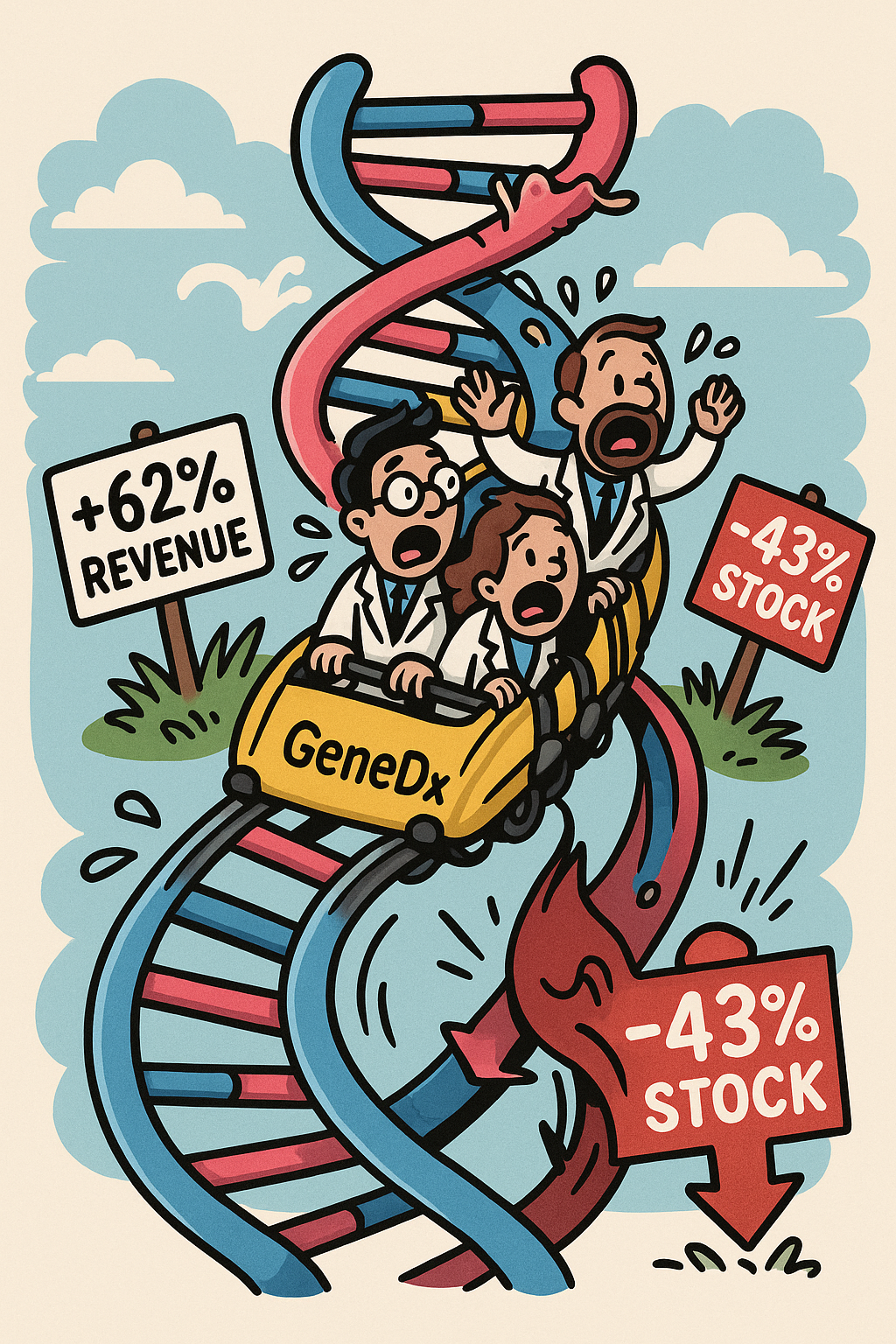

🧬 GeneDx (WGS): Profit, Progress, and a 43% Plunge? Sounds Genetic.

Ticker: WGS, $59.00, –0.24% (as of May 12, 2025, 4:00 PM ET)

Trigger: Director Keith Meister bought 100,000 shares @ $56.01 = $5.6M bet. That’s some confident DNA. 🧬💸

🧪 What’s GeneDx Again?

Stamford-based GeneDx specializes in genetic testing for rare diseases and pediatric conditions—think exome and genome sequencing, not 23andMe quizzes that say you're 12% Viking.

💼 Wall Street Likes What It Sees

📈 Institutional ownership: 113.20% of the float

(Yes, that’s more than 100%. Shorts and synthetics are in the building.)

🧠 Top holders:

-

Casdin Capital: 12.29%

-

Corvex Management: 8.67%

-

BlackRock, Vanguard, Goldman Sachs... you get the picture. Big money is in the lab coat.

- Check this out for more.

🧩 Jefferies just upgraded the stock to “Buy” with an $80 price target. Do they know something? Maybe. Or maybe they like genomes.

⚡ So Why Did the Stock Collapse 43%? (After Great News?!)

That’s the $5.6 million question. Here's what GeneDx just reported:

📊 Q1 2025 Highlights (aka "The Good Stuff")

-

Revenue: $87.1M (+42% YoY)

-

Exome/Genome Revenue: $71.4M (+62% YoY)

-

Adjusted Net Income: $7.7M (That’s a profit!)

-

Adjusted Gross Margin: 69% (was 61%)

-

Exome/Genome Volume: 20,562 tests (+24%)

-

GAAP Net Loss: $6.5M ( 🤷♂️)

Interested in investing in a leading-edge biotech?

Check this out.

🧬 Business Highlights (aka "The Cool Science Stuff")

🧠 Launched ultraRapid genome testing (results in 48 hours for NICU babies)

🧠 Added cerebral palsy and IEI (Inborn Errors of Immunity) as new testing indications

🧠 Rolled out Epic Aura to integrate testing into hospital systems

🧠 Expanded Medicaid coverage to 33 states for pediatric testing

🧠 Recognized by Fast Company as one of the world’s most innovative companies

So why the stock drop? 🤷♀️

Apparently, being profitable (but not quite on a GAAP basis!), innovative, and expanding isn’t good enough for some hedge funds and other investors.

(Also, a 14.28% short interest might explain a few things.)

💡 Full-Year 2025 Guidance (Post-Fabric Genomics Deal)

-

Revenue: $360M–$375M (raised!)

-

Exome/genome growth: 30%+ (confirmed)

-

Margins: 66%–68%

-

Profitability: expected every quarter

They’re even acquiring Fabric Genomics, a move meant to expand decentralized testing (read: high-risk, maybe genius, maybe just expensive).

🧠 Translation: This Is a Smart, Small-Cap Rollercoaster

💉 The science is promising

💵 The revenue is growing

📉 The stock is moody

🧬 The future? Still being sequenced

🧪 Verdict:

GeneDx could be a genomic juggernaut in the making—or just another volatile biotech name that confuses your portfolio as much as your family tree.

Want in?

Start small. Dollar cost average.

Or better yet: risk someone else’s money. 🧃💼

⚠️ Disclaimer:

We know nothing. Genetic testing of our investing track record revealed quasi-ancestral anomalies, untraceable logic, and possible Viking heritage. 🛡️🪓⚔️ Invest accordingly. 😉

🧭 Want More Like This?

Check out our Insider Purchases Hub or Turnaround Plays Section

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: