This Wound Care Stock Doesn't Have to Hurt! 🩸🩼

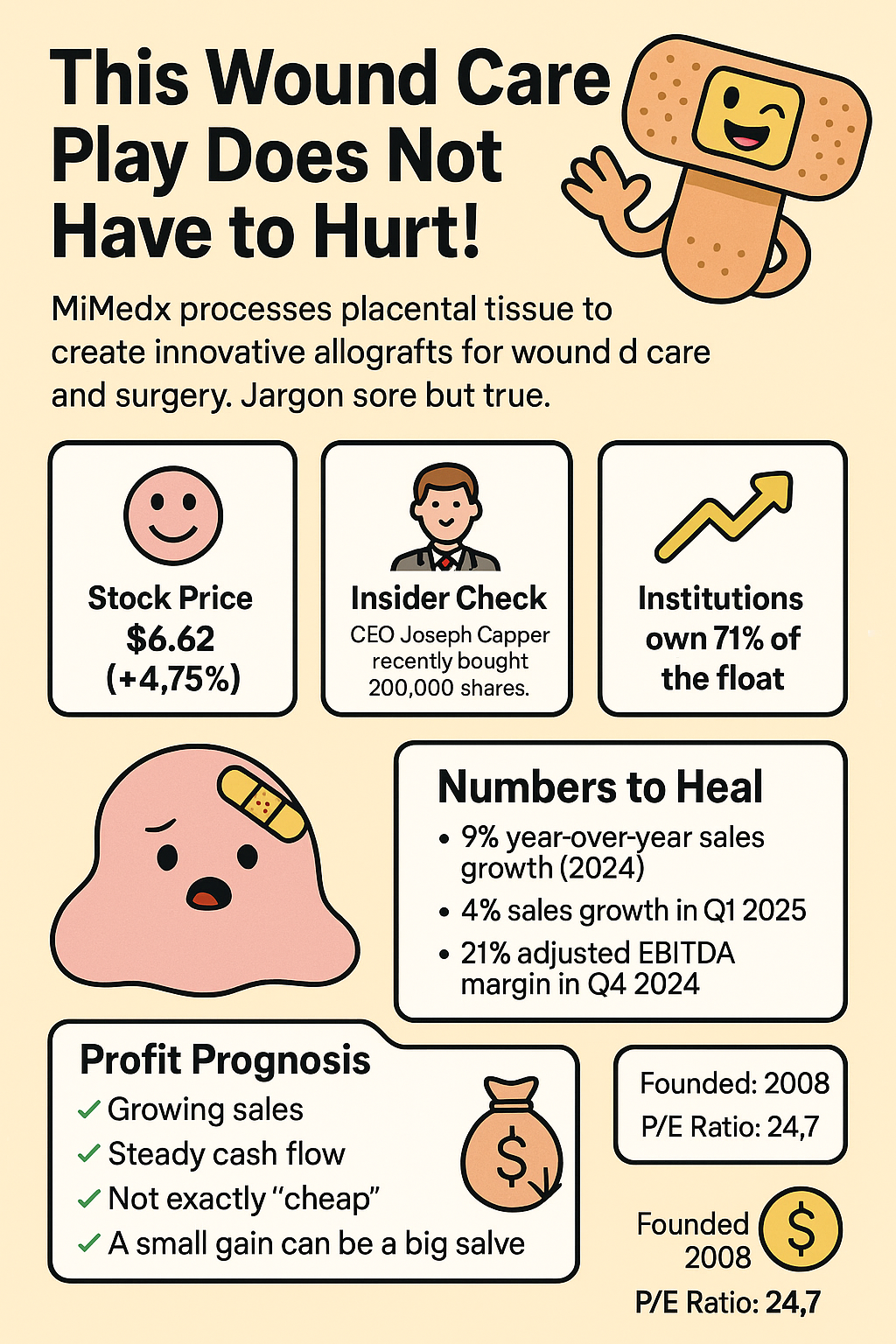

Stock Spotlight: MiMedx Group (MDXG, $6.62, +4.75%)

MiMedx Group is in the business of healing... quite literally. They specialize in high-tech wound care using placental tissue. Yes, you read that right. 🦲 Their patented PURION® process sounds more like a Marvel villain's origin story than a biotech protocol, but it's helping real-world patients and making real-world dollars.

🏥 What They Do:

MiMedx processes human placental tissue (membranes, umbilical cords, discs) to create high-value wound healing products like:

-

EPIFIX, EPICORD, and EPIEFFECT: Protective grafts used for wound care (the Band-Aids of biotech).

-

AMNIOFIX and AMNIOEFFECT: Surgical MVPs used in everything from vascular to plastic surgery.

Their tech preserves vital goodies like growth factors, cytokines, and chemokines—because nothing says healing like a soup of sci-fi-sounding proteins. 🧠

🚀 Why Are We Talking About This Now?

Because CEO Joseph Capper just bought 200,000 shares at $6.34. That’s a cool $1.27 million vote of confidence. 🤝

“Nothing screams bullish quite like a CEO buying big with his own wallet.”

Capper’s no amateur either—he previously led BioTelemetry, turning it around before selling it to Royal Philips for $2.8 billion. So yeah, he might know a thing or two.

🧹 Financial Bandages in Place

-

Q1 Net Sales: $88M (+4% YoY)

-

Adjusted EBITDA: $17M (20% of sales)

Net Income: $7M (not shabby)

-

Cash on Hand: $106M (or $88M net of debt)

Margins are slipping a bit (from 85% to 81%), but that’s mostly product mix. Overall, they’re still profitable, cash-positive, and growing.

📊 The (Kind of Meh?) Valuation:

-

P/E Ratio: 24.68

-

Forward P/E: ~23.21

It’s not screaming cheap, but it’s no nosebleed either. Think of it as moderately priced for moderate optimism.

Want to invest in an innovative biotech?

Check this out.

💸 Institutional Wrap-Up:

Institutions own about 71% of the float. Top holders:

-

Essex Woodlands: 28.2M shares (25.6%)

-

BlackRock: 10.18M shares

-

Trigran & Vanguard follow close behind

Names like State Street and Renaissance Tech also pop up on the list. Basically: it's got some smart money nibbling.

🌟 The Forecast:

-

High single-digit revenue growth in 2025

-

Long-term goal: low double-digit growth + >20% EBITDA margins

Not a rocket ship, but if they stick the landing with LCD/coding issues and product rollout (shoutout to new product CELERA™), this could be a slow-burn winner.

🕵️♂️ The Insider Takeaway:

This one might not be sexy, but sometimes boring bleeds green. You've got a seasoned CEO, solid fundamentals, new product momentum, and insider buying that screams: "I’m in."

Just remember: this isn’t a quick-fix bandage. It’s more like a long-term graft. ✨

Tags: InsiderPurchases, BiotechStocks, MDXG, HealthTech, ValuePlay, GrowthWithGrit, CEOBuyIn, EarningsBeat, MedTech

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: