Flipped A Coinbase And Landed On Tailwinds: It's A Buy

Summary

A bear in crypto, a deteriorating bottom line, intensifying competition, negative sentiment, and the prospect of heavier regulation, make any investment in Coinbase a contrarian play.

But crypto will not go away. Coinbase knows it. BlackRock knows it. Even the government knows it. We go against the grain, make the case Coinbase is a buy.

Coinbase has to regain profitability but network effects, a strong balance sheet, solid competitive positioning, and leadership in risk management and regulatory compliance, hold promise.

Coinbase is actively fighting trading fee erosion via the creation of a unique ecosystem that offers a wide range of services (well beyond trading) and multiple income streams.

Check out www.funanc1al.com for market insight and so much more. We enrich lives.

Coinbase (COIN) has to reclaim profitability but network effects, a strong balance sheet, solid competitive positioning, robust risk management practices and regulatory compliance, and the ability to offer a comprehensive gamut of services via a unique ecosystem, are helping the firm maintain leadership and stave off fee compression.

Crypto Is Not Going away Anytime Soon

Coinbase's fortunes are contingent on the success of crypto. Some argue that the longevity of the industry, still early in its life cycle, is at risk; Bitcoin, for example, is just code on computers crystallizing a conduit for evading government sanctions, not to mention the environmental toll of mining. Look no further than Charlie Munger, vice chairman of Berkshire Hathaway, who argues that crypto is an "investment in nothing" and Bitcoin is stupid because it's very likely to go to zero.

But confidence and interest in cryptocurrencies are unlikely to recede for a number of reasons. Put another way, bitcoin is inevitable. The recent plunge of crypto in value hardly weakens the argument often made that it can be an effective hedge against inflation. The asset class and associated prices have exploded since its inception. The recent pull-off is only logical. A bet on everlasting crypto price increases should not be considered as a prerequisite to Coinbase's success or even business viability. It remains part of the space's appeal for some, but it only creates unsustainable expectations. Stability enhances a currency's credibility, not speculation. An argument could be made that the recent pull-off, if it can lead to less volatility after years of exuberant rising, may ascertain the role of crypto as a major alt currency of recourse. As for Charlie Munger, whom the author otherwise salutes as a great investor no doubt, isn't he part of the same team who declined to invest in the Internet bubble but also only bought shares of Amazon 20 years after the start of its run?

Further, scarcity may indeed down the road protect crypto's value during times of inflation and serve as an antidote to government overreach. Currently, most nations use paper-based fiat currencies that only serve as a mode of payment. To quote the Corporate Finance Institute:

Unlike the traditional commodity-backed currencies, fiat currency cannot be converted or redeemed. It is intrinsically valueless and used by government decree. For a fiat currency to be successful, the government must protect it against counterfeiting and manage the money supply responsibly.

Trust in the government's ability to do so is paramount (and in the Fed to lead the fight against inflation while preserving employment no less key). Bitcoin is not a fiat currency, i.e., a legal tender issued by the government; rather it is a cryptocurrency backed by blockchain and exempt of a central authority. Critically, it does not rely on a government's inherently volatile competencies for proper functioning (independently of partly color).

The elimination of crypto is as undesirable and unlikely as its oversight is inevitable, given the size of the token market, at $1 trillion and economic interests in crypto from Wall Street to Main Street to Silicon Valley. The embrace of crypto as an alternative (a key word in any capitalist democracy, where choice is key and competition welcome) to fiat, qualifies as a major innovation of the new century. Innovation, in turn, spearheads U.S. leadership in the world and, critically, is a propeller of dollar strength independent of economic cycles. The fourth industrial revolution is seeing technology permeate all fields of life, including finance and investment (as well as health, commerce, etc.). Crypto helps America.

No wonder then BlackRock, the world’s largest asset manager, teamed up with Coinbase in August 2022, to provide institutional clients of Aladdin, BlackRock’s end-to-end investment management platform, with direct access to crypto.

Coinbase is trying to build no less than an Economic Moat

The risk that crypto fades and Coinbase's business goes defunct are thus low. That the firm is trying to build an economic moat should then come as no surprise. As the leading U.S.-based cryptocurrency exchange, Coinbase has positioned itself as the portal of choice to the cryptocurrency ecosystem for all crypto traders - as a reliable and compliant place to trade in an industry filled with risk and tentative security practices.

The amount of capital required to start an unregistered exchange is minimal. Hundreds of small players compete that can handle rudimentary tasks like account management or record keeping. However, it is far more challenging to attract trading volume, and the majority of Coinbase's rivals are unlikely to ever catch up with the leaders.

To quote Morningstar Equity Analyst Michael Miller:

Financial exchanges in general often benefit from network effects: as more buyers and sellers utilize a financial exchange, the order book deepens, and bid-ask spreads tighten. More trading volume generally leads to better liquidity, allowing buyers and sellers to enter and exit their positions with less impact on the price of the asset, reducing their implicit trading costs. (...) The benefit from having less market impact is often greater than any savings that could be achieved by using another exchange with lower transaction fees. As a result, there is often the tendency for liquidity to pool with higher trading volume, leading to lower costs, which in turn leads to even higher trading volume as buyers and sellers are drawn by better execution. For major trading pairs like bitcoin to U.S. dollars this is less of a concern as there is a large amount of liquidity available globally, but less well-known cryptocurrencies (...) have smaller markets and demonstrate more substantial liquidity pooling. In 2020 44% of Coinbase's total trading volume came from crypto assets other than ethereum or bitcoin, and the exchange's ability to support markets for these alt coins is a competitive advantage, especially as Coinbase has begun to focus on expanding the number of supported trading pairs as a growth strategy.

Scale, network effects, reputation, regulatory leadership and compliance, constitute the first increments of a moat Coinbase is trying to build. They allow the firm to maintain transaction fees above many of its peers (for now).

Fighting Trading Fees Erosion

Coinbase may very well try and establish industry leadership in a viable crypto market and yet fail miserably if trading fee erosion is to result from increasing competition and margins deteriorate to the point that the firm cannot become consistently profitable.

Coinbase gets the overwhelming majority of its revenue from transaction fees - charged as a fraction of the underlying assets being traded. Additionally, the bulk of Coinbase's trading revenue comes from retail traders. Coinbase collects more than 1% of its crypto trading volume as transaction revenue, according to figures compiled by Autonomous Research analysts (as reported in the Wall Street Journal).

Further, crypto markets show high cyclicality with long periods of depressed prices and trading volume. This adds volatility to Coinbase’s top line. For example, as evidenced in Coinbase's Q2 '22 shareholder letter, total trading volume declined 30% to $217 billion and net revenue 31% to $803 million, compared to Q1, driven by price correction. Assets on Platform declined an even more dramatic 63% as the crypto market cap crashed 60%.

The market draws in lots of competitors including giants like Fidelity Investments, which is already weighing adding bitcoin trading to its retail platform. A highly competitive landscape is likely to result in a compression of trading fees and brokers margins. Binance.US this year cut all fees for certain bitcoin trades, making it akin to a zero-commission stock trade.

The question then becomes, can Coinbase remain profitable in the face of cut-throat competition and trading fees price erosion. The answer is yes; price cuts may boost trading volumes and crypto firms may manage to thrive if they adapt. As Telis Demos writes in the Wall Street Journal:,

In fact, the history of the stock-trading business might even give investors hope about crypto’s future. On May 1, 1975 (...) stockbrokers were forced to abandon fixed commissions. Individual investors’ effective commission rates on the value of a trade fell almost 20% from April 1975 through mid-1980, and institutions’ commissions fell even more, according to Securities and Exchange Commission data from that time. Yet that was hardly the end of Wall Street: Broker-dealers’ commission revenues actually doubled from 1975 to 1980 as trading volume surged, according to SEC data.

But those hoping that crypto can emulate traditional Wall Street should also consider the wider story. Eventually, the climb in commission revenue plateaued for a time during the 1980s even as volume continued to grow. What continued to help propel the securities industry to being an economic juggernaut was consolidation and a broader diversification of services and sources of revenue, areas like research, mutual and exchange-traded funds, wealth management and banking services, says Reena Aggarwal, director of Georgetown University’s Psaros Center for Financial Markets and Policy. Securities commissions made up nearly half of broker-dealers’ total revenue in 1975; by the 1990s, they represented less than a fifth, according to SEC data.

The lesson then is to not only boost trading volume but also diversify the range of services offered. Coinbase is actively pursuing the strategy, as follows.

Coinbase is fighting back and creating a unique ecosystem

Unlike traditional exchanges, Coinbase wears multiple hats in the trading ecosystem. It serves as an exchange, lender, asset custodian, broker, crypto card purveyor, blockchain infrastructure support manager, and data analytics provider. This conglomeration of services both ascertains Coinbase's leadership in crypto as an end-to-end shop for consumers, institutions, and developers, and layers new revenue streams.

Per Coinbase's Q2 '22 shareholder letter, the firm now offers over 200 tradable crypto assets and 500 total trading pairs. It rolled out decentralized exchange trading in the Coinbase app through integration with various market participants. Advanced Trading in the retail app offers seamless access to staking, borrow, wallet, and Card. Coinbase One gives U.S. retail users unlimited trading, enhanced customer support, and additional benefits for a flat monthly fee. The subscription service delivers incremental growth in ARPU, as subscribers engage at higher volumes. Coinbase has also created a self-managed Web3 wallet based to help users move assets across networks (for example, to purchase an NFT).

Coinbase Prime provides institutional clients with a full-service platform offering trading, custody, transfers, financing, staking, and reporting, across multiple chains (in addition to leading security, insurance, and compliance). In Q2, Coinbase launched its first regulated derivatives offering.

Staking provides users with an opportunity to earn rewards for performing critical operational services. Across all assets supported, native units staked in Q2 increased vs Q1. Coinbase has also partnered with other staking leaders to create the industry’s first liquid staking protocol.

Coinbase Cloud enables developers to quickly and securely build Web3 apps, support crypto trading, provide fiat on- and off-ramps to their users, and more.

Per Coinbase's Q2 '22 shareholder letter:

Blockchain and crypto are ushering in a major wave of disruption to the internet’s current business model. Today’s internet is largely run by a handful of centralized companies that have access to — and monetize — their users’ personal data. We believe Web3 will be owned by builders and users and will be orchestrated by crypto tokens — creating a more decentralized and community-governed version of the internet.

Finally, non-fungible tokens, which Coinbase Wallet allows users to hold and transact across all major blockchains, are gaining momentum. Coinbase Cloud enables developers to build NFT apps. Coinbase NFT empowers creators and brands to build communities. Drop enables top tier creators and prominent personalities to sell NFTs and unlock unique utility to their loyal customers (like meeting the creator in real life, etc.).

Coinbase is thus looking to counter likely fee compression via trading volume amplification and the creation of an ecosystem that offers a wide range of services (well beyond trading) and multiple income streams. Because very few players have similar breadth in the United States, the company is essentially trying to build the foundations for an economic moat. Still, product diversification may face regulatory hurdles.

Coinbase Embraces Regulatory Leadership as a Key Part of its Strategy

Coinbase welcomes regulation. The rationale is that a legal framework will attract more mainstream investors, such as pension funds. It is all the more critical because the bankruptcies of crypto firms like Celsius Network have helped wipe out $2 trillion in the token market, undermining crypto’s credibility and appeal to investors, and putting pressure on lawmakers to erect consumer protections.

Coinbase has positioned itself as a safe and compliant exchange. It is registered in the United States. Its reputation has helped it maintain working relationships with regulators. Coinbase has money transmitter licenses in most states in the U.S. It is highly regulated including by the U.S. Department of Treasury registration as a Money Services Business. Internationally it holds a crypto exchange license in Japan and the first-ever German crypto license. Coinbase's Q2 '22 shareholder letter states:

Throughout Coinbase’s history, our company has pushed for regulatory clarity, and we believe such clarity will be a catalyst for the growth of Web3 and Coinbase. That’s why we recently filed a petition to the SEC requesting that the Commission initiate a public process to develop updates to its regulations that would enable the development of the crypto securities markets and the tokenization of the debt and equity markets. We have also engaged with the European Union on their Markets in Crypto Assets (MiCA) proposal, along with other jurisdictions that aspire to create a clear regulatory regime for crypto. We regularly get formal and informal questions from regulators about our views on the development of the cryptoeconomy, our products, and our operations. We welcome that dialogue (...). To that end, we have responded to requests for comment from regulators in the U.S. (including the U.S. Department of Commerce, the U.S. Department of Treasury, the Federal Reserve, along with the California Department of Financial Protection and Innovation) and around the world (...).

To quote Morningstar Equity Analyst Michael Miller:

Engagement with the U.S. regulatory regime does come with costs; Coinbase avoids listing cryptocurrencies that could be classified as unregistered securities by the SEC, limiting the number of trading pairs on its platform relative to some of its competitors. In December 2020, Coinbase announced that it was suspending trading of XRP, the third-largest cryptocurrency at the time, after the SEC filed a case against its parent company Ripple, accusing it of profiting from the sale of unregistered securities. With $17 billion in trading volume and $108.6 million in revenue in 2020, XRP trading was a material piece of Coinbase's business and removing it from the platform represented a tangible cost of complying with U.S. regulators (...) While these are real costs associated with Coinbase's compliance with U.S. and other nation's regulatory regimes, the firm does benefit from the strategy it has chosen, and the costs can be seen as an investment in building a brand intangible asset. Coinbase is well known as a safe exchange for experienced traders and newcomers alike. The value of this brand reputation is significant when considered in the context of the severe risk cryptocurrency traders face when it comes to exchange hacks and other security issues. Because the exchanges act as custodians they are prime targets for theft and the track record of the industry as a custodian of assets is poor, with billions in client assets lost to theft since 2014. Well-established exchanges have developed security procedures and have had success in limiting (but not eliminating) losses in recent years.

Coinbase is committed to collaborating with policymakers to build a regulatory framework for the crypto-economy that addresses any areas of risk - a key differentiator and moat edification enabler. The uncertainty is not in the regulation to come, but in the lack thereof. The development of the next wave of digital innovation likely depends on its adoption.

Recent Financials Show Strain but also Promise

Despite continued market softness, engagement with Coinbase’s platform remains resilient. Monthly Transacting Users reached 9.0 million in Q2 '22, a decrease of only 0.2 million or 2% compared to Q1. Further, worldwide long-term BTC holders (holding BTC for more than six months) are holding ~77% of total BTC supply, indicating they are not selling into market volatility, a net positive.

Trading Volume and Revenue

Trading volume declined 30% to $217 billion, compared to Q1 '22. Core U.S. retail customers are less active, but not leaving the Coinbase platform. A sequential decline in Q2 institutional trading volume relates to these participants gravitating towards products such as derivatives, which Coinbase is only now starting to offer. Partially offsetting this decline was continued growth in Coinbase Prime, which onboarded 1,500 new institutions.

Coinbase's Q2 '22 Shareholder Letter

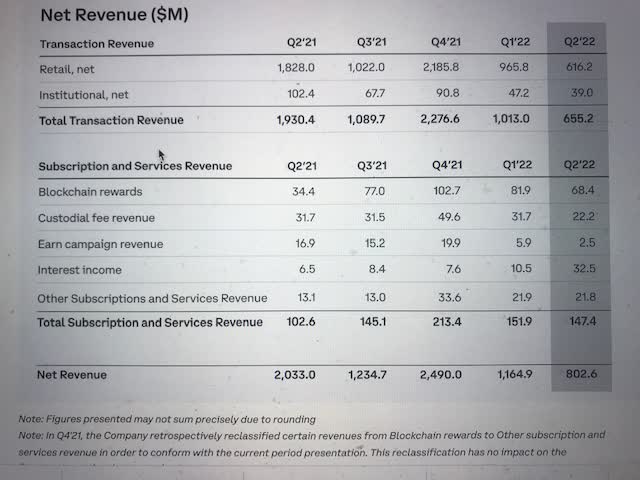

Q2 transaction revenue declined 35% compared to Q1. Subscription and services revenue was $147 million, down only 3% sequentially, illustrating how these revenues are less volatile compared to transaction revenue. Blockchain rewards revenue, down 16% to $68 million, still benefited from increased participation in staking. Lower crypto asset prices also impacted Custodial fee revenue, down 30%. Interest income was $33 million, up 211%, an increase primarily driven by USDC (digital dollar) activity, as well as higher interest rates generated on fiat customer custodial funds.

Coinbase's results continue to be dependent on transaction fees and cryptocurrency market conditions, but critically less so over time. The ratio of subscription and services revenue to transaction revenue goes from 5.3% in Q2 '21 to 9.4% in Q4 '21 to 22.5% in Q2 '22.

Operating Costs

Total operating expenses were $1.9 billion, up $132 million or 8% from Q2 to Q1 - including $377 million of non-cash impairment charges related to lower crypto asset prices. Transaction expenses were $167 million, down 40%. Lower performance marketing, softer crypto market conditions, and expense management efforts impacted Sales and marketing expenses, down 30% to $141 million. Technology and development expenses were $609 million, up 7%, boosted by higher software-related expenses (web hosting). General and administrative expenses were $470 million, an increase primarily driven by higher employee-related expenses from headcount growth in the first half of Q2.

Cash Flow and Profitability

Change in cash from Q1 to Q2 shows a $423 million sequential decline attributed to $161 million net use of cash in Operating activities; $73 million net source of cash in Investing activities, largely attributable to $92 million of funds returned, due to prudent risk controls in one of Coinbase's financing products; $200 million net use of cash in Financing activities, largely driven by repayment of $150 million in short term borrowings.

The income statement shows strain. In Q2, net loss of $1.1 billion included $446 million in total non-cash impairment charges relating to crypto investments and ventures investments. Adjusted EBITDA was negative $151 million.

If Coinbase increased its spending in 2021, recent cost-cutting measures have reversed some of these policies, and the company may avoid a prolonged period of unprofitability if cryptocurrency prices and trading volume can stabilize mid-term. Coinbase is streamlining its operating cost structure, including recalibrating hiring plans, optimizing vendor expenses, and constraining the deployment of marketing spend. Key measures include a June headcount reduction of 18% (1,100 employees); a focus on driving organic, non-paid traffic rather than paid media, and optimizing infrastructure spend and teams deployment in lower-cost regions.

Coinbase expects sales and marketing expenses of approximately $100 million in Q3 (vs $140m in Q2), and Technology & Development + General & Administrative Expenses of $1 billion (including stock-based compensation of $400 million) (vs $1.080 billion in Q2).

Seeking Alpha gives a profitability grade of A- to COIN.

Valuation

Analysts assign a buy rating to COIN with the following stock price Target, 62.7% above current price:

| High | $220.00 |

| Low | $42.00 |

| Average | $100.68 |

| Current Price | $62.28 |

The fair value estimate of COIN depends on trading volume assumptions, the rate at which Coinbase's trading fees compress and other services pick up over time, and how effective cost-cutting is. Coinbase may be able to increase its share of cryptocurrency trading as a result of its market leadership and international expansion plans. A revenue CAGR of 15% over the next decade seems a reasonable assumption.

Coinbase needs to boost operating margins to the high 20s (from the low-to-mid 20s assumed by most analysts) by 2025-30 to reach greater profitability. Regulatory constraints and higher marketing and service fulfillment requirements may make this a challenge, but efforts at creating an economic moat may help in the process. Paradoxically, robust risk management practices and compliance leadership give Coinbase a distinctive voice in the world of crypto.

Interestingly, Bank of America was maintaining a price target of $185 until recently, but now calculates a price objective of $92 (still well above current price) based on a 50/50 blend of 4.5x multiple to 2023E revenues and Discounted Cash Flow. The DCF model assumes a WACC of 15% and terminal growth rate of 4%.

Capital Allocation

Coinbase’s balance sheet is strong. It has ample liquidity to fund its business through a protracted, stressed market environment. Coinbase ended Q2 '22 with $6,154 million in cash & cash equivalents, USDC (backed 1:1 24/7 by US dollars), and custodial account overfunding. The fair market value of crypto assets held as investments was $428 million with a cost basis of $290 million. Available resources thus totaled $6,582 million. Coinbase holds $3.5 billion in debt.

Coinbase Exhibits Robust Risk Management

It is tempting to award Coinbase a high risk and uncertainty rating. But it is unlikely that cryptocurrency, a healthy alt to fiat, won't prove durable as an asset class. Further, Coinbase gets the overwhelming majority of its revenue from trading fees, but we expect the ratio of trading to non-trading revenue to decrease over time. The cryptocurrency market itself remains volatile and cyclical, but volatility won't likely worsen as regulators get involved (hence the welcome). Increased regulation will likely lead to more transparency, more predictability, and less volatility, and Coinbase is spearheading the effort, a smart move.

