Insider Purchases: Inside the Buy

Tag: CEOConfidence

How Many Insider Buys Will It Take for The Bull in Enphase Energy to Re-energize?

After a brutal drop, Enphase Energy’s CEO is buying big. Institutions are all in. Margins hold strong. Could this be the spark the solar bull needs?

Proto Labs (PRLB): The CEO Bought Shares. Should You?

The CEO of Proto Labs just invested in his own company — but it’s not just him. Wall Street giants are in, revenue’s at record levels, and PRLB might be building toward a breakout. Should you 3D-print it into your portfolio?

Arrow Electronics: A Straight Arrow, But the CEO Sees a Bullet

Arrow Electronics CEO Sean Kerins just bought nearly $1M of ARW stock. Is this undervalued tech distributor about to rebound, or just cruising under the radar? We take a shot at the bullseye—with puns and charts.

MSCI Keeps Winning — and the CEO Keeps Buying In

MSCI delivers world-class data tools for investors—and its CEO just bought in big. With soaring revenue, recurring subscriptions, and loyal institutions, is this still a buy? Or has the stock outpaced its fundamentals?

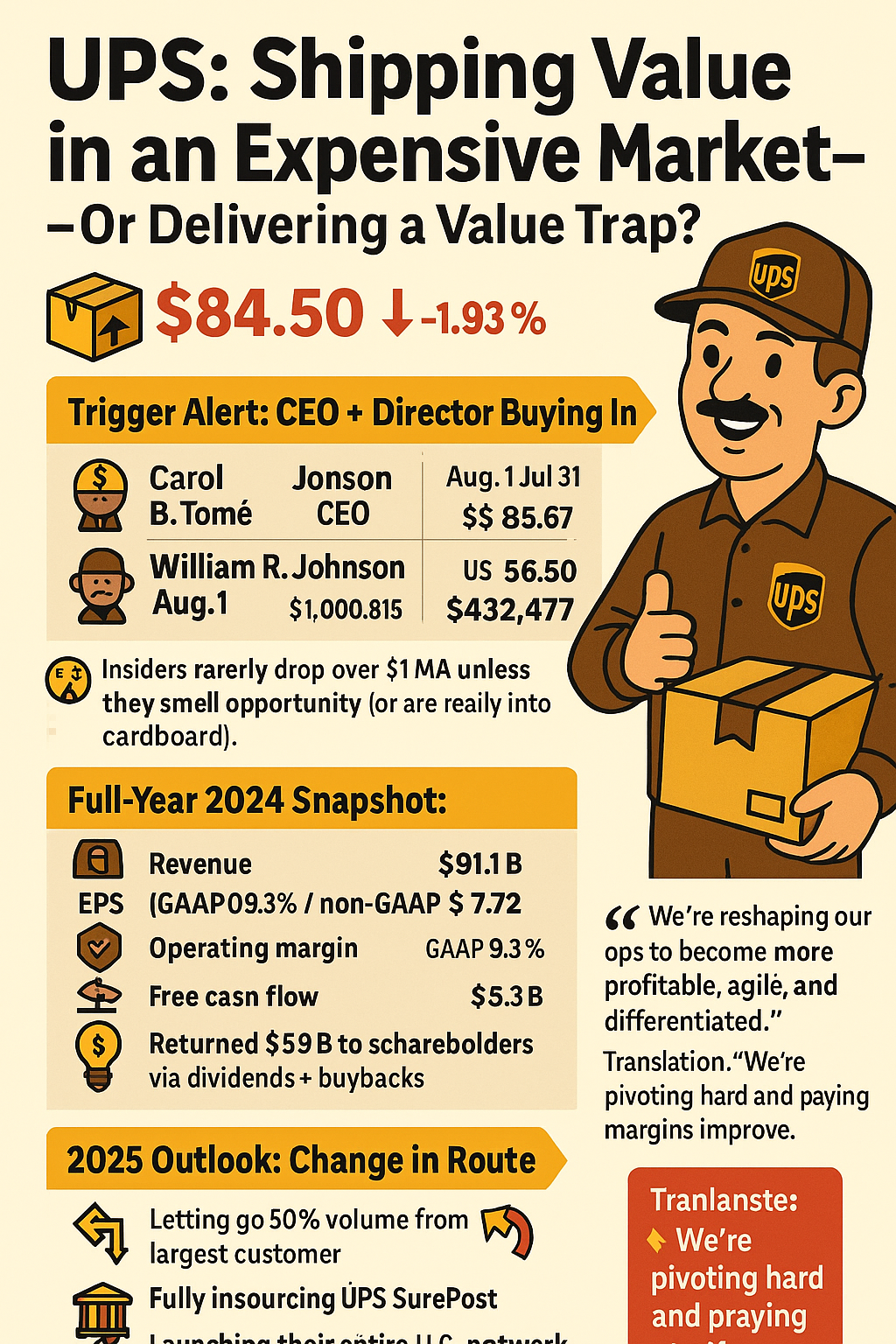

UPS: Shipping Value in an Expensive Market — Or Delivering a Value Trap?

UPS insiders are shipping signals of confidence 📬 with big stock purchases—even as growth slows and margins come under pressure. Should you get in on this box of value or beware what’s inside?

Does Align Technology’s Recovery Plan Have Teeth? The CEO Thinks So.

Align Technology insiders are smiling—because they’re buying. With a CEO purchase nearing $1M and Wall Street holding more shares than exist, ALGN may be regaining its shine. But should you sink your teeth into it now?

Can Elevance Reach Higher Elevations? The CEO Thinks So

📉 After falling nearly 50% from its highs, Elevance Health just got a $2.4M vote of confidence from its CEO. Is this the cure—or just another symptom? 🏥 Dive into the numbers, the risks, and the potential rewards. And yes, there will be icons. 📊💊📈

Wex Is No Wreck: President and CEO Buy Screams

Wex may sound like a typo, but it’s spelling big potential in 2025. With its CEO buying, institutions hoarding shares, and profits holding firm, this fuel-and-fintech hybrid might just surprise Wall Street.

Viatris: The CEO Just Bought Shares… Should You Pop a Pill or Press "Buy"?

When a CEO personally buys over half a million dollars of stock, it’s time to pay attention. Viatris (VTRS) may be undervalued, with insider confidence, institutional backing, and a promising drug pipeline. But big losses and high debt mean it’s not risk-free. Is now the time to nibble?

Ligand Pharmaceuticals (LGND): In a League of Its Own? Insiders Think So!

Ligand Pharma (LGND) isn’t chasing moonshots—it’s collecting royalties across a sprawling biotech empire. With both the CEO and CFO buying in, and a royalty engine showing 46% revenue growth, insiders may know something. Is this the most compelling quiet biotech turnaround on the Nasdaq?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.