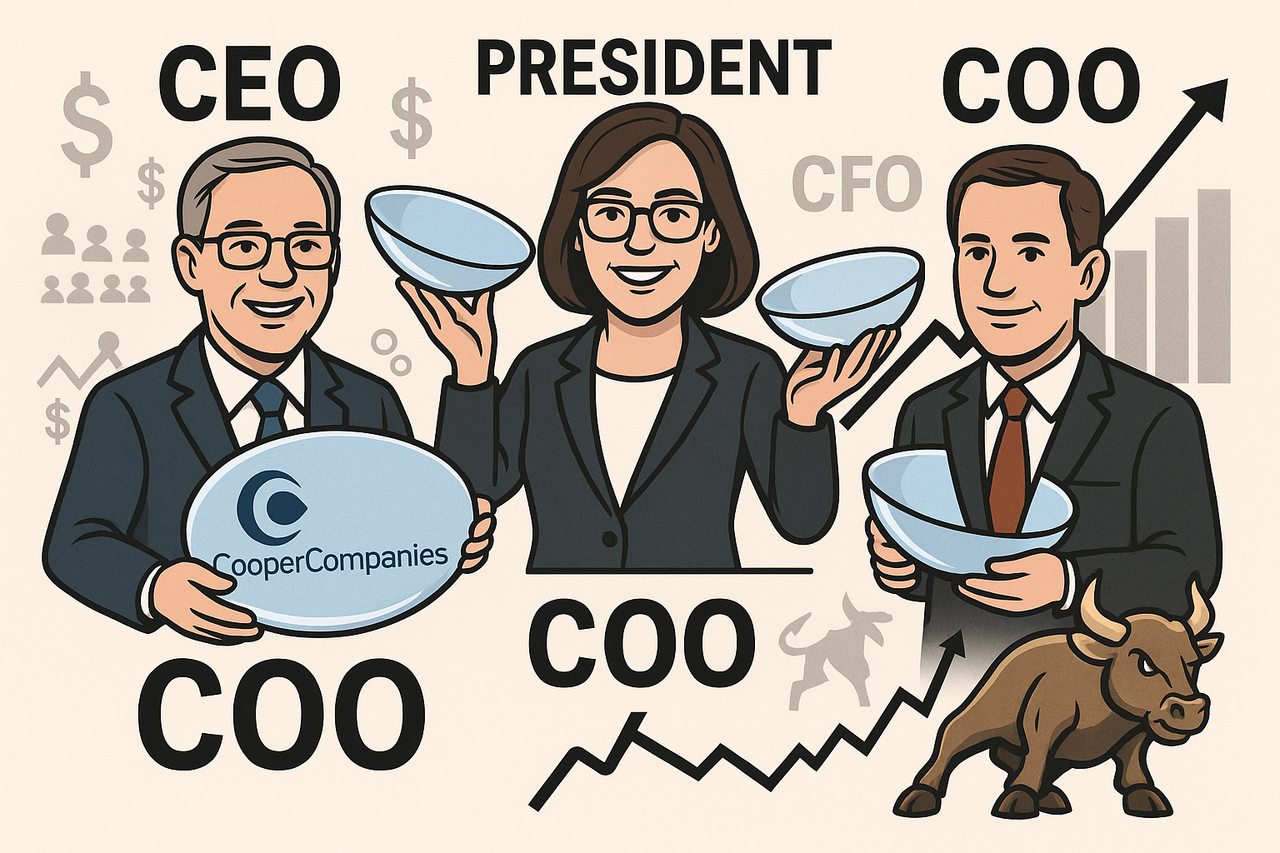

CEO, CFO, COO, and President, CooperVision, Are All Buying Shares of The Cooper Companies. Should You?

Ticker: COO 👓

Price: $68.09 (+0.13%) 📈

As of Sep 5, 2025, 4:00 PM ET

👀 Insider Optics: When the C-Suite Shops Together

Not every day do you see the CEO, CFO, COO, and President all swipe their corporate AmEx cards (metaphorically) for company stock. But that’s exactly what happened at CooperCompanies, the global medical device maker known for helping people see clearly 👁️ and grow families 👶.

In early September 2025, the company’s top brass loaded up on shares:

-

🧑💼 Albert White III (CEO) – Bought 10,000 shares @ $68.39 (+$683,900)

-

👓 Gerard Warner III (President, CooperVision) – Added 1,450 shares @ $69.23 (+$100,384)

-

📊 Daniel McBride (COO) – Picked up 3,000 shares @ $65.04 (+$195,120)

-

💰 Brian Andrews (CFO & Treasurer) – Bought 1,525 shares @ $65.68 (+$100,162)

👉 Translation: The leadership team just said in unison, “We’re buying our own product — and no, not contact lenses.”