The shocks to the crypto credit environment throughout Q2 are likely to be an turning point for the industry. The recent wave of bankruptcies (Celsius, etc.) was a reflection of credit-specific rather than crypto-specific risk; many of these firms were over-leveraged. Coinbase has no financing exposure to these entities. Further, it mitigates liquidity, credit, and counterparty risks. Coinbase's Q2 '22 shareholder letter states:

Risk management is a first principle in our product design. We hold customer assets 1:1. Coinbase funds our loans with corporate cash and does not rehypothecate or lend customer assets, thereby mitigating asset / liability risks. Any lending activity at Coinbase is at the discretion of the customer and backed by collateral, which serves as a first layer of protection against potential default contagion. Our standard practice is to require 100%+ in collateral, and we always measure risk against a substantially higher stressed price move. As a result, we have a record of no credit losses from our financing activities: no exposure to client or counterparty insolvencies: no blocking of client withdrawals or loan recalls, and no changes in access to credit for our trading clients. At the end of Q2, we had credit and counterparty risk primarily comprised of $126 million in loans secured by BTC and $169 million of cash deposits at third party venues to facilitate client trades or instant withdrawals. Risk exposure declined quarter over quarter due to reduced retail borrow balances. Our Retail Borrow program allows customers to borrow up to 40% of the value of the Bitcoin in their account, up to a total of $1 million.

Some may question the wisdom of carrying substantial cryptocurrency assets on balance sheet when Coinbase is already so deeply leveraged to cryptocurrency prices. But if Coinbase believes crypto is long-term safe and a currency proper, there is no reason it should not.

Investigation of the fiduciary conduct of 401(K)-plan and IRA sponsors that offer crypto as an investment—a swipe at Fidelity Investments, which aims to offer Bitcoin in retirement plans it administers, is another latent risk. As reported in Barron's, Fidelity responds:

Fidelity continues to have strong interest for digital assets and the blockchain. We are proud of the Digital Assets Account as a responsible solution to meet the demands of mainstream interest. In fact, client interest has not only been strong, but also spans across a wide range of industries and company sizes. We are on track to launch our first plan sponsor clients this fall.

Coinbase acts as an asset custodian, broker, exchange, and lender in the cryptocurrency economy. This creates potential for conflicts of interest. Theft and fraudulent activity could also cause substantial investor losses. But Coinbase has so far avoided any major pitfalls in these areas.

Some of the assets traded on Coinbase's platform (i.e., XRP) could be ruled by the SEC as unregistered securities. Some coins outstanding may also have little validity. Investor protection rules remain lacking and Coinbase welcomes some measure of regulation for a reason.

Finally, there is environmental and social risk in Coinbase’s business. A White House climate report on crypto indicates that mining operations, running computers 24/7, consume up to 1.7% of U.S. electricity (as reported in Barron's). Such trends may run afoul of the Biden administration’s goals of cutting emissions.

The current market conditions are reminiscent of the bankruptcies dozens of firms filed for as the internet bubble imploded. But Amazon, Google, and many more did more than survive, didn't they? Crypto will have its winners too.

Conclusion

Insiders have been buying Coinbase stock. Fred Ehrsam, co-founder and board director, bought more than 1.1 million shares back in May 2022 for a total of around $77 million at an average price just under $70 a share. Tobi Lütke, another director and the co-founder, CEO, and director of Shopify, has also been accumulating (at a slightly higher average price). At current price ($62.28, quote: Sep 26, 2022, 4:00 PM ET), the stock makes sense. Some may have bought at or around IPO prices when the company was still profitable despite running high operating expenses but crypto was bubbly. The prices of alt currencies and COIN shares have now compressed; Coinbase is rationalizing expenses, creating an ecosystem to boost subscription and service revenue, and working with regulators to maximize regulations outcomes. Clearly, it is working on becoming profitable again mid-term. You can buy the stock at 20% of the price, quite a discount. Bullish investors may consider a decisive buy. More cautious ones may dollar-average (pardon, crypto-average). The market is punishing long-duration stocks for now, thus not helping, but I'm unfazed. The bear may keep at it a bit longer, but a bull is sure to roar back up, always does.

Subscribe to our newsletter

New ideas, promotions, products, and sales. Directly to your inbox.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.