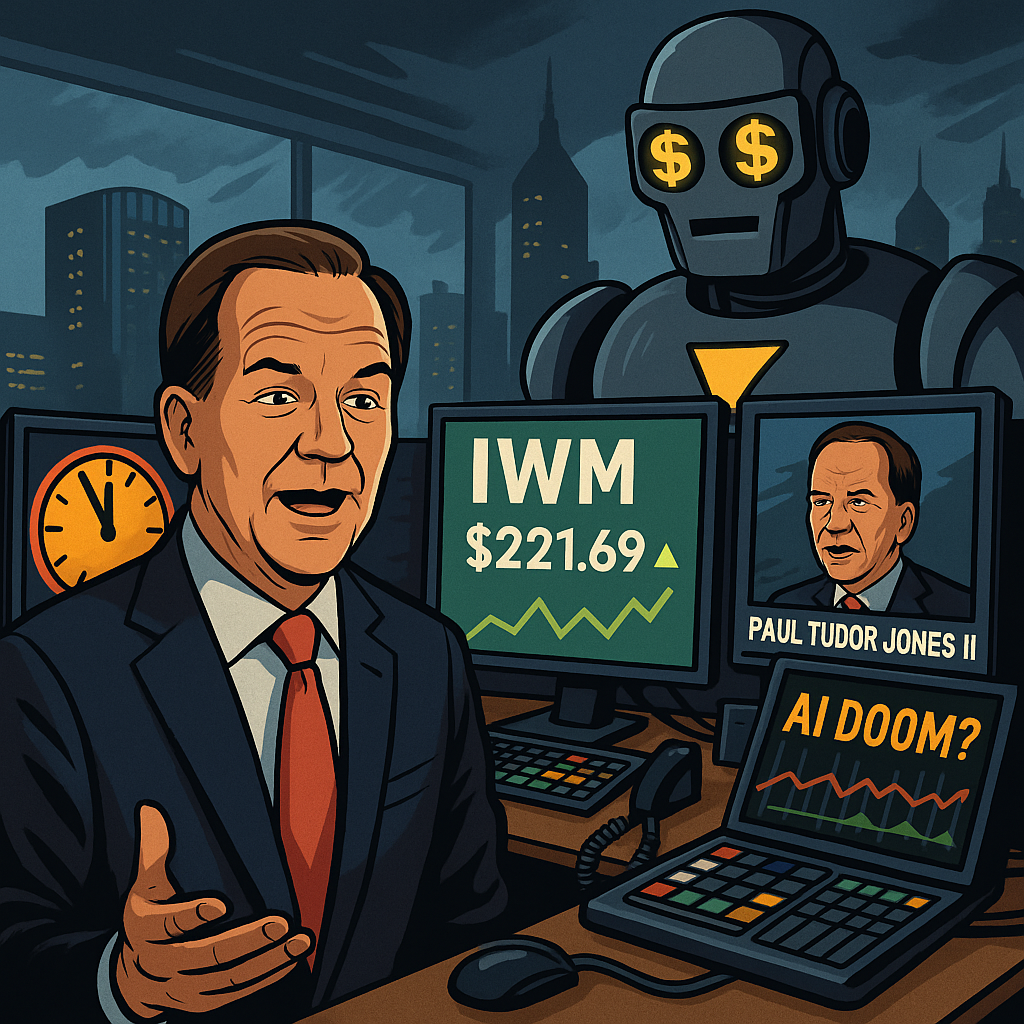

Paul Tudor Jones Loves IWM. Should You?

📉💣 Paul Tudor Jones II's Top Holding Is... a Bet on America?! 🇺🇸📈

So, I watched Paul Tudor Jones II on TikTok — yes, the billionaire hedge fund legend is now viral. (Next up: Warren Buffett dancing?) In this clip, Paul reveals he recently attended a secretive AI conference where four leading modelers assigned a 10% probability that AI will annihilate half of humanity within the next 20 years.

😱💻☠️

Spoiler 1: That's a lot of people.

Spoiler 2: Or more. But who's counting?

Naturally, this filled us with joy. So, what’s Paul doing in the face of impending robo-geddon?