🏛️ Company in Focus

Founded in 1958 and headquartered in San Ramon, CA, CooperCompanies has two main lenses (pun intended):

-

CooperVision (CVI): 🌍 Toric, multifocal, spherical lenses — helping millions fight astigmatism, presbyopia, myopia, and other “opia” cousins.

-

CooperSurgical (CSI): 🏥 Women’s health & fertility — from IUDs to IVF consumables, from cryostorage 🧊 to genomic testing.

Its products reach from New Jersey to New Delhi, sold through distributors, retailers, hospitals, clinics, and eye-care pros worldwide.

📈 Institutions in Love (Over 100% Float Held!)

Insiders aren’t the only ones bullish. Institutions own 104% of shares (yeah, more than technically exist — short interest magic ✨).

Big names on the registry:

-

🦍 Vanguard: 24.25M shares ($1.65B)

-

🕶️ BlackRock: 15.45M shares ($1.05B)

-

📜 State Street: 8.66M shares ($590M)

-

🌍 Capital World Investors: 8.39M shares (+8.3% jump!)

-

📈 Price T. Rowe Associates: +65.5% stake in one quarter

That’s some serious Wall Street optometry.

For CooperCompanies (COO)'s Institutional Ownership breakdown, 🔍 see here

💵 Q3 2025 Earnings Snapshot

Reported Aug 27, 2025:

-

Revenue: $1.06B (+6% YoY)

-

CVI: $718.4M (+6%)

-

CSI: $341.9M (+4%)

-

-

GAAP EPS: $0.49 (down 6%)

-

Non-GAAP EPS: $1.10 (up 15%)

-

Free Cash Flow: $164.6M 💸

-

Buybacks: $52.1M (~724K shares) @ avg $71.97

CEO Al White cheered “strong margins, robust free cash flow, and MyDAY® lenses leading Q4 growth.” Translation: profits are real, revenues need glasses. 👓

👉 Want the full picture? Dive into CooperCompanies (COO)'s financials here.

🔢 Valuation Check: Getting Cheaper (Finally)

Cooper’s stock has gone through multiple eye exams:

-

Trailing P/E cut nearly in half (from 58 → 33) 👀

-

Forward P/E ~15.5 (reasonable for medtech)

-

PEG ratio: collapsed from 10 → 1 (that’s not a typo) 📉

-

Price/Book: ~1.6 (not dirt cheap, but far from bubble land)

👉 Once trading above $115 in 2021, shares are still down ~40%. Bargain bin or value trap? Depends if you believe in recovery lenses.

🕵️♀️ Positives in Focus

-

Insiders loading up. When the CEO, COO, CFO, and President align, that’s a strong signal.

-

Institutions piling in. Vanguard, BlackRock, T. Rowe — the usual heavy hitters.

-

Buybacks. The company itself is voting with its wallet.

-

Solid free cash flow. $165M last quarter isn’t pocket change.

-

Resilient industry. Contact lenses & fertility treatments don’t exactly go out of style.

⚠️ Blurred Risks

-

Macroeconomic squints: Tariffs, FX swings, global slowdown could pressure growth.

-

IT control issues: Material weakness flagged in CooperSurgical division 👩💻🛑.

-

Competitive pressure: The global lens market has plenty of rivals (Alcon, Johnson & Johnson Vision, etc.).

-

Margins slipping (GAAP). EPS dipped on product exits & higher R&D.

-

Volatility. Defensive sector, but not bulletproof — a bear market could still smack the stock. 🐻

💡💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

🧮 Bottom Line: A Value Play in Plain Sight

CooperCompanies today looks more affordable than at any point in years. With valuation compressed, insiders buying, and institutions doubling down, the stock is sending “buy me” signals through every channel (except your optometrist).

But risks remain: macro headwinds, IT hiccups, and competition. Still, if management’s vision is 20/20, there’s a long runway from here.

😎 FUN Verdict

Seen through our lens, COO stock is shaping up like a crisp pair of new contact lenses — clearer, cheaper, and surprisingly stylish. Just don’t forget: investing is less like LASIK, more like bifocals — it takes patience to adjust.

⚠️ Disclaimer:

This is NOT financial advice. Just a reminder that even with insider confidence, you should do your own due diligence before investing. Or as we’d put it: 👓 Always check the fine print before buying new frames.

We laugh, we analyze, we meme. We sell jokes and opinions — and yes, we’re billing your sense of humor. 🎪💸

We’re not financial advisors. We’re FUNancial advisors.

Hold the FOMO, don’t invest what you can’t afford to lose, and invest at your own risk.

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 See the world differently and check out more international market picks and fun takes. Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.)

- 📈 Biotech Bets & Innovation Radar (Problem is we can't detect the Radar)

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Even Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: