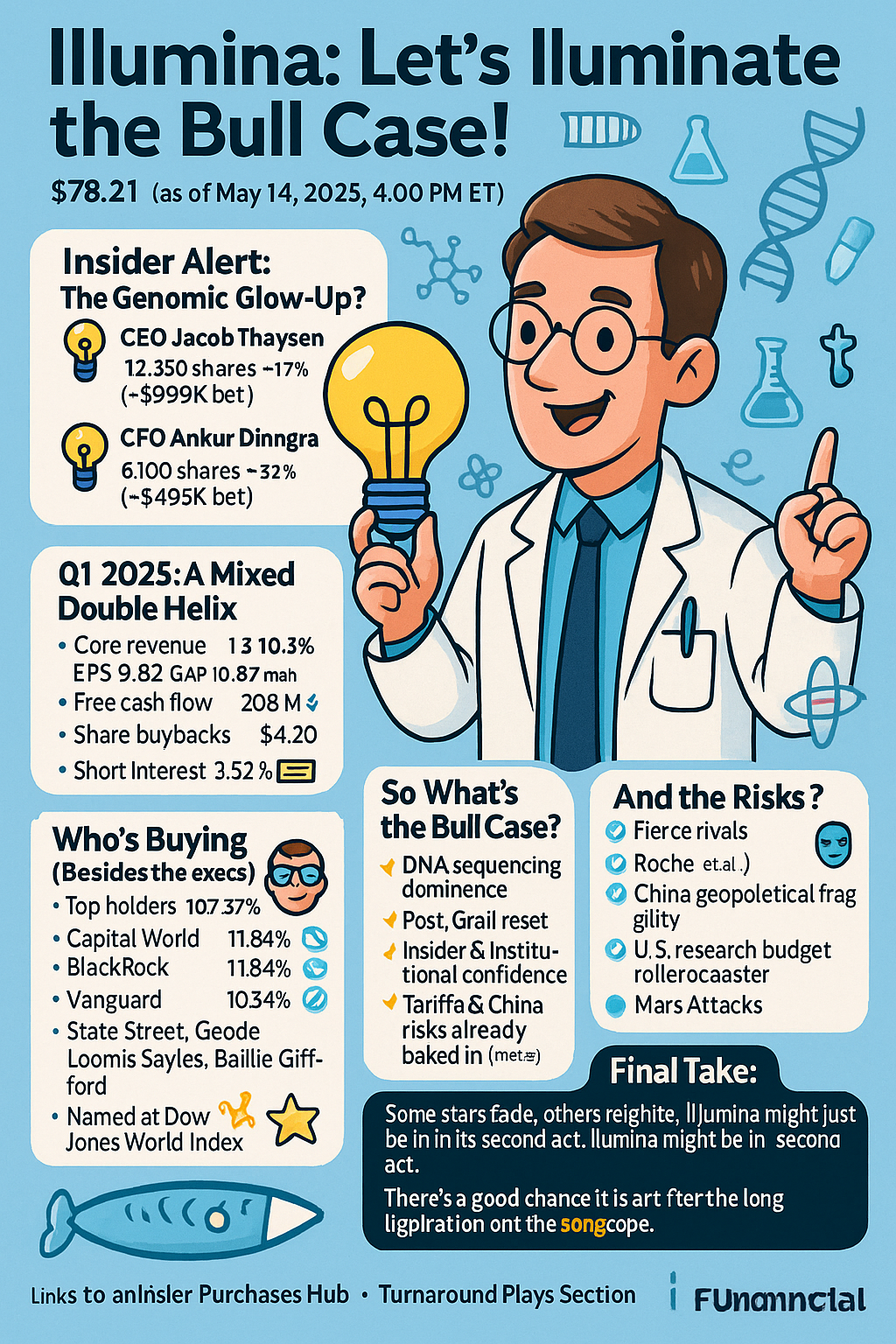

🔬 Illumina (ILMN): Let’s Illuminate the Bull Case!

After losing nearly 80% of its value since 2021, Illumina (ILMN) may be ready for a glow-up. CEO Jacob Thaysen and CFO Ankur Dhingra just bought big, and institutional holders are still hanging on. What do they see—and should you see it too?

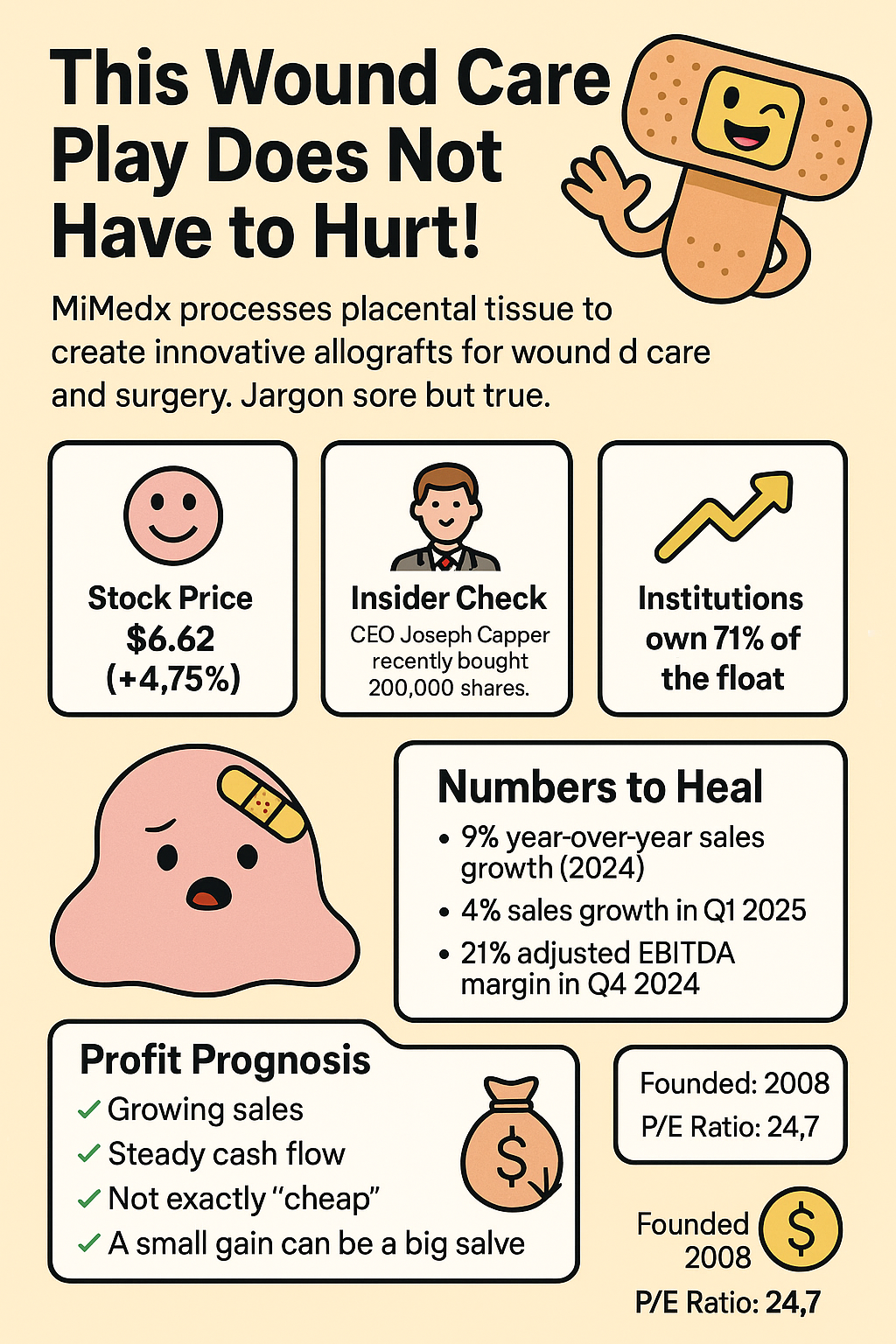

This Wound Care Stock Doesn't Have to Hurt! 🩸🩼

CEO Joseph Capper is buying big. The company’s 9% full-year sales growth and 20%+ EBITDA margins suggest something’s brewing at this placental powerhouse. From PURION™ to profitability—this is wound care with a serious upside.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.