He's buying small caps. Yes, small caps! His biggest holding is the iShares Russell 2000 ETF (IWM). What does that mean? That despite the AI apocalypse looming, Paul’s betting on America’s scrappy underdogs.

📚 Quick Paul Tudor Jones II 101:

Paul made his fortune shorting the 1987 crash. He's the founder of Tudor Investment Corp. A trading wizard. A hedging hero. A volatility whisperer.

🧨 Want to win like Paul? Just short the market! 🧨

Retail investors tend to go long. But Paul? Nah. He goes short. And options. And straddles. And spreads. His idea of fun is your panic attack.

But back to IWM...

🎯 The Stats:

-

Ticker: IWM

-

Fund size: $70.5 Billion 💰

-

Dividend yield: 1.1% 🍒

-

Expense ratio: 0.19% 🪙

-

Tracks: U.S. small-cap stocks across multiple sectors

-

Top sectors: Finance, Healthcare, Tech

-

Market cap split: Mostly Small Cap and Mid Cap

So why is Paul piling in?

🧩 What His Holdings Say:

7.1% of his portfolio is IWM. In Q1 2025, he increased his shares by 445.3% 🤯

Other big names in his portfolio:

-

Broadcom: +343.2%

-

Microsoft: +33.0%

-

NVIDIA: -24.1% (yes, he trimmed it!)

-

Walmart, Alphabet, Spirit AeroSystems... he's everywhere.

📊 Position Statistics (Q1 2025)

| Metric | Value |

|---|---|

| 🔢 Total Positions | 1,969 |

| 🆕 New Positions | 517 |

| 📈 Increased Positions | 1,025 |

| 📉 Decreased Positions | 913 |

| 🔄 Positions with Activity | 1,938 |

| ❌ Sold Out Positions | 512 |

| 💰 Total Market Value | $12,331M |

👉 Want the full picture? Dive into Paul Tudor Jones's portfolio here.

And his options? Buckle up:

-

Put Options on IWM: 34.8 million shares 😬

-

Call Options on IWM: 10.1 million shares 🥳

- Just to name a few...

🧐 What Does It All Mean?

-

Diversification is king 👑 — He's overweight and betting on the whole index, not a particular company; he seeks diversification and risk management (read risk reduction) first.

-

🌀 He’s spread thinner than avocado on a budget bagel. Close to 2,000 positions, constantly in motion. No single name can bring him down.

-

💼 Think of it as portfolio Tetris on turbo. Diversified like it’s his religion.

-

-

He's hedged to the moon 🌙 — More than 1,400 options positions. Probably also shorting his own coffee.

-

He’s playing both sides — Calls and puts. Gains if it goes up, gains if it goes down... maybe.

-

He made billions shorting the market, but here he is, overweight small caps. That's confidence (or chess on level 1000).

-

Nothing is what it seems. You can't replicate his portfolio just by copying. You don't know the strike prices, expiration dates, or internal hedges.

😎 Should You Buy In?

Only if:

-

You like small-cap U.S. exposure 📦

-

You believe in the American comeback (assuming America ever stopped leading) 🇺🇸

-

You're okay with some volatility ⚡

-

You're not planning to go head-to-head with Paul Tudor Jones II on options trading 😅

💡💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

🤔 Final Thought:

Paul is a legend because he balances bold bets with serious risk management. He diversifies. He hedges. He probably dreams in trailing stops.

🫵 And you? Just promise us you won’t YOLO your life savings into small caps because TikTok—or even Paul Tudor Jones—said so. Still, the man didn’t get where he is without serious chops. If he’s hedging like mad and losing sleep over AI, maybe… just maybe… pay attention—and act accordingly (but responsibly, please).

🧠 Bottom Line: AI apocalypse? Small-cap renaissance? If you're betting on the future — just remember to hedge your enthusiasm.

🚨 Disclaimer:

This is not financial advice. It’s just a second opinion — and yes, we’re billing your sense of humor. 🎪💸

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 See the world differently and check out more international market picks and fun takes. Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.)

- 📈 Biotech Bets & Innovation Radar (Problem is we can't detect the Radar)

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Even Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: