The Best Hedge Funds for Exceptional Investment Returns

Introduction:

- I have over thirty years of investment management experience:

- I have seen critical down cycles, bears and bulls, outperformed and then underperformed, sometimes dramatically. In the process, I have made all the mistakes possible and imaginable.

- But some key players, including top hedge funds and celebrated investors like Warren Buffett, Ray Dalio, Ken Griffin, James Simmons, Cliff Asness, Bill Ackman, Carl Icahn, etc., seem to beat the market consistently over a long period. Investing with them or emulating their portfolio can power up your own financial performance. Namely, a hedge fund's portfolio may constitute a terrific source of investment ideas (although you should still apply due diligence before actually investing). Conversely, you may want to ask yourself why is a stock you have fallen in love with is not owned by any star fund?

- I am the founder of MLI (www.ml-inc.com) and other ventures whose customers or prospects have included numerous tech, fintech, and biotech institutions, as well as many of the funds listed below.

- Investment strategies & risk management frameworks;

- Fund managers' reputation and longevity of firm;

- Key holdings and performance of the fund's portfolio;

- Investment rationales and strategic positioning;

- Fees, minimum capital required, and other investment criteria.

Table of Contents

- 1. Citadel

- 2. Bridgewater

- 3. Renaissance

- 4. Elliott Investment Management

- 5. Berkshire Hathaway

- 6. Pershing Square

- 7. AQR Capital

- 8. D.E. Shaw & Co.

- 9. Baker Bros.

- 10. Balyasny Asset Management

- 11. Tiger Global

- 12. Millennium

- 13. Two Sigma

- 14. Viking Global Investors

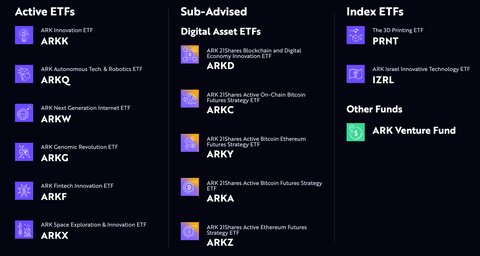

- 15. Ark Invest

- 16. Davidson Kempner

- 17. Coatue Management

- 18. What are hedge funds?

- 19. Executive Summary

Disclaimer 1: We are not a financial advisor. If you're looking for trusted and comprehensive support in managing your finances, consider speaking to a professional financial advisor. This list, which incorporates several objective metrics but is subjective by nature, is intended to be a starting point for research, not a final destination.

Disclaimer 2: While we did our best to inform readers, some information may need to be revised or rapidly decaying. The following list of best hedge funds is best construed as a living organism - constantly evolving and subject to various updates regularly. Some information divulged may need to be corrected, pending confirmation, or completed. We welcome feedback/input, including from hedge funds themselves, at https://funanc1al.com/pages/contact.

Disclaimer 3: A hedge fund's past performance does not guarantee future performance. Returns may vary considerably from year to year.

Disclaimer 4: A couple of hedge funds have approached me, but I have never used the services of one. I manage my portfolio of stocks independently; however, examining leading investors' portfolios provides invaluable insight into the market and offers terrific investment ideas. I wish I had sometimes emulated them instead of erring the way I did (at least during some cycles).

Disclaimer 5: Although this is not the case at the time of writing, this post may later incorporate affiliate links. If you choose to invest with any of the hedge funds or other firms mentioned, we may earn a commission.

Disclaimer 6: Hedge funds are complex, loosely regulated vehicles. You must be an accredited investor before investing with many of them. Exceptions that we are aware of are duly noted below.

Acknowledgment: To assemble the information below, FUNanc1al has gathered data from multiple sources, including the hedge funds's respective websites (mentioned below), Wikipedia, and a few other websites (in particular, https://smartasset.com/financial-advisor/, in particular for relevant delineation of fees).

Note: We've considered including Paulson & Co., George Soros, and a few other top players in the list, but those managers and their entities have often converted into family offices and no longer qualify as active hedge funds.

Contact: We welcome constructive feedback from both hedge funds and our readers, as well as inquiries of all sorts (sponsorship, etc.). Any questions or comments should be directed to https://funanc1al.com/pages/contact.

1. Citadel Llc.

Best For

Fred’s Take

One of the largest hedge funds, Citadel can outperform many, if not most, rivals in some years, sometimes dramatically. But it has underperformed at other times. Expect volatility. Fees are relatively high. It has attracted criticism for barring investors from withdrawing funds in 2008. Big on quants.

A top ten recommendation for its performance potential/risk management profile

9.5 out of 10 (tied)

Profile:

- Founded in 1990 by Ken Griffin.

- US$62.3 billion (lead fund, December 31, 2022) in Assets under Management (AUM); as much as $244 billion across all funds.

- Over 2,500 professionals.

- Invests on behalf of the world's leading universities, healthcare organizations, and other institutions to deliver best-in-class long-term returns.

- High-frequency trading arm Citadel Securities, the world's biggest algorithmic "market-maker," handles over a quarter of all U.S. stocks bought and sold daily, and serves more than 1,600 clients, including some sovereign wealth funds and central banks.

- Global Quantitative Strategies, one of the largest quantitative trading teams, leverages proprietary research, advanced statistical and modeling techniques, and leading-edge technology, to build and execute algorithmic strategies and delineate new investment opportunities across Equities, Fixed Income, and other products.

- Sold a $ 1.15 billion stake in Citadel Securities to venture capital firms Sequoia Capital and Paradigm.

- Citadel is evaluating the prospects of an initial public offering.

Key Strategic Focus:

- Commodities: lead markets include energy (oil, power, refined products), agriculture, etc. - 165 professionals.

- Credit and Convertibles: top products traded include corporate and convertible bonds, preferreds, credit and equity derivatives, bank loans, and Collateralized Loan Obligations - the unit is growing fast, with close to 50 professionals.

- Equities: Takes a market-neutral approach and pursues optimal returns regardless of market conditions. The investment rationale is grounded in fundamental research and disciplined risk management. Long/short, event-driven, and volatility plays - 400+ investment professionals as of Oct. 2023.

- Global Fixed Income & Macro: the focus is on rates (interest rate swaps, sovereign bonds, inflation), currencies, emerging markets, equities, commodities, and credit. Market positioning reflects takes on macroeconomics, monetary policy, and relative value strategies -160+ professionals.

Risk Management

- Citadel lost an astonishing $8 billion in the financial crisis of 2007-2008. It was highly leveraged (7:1). The firm's most sizable fund(s) finished 2008 down 55%. Citadel barred its investors from withdrawing funds for ten months, attracting severe criticism. However, the fund rebounded with a 62% return in 2009; some years, it does outperform most rivals.

- Risk management practices focus on stress exposure, risk capital allocation, and liquidity management. Citadel's risk management center monitors thousands of instruments traded within the firm's portfolios. The hedge fund runs stress tests daily to simulate the impact of potential economic crises, geopolitical threats, and other dislocations.

Top Executive: Kenneth C. Griffin

- Serves as Founder, Chief Executive Officer, and Co-Chief Investment Officer.

- Started investing when a freshman at Harvard, where he got an A.B. in Economics. Griffin had a satellite dish deployed on the roof of Cabot House, a dormitory, to receive stock quotes just before the Black Monday crash of 1987 - this after convincing school administrators to suspend a ban on running businesses from campus. He was betting on stocks falling and made a killing. Griffin's returns attracted the attention of hedge fund pioneer Frank Meyer, who bankrolled the launch of Citadel.

- As of April 2023, Griffin had a net worth of approx. $35 billion, making him the 38th-richest person in the world.

- Included in Forbes's 2023 list of the United States' Most Generous Givers. He has donated more than $1.5 billion to charitable causes ranging from education to economic mobility, medical research, and other domains. In April 2023, Griffin donated $300 million to the Harvard Faculty of Arts and Sciences.

- Griffin has contributed large amounts of money to political candidates and causes, usually Republican or conservative in ideology.

- Griffin is an avid collector of modern and contemporary art from mainstream artists. His portfolio may approach $1 billion in value and includes several of the most expensive paintings ever sold.

Funds:

- Wellington Fund – Citadel's flagship fund.

- Citadel Global Equities

- Tactical Trading

- Global Fixed Income

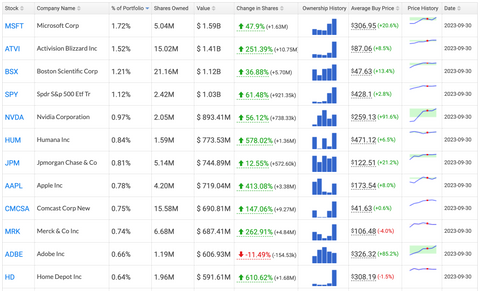

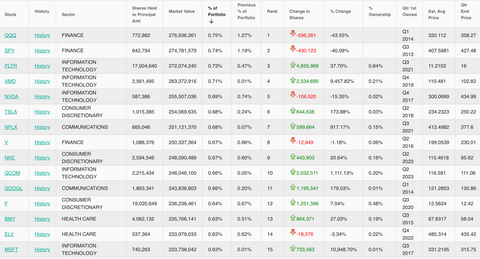

Portfolio: Top 12 holdings

Source: https://hedgefollow.com/funds/Citadel+Advisors

- Highly diversified - with no position constituting more than 2% of total portfolio (at the time of writing);

- More than 5,000 positions;

- Many mainstream investments include Big Tech (AAPL, MSFT, NVDA, etc.) and other blue chips.

Minimum Investment

The minimum investment required (for several funds) is $10 million. The firm may waive these minimums at management's discretion.

Fee Structure:

Citadel charges a combination of a sum approaching 5% of the fund’s assets every year (equivalent to a management fee) and 20% of all gains (performance fee, if applicable). Citadel’s Wellington fund has significantly outperformed in some years but must deliver consistently to justify any premium compensation.

What I Like/Dislike About Citadel:

- Citadel has delivered a remarkable performance in some years.

- One of the most profitable hedge funds of all time, Citadel generated $16 billion in profits for its investors in 2022. Citadel has earned $65.9 billion in net gains since 1990, making it the top-earning hedge fund ever.

- Strong quants and risk management.

- High Fees.

- High Volatility - Major losses some years are in the realm of possibilities.

- Difficulty to withdraw cash at difficult times, although this has been and may continue to be a one-time event.

Fund Updates:

- In a message sent to employees in June 2022, the firm announced it was relocating its headquarters to Miami, Florida, due to a more favorable business climate and a rise in crime complaints in Chicago.

2. Bridgewater Associates.

Fred’s Take

As of 2022, Bridgewater has achieved the second heftiest gains of any hedge fund since its foundation in 1975. But it has, at times and more recently, underperformed. The hedge fund has pioneered several concepts, including risk parity and the separation of alpha and beta strategies. It reportedly accepts funds from institutional clients only or primarily. Bridgewater is big on global macro as well as systemic and rules-based investment management.

A top ten recommendation for its performance potential/risk management profile

9.5 out of 10 (tied)

Profile:

- Founded in 1975 by Ray Dalio.

- Headquartered in Westport, CT.

- Bridgewater has 1,200 professionals (as of August 2022).

- US$123.5 billion in AUM, as of Jan. 31, 2023 - good for No. 2.

- Bridgewater reportedly accepts funds from primarily, if not only, institutional clients such as pension funds and central banks rather than private investors.

Key Strategic Focus:

- Dalio depicts Bridgewater Associates as a "global macro firm." The fund invests in economic trends, such as inflation and GDP growth. Currency and fixed-income markets are other key investment parameters.

- The hedge fund does not seek to invest in individual shares of companies, unlike Warren Buffett and many other fund managers.

- Founder Dalio endorses the risk parity approach, which Bridgewater resorts to for risk management and diversification. The hedge fund takes positions across uncorrelated assets (long or short, in all markets) internationally to further derisk and diversify.

- Leverage, external diversification, and short selling are paramount strategic foci allowing Bridgewater to use any asset combination and seek an optimal risk target level. Risk management supersedes capital allocation.

Risk Management:

- Global macro firm uses a quantitative investment approach to identify new opportunities and seeks uncorrelated investment returns across assets based on risk allocations.

- The company divides its investments into Beta pursuits assuming passive management and standard market risk, and Alpha endeavors assuming active management and seeking higher returns uncorrelated to the general market.

- Dalio was one of the rare few financiers who forecasted the global financial crisis of 2008.

Founder: Ray Dalio, now retired

- Founded Bridgewater two years after graduating from Harvard (MBA, 73') from his two-bedroom apartment in New York City.

- Dalio began investing at age 12 and tripled his investment in Northeast Airlines after the airline merged with another firm.

- Developed a strong reputation after turning a profit from the 1987 stock market crash.

- Dalio had a net worth of approximately $20 billion as of January 21, 2022. He ranked 88th on the Forbes billionaires list and 36th on the Forbes 400 list.

- Dalio is the author of Principles: Life & Work, which reexamines corporate management and investment rationales (featured on The New York Times bestseller list).

Funds:

- Pure Alpha. Bridgewater launched its flagship fund, Pure Alpha, in 1989. Through active management, it invests across various asset classes and balances risk amongst multiple non-correlated assets. It includes dozens of simultaneous trading positions in bonds, stock indexes, currencies, and commodities to prevent overexposure in specific areas. The fund was closed to investors in 2006. As of 2019, it achieved an average annualized return of 12 percent since its foundation, losing money in only three of its 20 years. However, Pure Alpha has more recently underperformed major indices.

- All Weather, Bridgewater's second fund, started as the founder's trust fund in 1996, focusing on low fees, global inflation-linked bonds, and fixed-income investments. The fund was later opened to clients. The goal was to achieve risk-adjusted returns that exceeded the general market's return. The All Weather fund qualifies as one of the largest funds in the U.S. (with more than $46 billion in AUM).

- After the collapse of Lehman Brothers in April 2009, the fund switched to "safe portfolio" mode, focusing on nominal and inflation-linked bonds (40%), treasury bills (30%), treasury bonds (20%), and gold (10%) instead of equities.

- Bridgewater started its first Chinese investment product targeting qualified investors in mainland China in 2018.

- The hedge fund started the Pure Alpha Major Markets in 2011 with approx. $2.5 billion from existing clients and opened to outside investors with an advance commitment of $7.5 billion. The fund, intended to replicate Pure Alpha but with enhanced liquidity, reportedly qualified as the largest hedge fund launch at the time.

- As of early 2023, Bridgewater had raised $800 million for its new Defensive Alpha strategy, which aims to help investors weather bear markets.

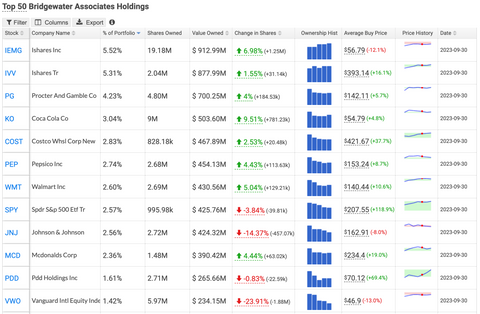

Portfolio: Top 12 holdings

Source: https://hedgefollow.com/funds/Bridgewater+Associates

- Highly diversified

- 740 holdings

- Lots of mainstream investments including major stock indices (emerging markets, S&P 500, etc.), blue chips (PG, KO, MCD, JNJ, etc.), and mostly defensive plays.

Minimum Investment

The firm offers investment management services primarily to pension funds, governments and central banks, university endowments, charitable foundations, funds of funds, Union/Taft Hartley plans, etc.

Bridgewater prioritizes institutions, not retail clients, and generally requires a minimum of $7.5 billion of investable assets.

Fee Structure:

Bridgewater grew in size using the standard hedge fund model, which takes a 2% management fee of assets and 20% of yearly profits accrued from an investment system. Fees are competitive.

What I Like/Dislike About Bridgewater:

- Solid performance since fund's inception.

- Fees are competitive

- Strong on macro. Bridgewater's portfolio can provide insight into major economic trends, which, in turn, can shed light on diversification foci (industry verticals, individual stocks) and resulting position sizing.

- Prioritizes institutions over retail (high-net-worth) investors.

- Financial returns have lagged more recently.

- Stock picks aren't necessarily what the fund is known for.

Fund Updates:

- Nir Bar Dea was named Bridgewater’s co-CEO in January 2022. Before joining Bridgewater in 2015, he served as Advisor to the Israeli Mission to the United Nations in the General Assembly. He also ran a multinational real estate investment operation and founded a drone technology start-up. Originally from outside Tel Aviv, the retired major and platoon leader (Israeli Defense Forces) received his MBA from Wharton.

3. Renaissance Technologies.

Fred’s Take

Profile:

- Founded in 1982 by James Simons. The mathematician used to be a code breaker during the Cold War.

- Headquartered in East Setauket, New York, on Long Island.

- Renaissance specializes in automated, systematic trading leveraging quantitative analysis derived from mathematical and statistical modeling.

- Renaissance has three hundred+ professionals (2021). Many Ph.D.s include AI experts, computational linguists, statisticians, mathematicians, astronomers, etc. The firm does not hire the typical Wall Streeter.

- US$106 billion in AUM.

Key Strategic Focus:

- According to The Man who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman, the ability to "scrutinize large, confusing data sets and discover subtle phenomena" is readily deployed by statisticians and scientists (astronomers, etc.) to identify overlooked market patterns.

- The Fund analyzes hundreds of financial metrics, social media feeds, online traffic data, job listings, "and pretty much anything that can be quantified and tested (...) new factors, some borderline impossible for most to appreciate."

- Engages in equity, bond, commodity, and currency trades; makes money from trending and reversion-predicting signals.

- Per Zuckerman, "The gains on each trade were never huge, and the fund only got it right a bit more than half the time, but that was more than enough." Zuckerman also quotes Robert Mercer, one of the Fund's executives, "We're right 50.75 percent of the time... but we're 100 percent right 50.75 percent of the time. You can make billions that way."

- When Renaissance wins, someone loses. Who is on the other side of the trade? Probably not long-term investors, per Renaissance's management, as reported by Zuckerman. One of the executives pointed to "traders infamous for both their excessive trading and overconfidence when it came to predicting the direction of the market."

Risk Management

- Renaissance uses mathematical, computer-based models to predict price changes in financial instruments and perfect trades. These models rely on analyzing as much data as possible and then looking for non-random movements to make predictions.

- Intricate mathematical models comb through vast volumes of financial data, seeking inefficiencies and patterns that elude human perception.

- Renaissance relies on advanced algorithms, high-frequency trading techniques, and big data analytics to boost performance and qualifies as one of the most innovative players in the financial vertical.

- Renaissance deploys a range of algorithms and mathematical concepts, including stochastic calculus and probability theory, to model market behavior and potential opportunities. Quants and data scientists continuously work to identify and exploit market inefficiencies.

- Various risks are embedded in the firm's quantitative approach to mitigate potential downsides. Advanced risk models help quantify and manage exposure, ensuring that trading positions are carefully calibrated to meet risk appetite targets.

Founder: James Simons, now retired

- Simons founded Renaissance Technologies after serving as the head of the Department of Mathematics at Stony Brook University for a decade.

- In 1976 he was awarded geometry's highest honor (the American Mathematical Society's Oswald Veblen Prize).

- Simmons founded and ran Renaissance until his retirement in late 2009.

- Served as non-executive chairman long after that but stepped down in 2021.

- Simons remains invested in Renaissance's funds, particularly the Medallion fund.

- Simons had a net worth of approx. $30 billion in 2023, qualifying him as the 25th wealthiest person on the Forbes 400 list.

- In 1994, Simons (along with wife Marilyn) founded the Simons Foundation, which supports various causes in education, health, scientific research, etc. The foundation is the top benefactor of Stony Brook University, Marilyn's alma mater, and is a significant contributor to his alma maters - MIT and UC Berkeley. Simons has given well over $4 billion to philanthropic causes.

- In 2016, the International Astronomical Union named asteroid 6618 Jimsimons (discovered by Clyde Tombaugh in 1936) after Simons for his contributions to mathematics and philanthropy.

- Simons got a bachelor's degree in mathematics from MIT and a PhD in mathematics from Berkeley.

Funds:

- Flagship Medallion fund has the best performance (and arguably reputation to match) of any fund on Wall Street, yielding more than 66 percent annualized returns before fees (and nearly 40% after fees) over three decades from 1988 to 2018. Unfortunately, the only customers are fund employees.

- Holds thousands of short and long positions at any time (Source: The Man Who Solved the Market, Gregory Zuckerman).

- The holding period ranges from 1 or 2 days to 1 or 2 weeks (ditto).

- Lots of fast (high-frequency) trades, many of those to hedge or build positions (ditto).

- Renaissance offers a couple of other portfolios to outside investors—including:

- Renaissance Institutional Equities Fund (RIEF), which employs a net-long trading strategy with exposure to both U.S. and non-U.S. equities, as well as certain derivatives.

- Renaissance Institutional Diversified Alpha (RIDA), best described as pooled investment vehicles focusing on equity securities publicly traded on global exchanges, as well as derivatives.

- Renaissance Institutional Diversified Global Equities (RIDGE), which shares similarities to the RIDA funds.

- The Kaleidoscope fund is a fund of funds for employees and investors related to employees. It invests in the Medallion, RIEF, and RIDA fund families.

- Medallion surged 76 percent in 2020, one of its best years ever. But other Renaissance funds — two of which had their worst years ever — underperformed. RIEF, which launched in 2005, lost approx. 22% through December 25. RIDA, launched in 2012, fell even more: 33.5% through the same period. Those two funds made HSBC's top 20 losers list for 2020.

- RIEF underperformed during the financial crisis: The Fund lost 35.73 percent between May 2007 and April 2009. But RIEF has at other times delivered double-digit returns for extended periods (although it may have lagged the Standard & Poor's 500 stock index depending on the period considered).

- RIEF has a 6-month to one-year holding time and uses factor-based risk models to hedge risk. The COVID-19 crisis and subsequent stimulus and relief efforts undertaken by the U.S. government created a unique pattern of stock price movements that couldn't be adapted to by quant models built on historical patterns, as there had not been a pandemic in over a century.

- Medallion has a much shorter holding time and adapts more quickly to market changes. Despite dramatic volatility at the outbreak's inception, the Fund was able to capitalize on the market's rebound. It also uses more leverage than RIEF, which boosted returns as markets bounced back.

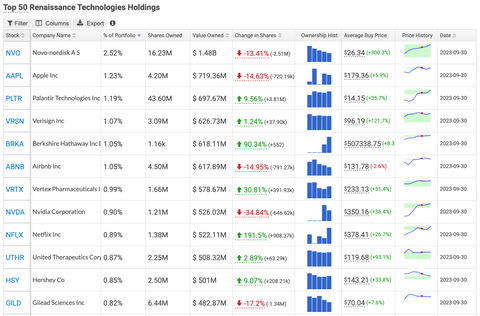

Portfolio: Top 12 holdings

Source: https://hedgefollow.com/funds/Renaissance+Technologies

- Highly diversified. More than 3,500 holdings.

- The top 12 positions only constitute around 13% of the portfolio (if that).

- Holds thousands of short and long positions at any time (Source: The Man Who Solved the Market, Gregory Zuckerman).

- The holding period ranges from 1 or 2 days to 1 or 2 weeks (re: Medallion, ditto).

- There are lots of fast (high-frequency) trades, many of which hedge or build positions (ditto).

- Many mainstream investments include blue chips and big tech (AAPL, BRKA, NVDA, etc.).

Minimum Investment

Medallion has a closed-door policy; the Fund is unavailable to outside investors. Minimum investments (estimates, to be confirmed) vary across the firm's other funds and fund families:

- REIF Fund Family: $25,000 to $50 million

- RIDA Fund Family: $100,000 to $50 million

- RIDGE Fund Family: $5 million to $50 million

Source: https://smartasset.com/financial-advisor/renaissance-technologies-review.

Fee Structure:

The firm's reputation and Medallion's exceptional performance warrant high fees, but Renaissance's other funds' performance may weigh on them.

Medallion charges a management fee of 4% of funds invested and a performance fee of 36% - 44% of net profits.

RIEF Funds charges a management fee of 0.20% - 1.50% of net asset value and a performance fee of 0% - 10% of net capital appreciation.

RIDA Funds charges a management fee of 0.85% - 1% of net asset value and a performance fee of 10% of net capital appreciation.

RIDGE Funds charges a management fee of 0.85% - 1% of net asset value and a performance fee of 10% of net capital appreciation.

What I Like/Dislike About Renaissance:

- Renaissance has achieved exceptional performance since the Fund's inception.

- Renaissance may qualify as the lead quant on Wall Street.

- Strong on macro. The portfolio can provide insight into major economic trends, which, in turn, can shed light on individual (vertical, individual stock) position sizing.

- The flagship fund (Medallion) is closed to retail (accredited or high-net-worth) investors.

- Other funds open to high-net-worth investors may not perform as well. Medallion surged 76% in 2020, but other funds tanked.

- Performance is difficult to replicate for individual investors flying solo, given short-term positioning and proprietary trading prowess.

- Exclusivity and secrecy result in little transparency.

Fund Updates:

- Peter Brown, a computer scientist specializing in computational linguistics, now runs the Fund. He joined Renaissance in 1993 from IBM Research.

4. Elliott Investment Management L.P.

Fred’s Take

Profile:

- Paul Elliott Singer created Elliott (his middle name) Associates in 1977, starting with $1.3 million from family and friends.

- Elliott is one of the oldest hedge funds, having operated under the same management team since its inception.

- Relocating to West Palm Beach, FL.

- As of June 30, 2023, Elliott manages approximately $59.2 billion in assets.

- Approximately 550 employees, nearly half dedicated to portfolio management and analysis.

Key Strategic Focus:

- From its roots in convertible arbitrage, the firm has transitioned into a multi-strategy hedge fund pursuing a broad range of strategies, including equity-oriented, private equity/credit, distressed and non-distressed securities/debt, real estate-related securities, commodities trading, hedge/arbitrage, and portfolio volatility protection.

- The firm's distressed securities trading strategies typically refer to the debt of bankrupt or near-bankrupt companies. They are highly contingent on deep skill sets and intensive hands-on efforts. They pursue uncorrelated situations requiring due process, complexity, negotiations, and factors unrelated to the forces impacting stocks and bonds generally or business-value-driven situations.

- Non-distressed debt consists of highly complex products, including first-lien bank debt, unsecured corporate debt whose servicing is unlikely to require restructuring, and structured credit products. They often demand methodical analyses of multi-layer securitization and are poorly understood by many investors. Elliott's expertise in these products allows the firm to identify attractive opportunities where securities can be mispriced significantly. It's unlikely that most retail investors, even accredited, will be able to uncover similar opportunities independently.

- Elliott's portfolio also leverages hedge/arbitrage positions and focuses on event arbitrage, related securities arbitrage, convertible arbitrage, volatility arbitrage, and fixed-income arbitrage. Hedge/arbitrage seeks and benefits from often minor disconnects between related instruments and achieves overall portfolio risk management objectives on an opportunistic basis.

- Elliott also pursues equity positions that help garner control of or a substantial minority stake in, often private companies or, on occasion, companies with a small public float (one of its other bread and butter). It may then use its influence and voting rights to induce change. Elliott may also buy or source credit and preferred equity positions in companies (often less liquid than listed securities with longer investment horizons). Special purpose vehicles, joint ventures, or similar arrangements may be deployed to pursue opportunities related to a particular sector, industry, or strategy.

- The firm often takes long positions to achieve the strategic objectives mentioned above. It rarely builds long equity stakes driven by valuation considerations (unlike Warren Buffett, for example). Elliott pursues positions uncorrelated with others in the portfolio or with the general risks of equities or where the firm's manual efforts can enhance protection against risk. High asymmetry of risk/reward creates some degree of optionality and guides investments.

- Elliott resorts to credit, equity, volatility, interest rates, gold, and currency instruments to achieve Portfolio Volatility Protection; the strategy helps hedge Elliott's portfolio against certain adverse market conditions.

- The firm also engages in commodities trading and real estate-related securities.

Risk Management:

- The firm's portfolio is atypical (given its listed objectives - see above), unlike most other hedge funds. Risk management is deep-embedded in the way the fund uncovers opportunities.

- Elliott's culture highlights due process, tenacity, hard work, and creativity.

- Elliott trades in securities across the entire capital structure. It often takes a leading role in event-driven situations to create value or manage risk. Elliott is one of the last genuine activists.

- Elliott seeks to generate a consistent, superior return by pursuing an opportunistic trading approach, the creation – not just the identification – of value (proactive), robust liquidity management, and counterparty/operational risk management.

Founder: Paul Singer

- Paul Singer is the Founder, President, and Co-Chief Executive Officer of Elliott. He also serves as Co-Chief Investment Officer.

- Mr. Singer is also a member of the Management, Risk, Valuation and Global Situational Investment Committees. He is the Founder of The Paul E. Singer Foundation and Co-Founder of Start-Up Nation Central. He is also Chairman of the Manhattan Institute for Policy Research.

- Elliott is widely considered one of the most innovative fund managers (for good reason). He boasts a unique track record as a (so-called) vulture capitalist and an innovator in purchasing sovereign debt and pursuing countries for unpaid bonds.

- As of June 2023, Paul Singer's net worth approximates US$5.5 billion.

- Singer's political/charitable activities include financial support for LGBTQ rights (amongst other causes). He's an active participant in Republican Party politics.

- Singer is the owner of AC MILAN, a top European soccer club.

- University of Rochester and Harvard Law School (J.D.) graduate.

Funds

- Elliott Management has 2 funds, including Elliott Management Private Equity Fund.

- Access to new investors has yet to be confirmed.

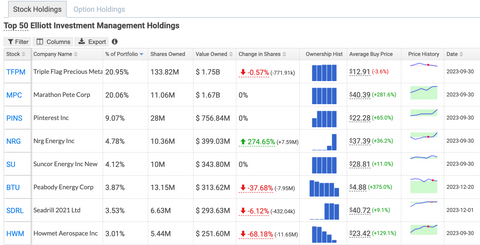

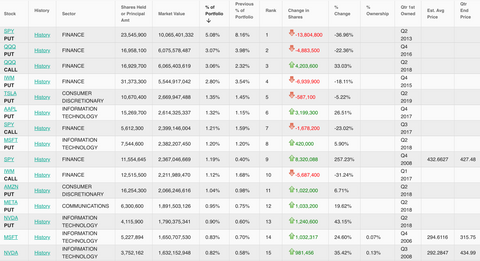

Portfolio: Top 15 holdings

Source: https://hedgefollow.com/funds/Elliott+Investment+Management

- The fund's concentrated portfolio has 40% of the total weight in 2 positions (TFPM and MPC at 20% each).

- As indicated above, the firm's portfolio is atypical (given its listed objectives) and unlike most other hedge funds. It contains few blue chips or big-tech investments.

- Energy vertical is well-represented (somewhat reminiscent of Carl Icahn's vertical takes).

- 50+ holdings in total.

Minimum Investment

- A $5 million minimum may apply.

Fee Structure:

- Elliott may have applied a 1.5% management fee and 20% performance fee, which are standard in the industry (to be confirmed).

- Existing and prospective investors should consult offerings documents and contact the firm directly for details on access to funds, fee schedules, and other expenses.

What I Like/Dislike About Elliott:

- Elliott is one of the oldest hedge funds, having operated under the same management team since its inception.

- Skilled activist investor, one of the last of its kind.

- Elliott is an expert at deploying and lubricating distressed- and non-distressed-securities trading strategies.

- Elliott is a robust arbitrage delineator and a highly-skilled, proactive risk manager.

- The fund is an excellent source of ideas (but often idiosyncratic).

- Helpful website.

- Elliott seems currently close to new investors (to be confirmed).

Fund Updates:

- Shares of Phillips 66 climbed toward the end of 2023 after activist Elliott Investment Management announced a $1 billion stake in the energy company. Along with the significant equity investment, Elliott is seeking two board seats to help drive improved execution and performance.

5. Berkshire Hathaway

Fred’s Take

Profile:

- American multinational conglomerate holding headquartered in Omaha, Nebraska, United States.

- Founded as a textile manufacturing company in 1839. Berkshire became a holding company in 1970.

- Its main line of business and source of capital is insurance. The firm invests the float or retained premiums in an extensive portfolio of subsidiaries, equity positions, and other securities.

- 383,000 employees (2022)

- Generated revenue of 302 billion and net income of 22.8 billion with $948 billion of total assets and $472 billion of total equity (2022).

- Chairman and CEO Warren Buffett and (from 1978 to 2023) vice chairman Charlie Munger have overseen the firm since 1965.

- Under their direction, Berkshire's book value has compounded at an average rate of 20% (vs. about 10% for the S&P 500 index, dividends included).

Key Strategic Focus:

- Warren Buffett and (now deceased) Charlie Munger embrace value investing principles.

- To quote Buffett, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

- Buffett also said, "The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage."

- Most holdings are long-term. To quote Buffett, "Our favorite holding period is forever." He added, "The stock market is designed to transfer money from the active to the patient." He also said, "Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things just take time: You can't produce a baby in one month by getting nine women pregnant." Similarly, "Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic."

- The firm employs large amounts of capital but minimal debt to achieve desired results.

- According to Buffett, "It is a terrible mistake for investors with long-term horizons -- among them pension funds, college endowments, and savings-minded individuals -- to measure their investment' risk' by their portfolio's ratio of bonds to stocks."

Risk Management

It is best to quote Buffett and Munger:

- "Diversification is protection against ignorance. It makes little sense if you know what you are doing." (Buffett)

- "An investor should act as though he had a lifetime decision card with just twenty punches on it." (Buffett)

- "Risk comes from not knowing what you are doing." (Buffett)

- "Widespread fear is your friend as an investor because it serves up bargain purchases." (Buffett)

- "The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd." (Buffett)

- "Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future." (Buffett)

- You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital." (Buffett)

- "After 25 years of buying and supervising a great variety of businesses, Charlie [Munger] and I have not learned how to solve difficult business problems. What we have learned is to avoid them." (Buffett)

- "It is not necessary to do extraordinary things to get extraordinary results." (Munger)

- "It takes character to sit with all that cash and to do nothing. I didn't get to where I am by going after mediocre opportunities. (Munger)

- "In my whole life, I have known no wise people (over a broad subject matter area) who didn't read all the time — none, zero. You'd be amazed at how much Warren reads – and at how much I read. My children laugh at me. They think I'm a book with a couple of legs sticking out." (Munger)

- "All I want to know is where I'm going to die, so I'll never go there." (Munger)

Founder: Warren Buffett

- As a result of his remarkable investment record, Buffett is one of the most celebrated investors in the world. As of December 2023, he had a net worth of $120 billion, making him the seventh-richest person in the world.

- A book borrowed from the Omaha public library when he was seven inspired Buffett's early entrepreneurial pursuits - selling chewing gum and Coca-Cola door to door. While still in high school, he made money delivering newspapers and selling golf balls and stamps, among other means. His father took time to educate his son's interest in business and investing, taking him to visit the New York Stock Exchange at age 10.

- The son of U.S. congressman and businessman Howard Buffett, he developed an interest in investing during his youth. He entered the Wharton School (University of Pennsylvania) in 1947 before graduating from the University of Nebraska. Rejected by Harvard Business School, he attended Columbia University, obtained a Master of Science in economics, and graduated from Columbia Business School, where Benjamin Graham taught value investing.

- Buffett worked as an investment salesman and a securities analyst before serving as a general partner at Buffett Partnership, Ltd. and as the chairman and CEO of Berkshire Hathaway starting in 1970.

- "In 1951, Buffett discovered that Graham was on the board of GEICO insurance. Taking a train to Washington, D.C., on a Saturday, he knocked on the door of GEICO's headquarters until a janitor admitted him. There he met Lorimer Davidson, GEICO's vice president, and the two discussed the insurance business for hours. Davidson would eventually become Buffett's lifelong friend and a lasting influence, and would later recall that he found Buffett to be an "extraordinary man" after only fifteen minutes. Buffett wanted to work on Wall Street, but both his father and Ben Graham urged him not to." (Source: Warren Buffett - Term Paper. https://www.termpaperwarehouse.com/essay-on/Warren-Buffett/72274)

- Buffett has pledged to give away the vast majority of his net worth (as much as 99%) to a range of philanthropic causes. The Bill & Melinda Gates Foundation is the lead beneficiary. He launched the Giving Pledge in 2010 with Bill Gates; billionaires pledge to give away at least half of their fortunes.

Funds:

Berkshire Hathaway is not a hedge fund.

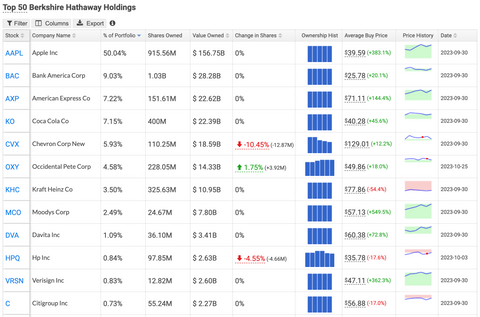

Portfolio: Top 12 holdings

Source: https://hedgefollow.com/funds/Berkshire+Hathaway

- Auto-insurer GEICO and reinsurance leader General Re constitute the company's prime insurance brands. Non-insurance subsidiaries operate in railroads, confectionery, home furnishings, apparel, electrical power, etc. Berkshire partially owns Pilot Flying J (80%), Kraft Heinz Company (above 25%), American Express (close to 20%), Paramount Global (approx. 15%), Bank of America (around 12%), The Coca-Cola Company (just under 10%) and Apple (5.57%).

- The firm's portfolio of publicly traded equities is highly concentrated. Buffett has 50% of his holdings in Apple (AAPL) and more than 90% in his top 10 positions (AAPL, BAC, AXP, K.O., CVX, OXY, KHC, MCO, DVA, HPQ) (see table above for detail).

- Many mainstream investments include blue chips and big tech (AAPL, BAC, K.O., AXP, CVX, etc.).

- Holdings are usually very long-term.

Minimum Investment

Berkshire Hathaway is not a hedge fund. Any investor can buy the stock of the New York Stock Exchange. This said, class A shares traded at $581,600 (as of 2/1/2024). The shares are the highest-priced on the New York Stock Exchange, having never incurred a stock split and having only paid a dividend once since Warren Buffett took over. The firm retains corporate earnings on its balance sheet (avoids double taxation). Berkshire Hathaway created a second class of shares, Class B shares; they traded at $386.44 (as of 2/1/2024).

Fee Structure:

No fee applies - just a small commission to buy and sell the stock.

What I Like/Dislike About Berkshire Hathaway:

- Exceptional performance since Buffett took over Berkshire.

- Remarkable leadership, unique stock-picking abilities

- Strong in ethics, risk management, and business rationale.

- The portfolio can provide unique insight into defensive stakes in times of turmoil.

- Lessons in position sizing.

- Sadly, Charlie Munger recently passed away; we can only hope Warren Buffett will survive him another quarter century.

Fund Updates:

- In May 2021, Warren Buffett selected Greg Abel as the new CEO of Berkshire Hathaway.

- Investing legend Charlie Munger died on November 28, 2023 at 99.

6. Pershing Square Capital Management

Fred’s Take

Profile:

- The American hedge fund management company founded and run by Bill Ackman is headquartered in New York City.

- US$18.5 billion (2022) in AUM.

- Ackman started Pershing Square in 2004, with $50+ million in funding from his personal funds and former business partner Leucadia National.

- Ackman may hire people outside of traditional finance backgrounds; for instance, his professionals have included a former fly fishing guide and a man whom he met in a taxi.

- The staff is small (<100 employees).

Key Strategic Focus:

- Ackman considers Warren Buffet a mentor and invests in quality companies offering both value and growth potential. He seeks to invest in typically 8 to 12 core investments and seeks minority stakes in publicly traded companies. Like Buffett, he'd rather invest in fewer firms he understands well, knowing that attractive opportunities are rare. Large diversified portfolios of investments may deliver suboptimal risk-adjusted returns.

- The firm sets no major restrictions on the securities or other financial instruments it uses. It also does not follow any particular asset allocation model.

- Pershing pursues midsize to large bets (but never so large that they may turn life-threatening) on various equities and other investment vehicles.

- Opportunistic, the fund may go short or long depending on profit potential.

- The activist investor has launched activist campaigns against McDonald's, Wendy's, and Herbalife.

- Pershing Square has a long history of well-publicized deals, some very successful, others not. In the first quarter of 2016, Ackman's fund experienced its largest quarterly loss (25%) due in part to its near-10% stake in Valeant Pharmaceuticals International (now Bausch Health, BHC). Pershing Square sold all of its stake in Valeant with a total loss of $4 billion.

- Just before the 2020 stock market crash, Ackman invested $27 million to purchase credit protection (rather than selling off his holdings whose businesses he considers robust) to hedge Pershing Square's portfolio. The hedge generated an impressive $2.6 billion in less than one month.

Risk Management

- Ackman may pursue bold, controversial investments.

- Major bets have included shorting MBIA's bonds during the financial crisis of 2007-2008, a hefty stake in Valeant Pharmaceuticals' stock, and, from 2012 to 2018, a US$1 billion short against the nutrition company Herbalife, which he described as a pyramid scheme. Karl Icahn was long and saw the bet as misguided.

- After performing poorly in 2015–2018, Ackman told investors in January 2018 that he would be slashing staff and focusing on research. The following year, Pershing Square returned a market-beating 58.1%.

- Ackman admires short sellers such as Carson Block of Muddy Waters Capital and Andrew Left of Citron Research.

Founder: William (Bill) Albert Ackman

- Ackman serves as the Founder and CEO of Pershing Square Capital Management.

- Received a B.A. magna cum laude in social studies from Harvard College in Cambridge, Ma. In 1992, he received an MBA degree from Harvard Business School.

- As of June 2023, Ackman's net worth was estimated at $3.5 billion by Forbes.

- A signatory of The Giving Pledge, Ackman intends to give away at least 50% of his wealth by the end of his life to charitable causes.

Funds:

- Pershing Square and Pershing Square International are the firm's core funds.

- Ackman launched its UK-based closed-end fund, Pershing Square Holdings, on the London Stock Exchange in October 2014.

- Target investors are pension funds, endowments, high-net-worth individuals, trusts, estates, charitable organizations, corporations, and foreign sovereign wealth funds (amongst other investors). But shares of Pershing Square Holdings (ticker: PSHZF) can be bought over the counter.

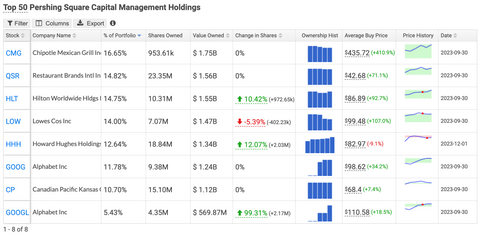

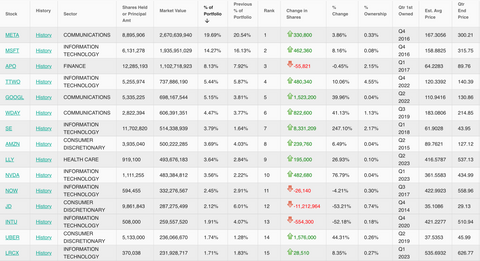

Portfolio: Top 12 holdings

Source: https://hedgefollow.com/funds/Pershing+Square+Capital+Management

- Highly concentrated portfolio, with 45% of holdings in three stocks (CMG, QSR, HLT) (as of the end of 2023).

- Pershing Square has a total of only seven positions.

- All holdings are highly familiar names (including the above three, Alphabet, and Lowes Co.).

- Verticals revolve around restaurants, hotel & entertainment services, real estate operations, railroads, and tech.

- Holding times vary significantly from a few weeks to a few years.

Minimum Investment:

As indicated above, Pershing Square Holdings (ticker: PSHZF) is a public fund whose shares can be bought over the counter.

Fee Structure:

Pershing Square Capital typically charges an annual management fee of 1.5% of AUM and a performance-based fee, which starts at 20% of the increase in net asset value (after certain costs and losses have been deducted).

What I Like/Dislike About Pershing Square:

- Inspired deal-making.

- Solid performance over the years.

- High transparency - any investor can check the fund's performance records here. Annual and semiannual reports, financial statements, letters, notices, and presentations to shareholders are also available online at the fund's website.

- Strong in ethics and risk management.

- Pershing Square's portfolio can provide unique insight into defensive stakes in turmoil.

- Lessons in position sizing.

- Not a dislike per se, but some of the most remarkable deals Ackman has initiated had nothing to do with stocks (corporate credit, bonds/bills, etc.).

- Similarly, not all positions are long, as the fund is happy to bet against the market when deemed promising.

Fund Updates:

- In August 2023, Pershing Square took a short position on 30-year Treasury Bills through options instead of shorting the bonds outright, betting that long-term inflation would settle about 100 points higher than the Federal Reserve's 2% target. He closed the position less than three months later, citing geopolitical risks and a slowing economy, earning $200 million.

7. AQR Capital

Fred’s Take

Profile:

- Global investment management firm founded in 1998 and headquartered in Greenwich, CT, United States.

- AQR stands for applied quantitative research.

- US$100 billion (as of November 2023) in AUM.

- Approx. 1,000 employees.

Key Strategic Focus:

- AQR relies on fundamental investing and sound economic analysis to deliver long-term, repeatable results and deploys both qualitative and quantitative tools to construct portfolios.

- AQR offers 40 diversified strategic profiles across equity and alternative investments.

- The firm pioneered factor investing, applying value, momentum, defensive, and carry styles to build portfolios offering low correlation to traditional equity-dominated strategies.

Risk Management

- Quantitative research and a disciplined approach to risk management to identify reliable sources of returns underpin portfolio construction.

- AQR avoids any major bet on individual stocks. Diversification is key.

- AQR offers a low-correlation alternative to traditional, equity-dominated portfolios via multiple funds and instruments (alternatives).

Founding Team: Cliff Asness, Robert Krail and John Liew

- Three of AQR's founding principals met in the University of Chicago's Ph.D. program, where they incubated the foundation of AQR's investment philosophy.

- Managing and Founding Principal Cliff Asness was a Managing Director/Director of Quantitative Research at Goldman Sachs & Co. (Asset Management Division) before co-founding AQR. He has won multiple awards and was named one of the 50 Most-Influential People in Global Finance by Bloomberg Markets magazine.

- Mr. Asness started the Goldman Sachs Global Alpha Fund, a systematic trading hedge fund considered one of the industry's earliest quant and high-frequency traders; it leveraged short-selling and computerized modeling to identify underpriced equities, bonds, and other assets and make money regardless of market direction.

Funds:

- AQR caters to a wide range of equities-oriented investment needs by offering single-style (defensive, momentum, value, etc.) and multi-style investing (blending). Some vehicles seek to outperform particular benchmarks, while others leverage long/short equity strategy like limited shorting in a 130/30 configuration (ratio of 130% of starting capital allocated to long holdings achieved by deriving 30% of the starting capital from shorting stocks) combined with beta-1 ( S&P 500-aligned) products. Others factor in country and currency considerations.

- AQR also offers a wide range of alternative investing vehicles. Some products seek near-zero correlation to traditional markets (via absolute returns). In contrast, others provide convertible, merger, and event-driven arbitrage strategies or pursue a global macro focus. Inflation-hedging and identifying highly undervalued securities drive yet other vehicles.

- AQR offers a variety of investment products (from offshore limited partnerships to mutual funds and UCITS funds) to reflect different strategies.

- The company serves institutional investors—including pension funds, defined contribution plans, insurance companies, endowments, and foundations—with private funds, separate managed accounts, and other vehicles to suit its client organization's governance, pricing, and liability needs.

- AQR also serves individual investors through AQR-sponsored mutual funds and offers options for investors in Europe and Australia.

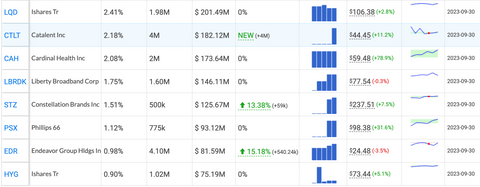

Portfolio: Top 10 holdings

Source: https://hedgefollow.com/funds/Aqr+Capital+Management

- Highly diversified portfolio, with no position constituting more than 3% of total weight.

- The vast majority of holdings constitute around 1% or significantly less of total weight.

- Many positions are familiar names (including big tech and other blue chips).

- Holding times vary considerably from a few weeks to a few years. Some long-term positioning.

- The stocks differ, but the approach to portfolio construction is reminiscent of D.E. Shaw's and even Renaissance's (see separate profiles).

Minimum Investment:

- Many funds have a minimum investment requirement of $5 million and may only be available to accredited retail customers.

Fee Structure:

-

There are various fee arrangements for funds at AQR. As is the case for most hedge funds mentioned in this article, a combination of asset-based management fees and performance-based fees often applies. Advisory fees for AQR funds approach 1.45% of AUM; fees for AQR UCITS around 1.40% (add a performance fee that may approach 15% of profits), and sponsored funds charge an annual management fee of up to 2% of AUM plus a performance-based fee that may approach 30% of profits. Managed accounts charge a similar performance-based fee; the fixed asset-based free varies by fund and may approximate 1.00%.

What I Like/Dislike About AQR Capital:

- AQR has a solid quantitative background and risk management arsenal.

- Many investment-style options are available (both traditional and alternative) for qualified investors. AQR was one of the first hedge funds to offer alternative mutual funds (launched in 2009).

- Strong ties to academia and interesting research and data sets are available online.

- Diversified portfolio can provide unique insight into defensive stakes in times of turmoil.

- Lessons in position sizing.

- As is the case for most, if not all, players mentioned in this list, some years, the funds have underperformed significantly. After AQR's Annual Profit plunged 34% in 2018, the firm announced job cuts in early 2019.

- For the seventh consecutive year, Pensions & Investments ranked AQR as one of the Best Places to Work in Money Management for 2023.

8. D.E. Shaw & Co.

Fred’s Take

Profile:

- Founded by David E. Shaw in 1988.

- Headquartered in New York City.

- US$60 billion (2023) in AUM.

- Approx. 2,500 employees.

- Amazon founder Jeff Bezos is an alumnus.

- 1 in 6 investment professionals is a published author.

- Staff includes 650 developers and engineers and scores 24 International Math Olympiad medals.

Key Strategic Focus:

- Systematic, discretionary, and hybrid strategies mine three decades of research and infrastructure development and leverage quantitative and computational techniques.

- Systematic equity strategies seek attractive long-term excess returns by applying a risk-aware framework to stock selection. Equity arbitrage opportunities identify technical, event-related, or fundamental inefficiencies. Systematic futures trading instruments place bets on equity indices, bonds, rates, currencies, and commodities.

- The hedge fund also relies on experienced staff to pursue discretionary investment opportunities across various asset classes (asset-backed, corporate credit, energy trading, private investing, reinsurance, renewable energy, fundamental equity, etc.). This process-driven investment approach often seeks to maintain a low correlation to broader indices and macroeconomic parameters.

- Some combination of strategies (hybrid) may apply. The firm uses the same rigorous quants-heavy framework to invest across several systematic, discretionary, and hybrid strategies.

Risk Management

- The D. E. Shaw group considers risk management a critical differentiator between winners and losers over the long run. The firm has tested and refined principles over three decades, including significant market disruptions and cycles.

- The firm's Risk Committee, which includes Members of the Executive Committee, Chief Risk Officer, and Rotating Managing Directors, evaluates risk in various dimensions and manages capital allocation among strategies. Every manager is considered a risk manager.

- The firm's website shares relevant literature. Check out the following for starters.

Founder: David E. Shaw

- PhD from Stanford University.

- Former assistant professor in Columbia University's computer science department.

- David Shaw worked at Morgan Stanley in proprietary trading/technology.

- Several presidential appointments (Council of Advisors on Science and Technology, under both Bill Clinton and Barack Obama)

- David Shaw figures in the Forbes 1000 list of US billionaires (net worth: $8.3 billion, #105).

Funds:

- As of December 1, 2023, the firm had over $60 billion in investment and committed capital. Investment activities fall into 1) alternative investments and 2) long-oriented investments.

- Alternative investment funds pursue specific strategies or combine several and seek absolute returns, often with low targeted correlation to traditional assets like equities.

- Long-oriented strategies concentrate on major, tradeable asset classes. Started in 2000, Active Equity embraces various strategies that allow institutional investors to customize their exposures to specific stock indices.

- Founded in 2013, Orienteer aims to offer diversified exposure to global asset classes while pursuing select alpha opportunities.

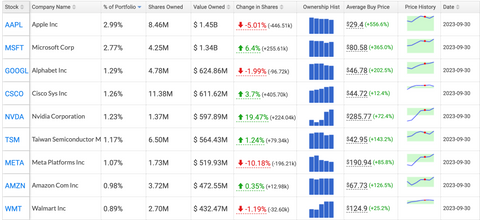

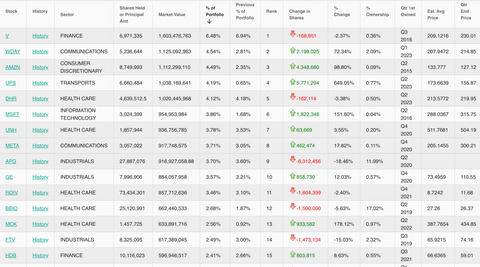

Portfolio: Top 15 holdings

Source: https://hedgefollow.com/funds/DE+Shaw

- Highly diversified portfolio, with no position constituting more than 4% of total weight.

- Most holdings constitute around 1% or significantly less of total weight.

- Many positions are familiar names (including big tech and other blue chips).

- Holding times vary significantly from a few weeks to a few years. Some long-term positioning.

- The stocks differ, but the approach to portfolio construction is reminiscent of AQR's.

Minimum Investment

- As is the case for most funds included in this article, only accredited investors may invest in D.E. Shaw's hedge fund products. Accredited investors must generate a minimum of $200k of earned income ($300k for couples) and be expected to see income trend positively in the foreseeable future. Alternatively, an accredited investor may have a minimum net worth of $1 million (not including the value of their primary residence), either on their own or with their spouse. This said, many funds offered by DE Shaw have a minimum investment requirement of $1 million.

- Specific funds may have their own minimum investment requirements. Please get in touch with the fund for further information.

Fee Structure:

- Fee schedules at D. E. Shaw vary based on the specific fund. However, most funds charge an asset-based management fee and a performance-based fee.

- The management fee is based on a ratio of the fund's market value. This fee may approach 3.5% for some funds.

- Performance-based fees are computed based on a percentage of the gain a given fund accrues and may approach 15% to 35% of net profits. Again, specific funds may have their own fee schedule. Please contact the fund for further information.

What I Like/Dislike About D.E. Shaw:

- Best-in-class quantitative background and robust risk management make this quant trading pioneer a compelling choice.

- Lots of investment style options are available (both traditional and alternatives) for qualified investors.

- Helpful research and data sets are available online.

- Diversified portfolio can provide unique insight into defensive stakes in times of turmoil.

- Lessons in position sizing.

- As is the case for most, if not all, players mentioned in this list, some years, D.E. Shaw's funds have underperformed.

Fund Updates:

- In 2024, D.E. Shaw & Co. will relocate its Midtown headquarters from 1166 Avenue of the Americas to Two Manhattan West on the far west side of Manhattan, taking eight floors in the massive Brookfield Properties Hudson Yards office building.

9. Baker Brothers Advisors LP

Fred’s Take

Profile:

- Julian and Felix Baker founded the New York City-based hedge fund sponsor in 2000.

- Headquartered in New York City.

- Discretionary assets under management (AUM) of $23,154,517,129 (Form ADV from 2023-03-24)

Key Strategic Focus:

- Baker Bros has developed unique, vertical-specific expertise in a sector that can be quite treacherous for novices.

- Baker and Bros is a long-term investor. The Fund holds investments for an average of three years or longer.

- The portfolio is heavily weighted towards healthcare and life sciences, particularly biotech.

- The firm's concentrated investment strategy has been a hallmark of its success, eschewing diversification in favor of significant positions in select leading enterprises.

Risk Management

- Baker Bros may adhere to Warren Buffetts's words, "Diversification is protection against ignorance. It makes little sense if you know what you are doing."

- Baker Bros is an atypical fund: mostly biotech. Fifty percent of the fund's total portfolio is in 2 stocks and 60% in 3.

- However, the concentrated portfolio often leverages remarkable insight. Significant investments are usually less risky than the sector would have you believe (commercial vs. development stage, profitability or strong prospects of reaching it, etc.). High conviction often pays off.

Founders: Felix and Julian Baker

- Brothers Felix and Julian Baker started their fund-management careers in 1994. The Tisch Family acted as a seed investor.

- Felix holds a B.S. and a Ph.D. in Immunology from Stanford University, where he also completed two years of medical school; has served as a director on the boards of several public companies (Seattle Genetics, now part of Pfizer; Alexion, now AstraZeneca; Genomic Health, now part of Exact Sciences Corporation; Kodiak Sciences, etc.)

- Julian holds an A.B., magna cum laude, from Harvard University. He serves on the boards of Incyte Corporation, Acadia Pharmaceuticals, Inc., Prelude Therapeutics, Inc., Everyone Medicines Inc., and Alumis, Inc.

- Felix and Julian Baker's net worth is $2.8 billion each, ranking at #1142 globally (Forbes, end 2023).

Funds:

- Baker Bros manages long-term investment funds focused on publicly traded life-sciences companies.

- Fund investors are major institutional clients.

- There is limited to no focus on retail investors. Baker Bros does not have a major website.

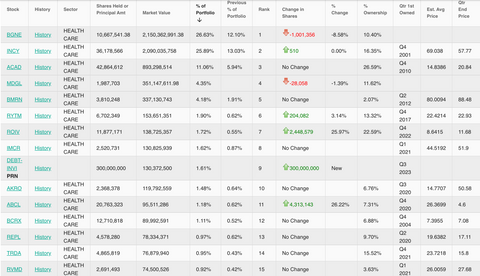

Portfolio: Top 15 holdings

Source: https://whalewisdom.com/filer/baker-bros-advisors-llc

- Highly concentrated portfolio, with more than 50% of the total weight in two stocks (BGNE, INCY). Both biotechs are commercial-stage with a growing, diversified portfolio of therapeutics.

- The fund owns as many as 117 stocks, including many small biotechs, but most such positions are well under 1% of total weight, which helps Baker and Bros avoid unduly high risk investing in dilution-prone, developmental ventures.

- While Baker Bros's fund is often labeled as a healthcare-focused portfolio, there are very few managed healthcare (UNH, etc.) or big pharma (PFE, JNJ, etc.) plays.

- The average holding time is long-term. The firm may hold some positions for years if not decades. It started investing in INCY in Q4 2001.

- Baker Bros's investments offer great food for thought for biotech investors.

Minimum Investment

- As is the case for most funds in this article, only accredited investors are eligible for investment.

- The Company provides investment advisory services to pooled investment vehicles (i.e., very few clients).

- There is limited to no focus on retail investors, be they accredited or not.

- Baker Bros Advisors has no mainstream website.

Fee Structure:

- It is largely irrelevant, as the hedge fund only has a few clients and it is hardly open to retail (even accredited) investors.

What I Like/Dislike About Baker Bros:

- Baker Bros is a best-in-class investor in the healthcare and, in particular, biotech sector.

- The portfolio is an excellent source of ideas for investors looking to invest in the vertical.

- Baker and Bros. has a knack for investing in buyout prospects pre-merger (Seattle Genetics, Alexion Pharma, etc.)

- Diversified portfolio can provide unique insight into defensive stakes in times of turmoil, a critical point since the sector can compress dramatically in a bear (given the dearth of profits amongst small biotechs).

- Lessons in position sizing for biotech-prone investors.

- Baker Bros offers a concentrated portfolio in one vertical/industry sector only; as a result, its portfolio should only be construed as one of many tools to deploy for global portfolio edification.

- There is little focus on retail investors.

Fund Updates:

- The Fund recently liquidated its stake in Seattle Genetics following its merger with Pfizer.

10. Balyasny Asset Management (BAM)

Fred's Take

Profile:

- BAM was founded in 2001 by Dmitry Balyasny, Scott Schroeder, and Taylor O'Malley.

- Headquartered in Chicago, IL.

- Sixteen global offices with 1,500 team members and 150+ investment teams (approx.).

- Manages approx. $120 billion in AUM.

Key Strategic Focus:

- BAM seeks to achieve absolute returns in all market environments consistently. The firm relies on a multi-strategy, multi-portfolio manager model with six core strategies: Equities Long/Short (primarily), Macro, Equities Arbitrage, Commodities, Credit, and Growth Equity.

- BAM's Equities Long/Short business attempts to generate alpha by leveraging a fundamental, bottom-up approach to analyzing the relative prospects of companies. Equities Arbitrage seeks uncorrelated equity investment opportunities in Event and Arbitrage Strategies.

- BAM's Macro teams capture opportunities across various geographies and asset classes through a diversified mix of complementary strategies. The firm harnesses the expertise and insights of its global teams to identify opportunities worldwide.

- BAM's Commodities teams pursue alpha and diversified return streams for investors by investing across all commodities in multiple geographies. Credit teams identify opportunities across asset classes and geographies in liquid global credit markets.

- Growth equity is another focus. BAM Elevate seeks to leverage a sophisticated research and data analytics platform to detect unique opportunities in private tech and tech-enabled (high-growth) sectors and help portfolio companies prepare for an IPO.

Risk Management

- Like others listed in this article, BAM views risk management as a competitive advantage. Decades of experience navigating challenging markets, innovative technologies, sophisticated portfolio construction, and rigorous hiring and training help Chief Risk Officer Alex Lurye and his team optimize risk management for alpha generation.

- Investment teams deploy leading systems and technologies to evaluate and optimize investment portfolios quantitatively. The firm also closely monitors cash reserve levels to ensure sufficient capital under both normal and stressed market conditions.

- BAM systematically evaluates all potential stress factors to manage exposure across its portfolio. Economic and political event risk assessment allows the firm to identify and mitigate tail exposures to ensure the right balance between risk and reward, diversification across every investible sector, and the minimization of market volatility while delivering returns for investors.

- BAM ensures that even in more liquid asset classes, such as listed equities and sovereign bonds, the firm's positions do not become overly concentrated to breach liquidity thresholds. It also models liquidity scenarios during periods of market stress. It delineates the expected timescale to liquidate some or all of the positions.

Founder (Lead): Dmitry Balyasny

- Founded Balyasny Asset Management still owns more than 75% of the hedge fund. He now serves as the Managing Partner and the Chief Investment Officer.

- Balyasny started trading and got licensed as a stockbroker early; he landed a job at a tiny firm while earning a bachelor's degree in finance at Loyola University in Chicago. Early losses only served as a stimulant. Balyasny began his more mature trading career with Schonfeld Securities in 1994.

- Balyasny is a fan of writer Ayn Rand, whose philosophy prioritizes the right of individuals to pursue their self-interest. Ayn Rand's most famous novel, Atlas Shrugged - a nudge to individualism, limited government, and capitalism - inspired Balyasny's funds' names.

- Balyasny has been involved in a variety of philanthropic organizations promoting access to education and seeking to improve public health.

- Co-founding Partner and President Taylor O'Malley is a member of the firm's Investment Committee and Management Committee and serves as Chair of the Global Macro Strategy Committee. He oversees Risk, Technology, Data Intelligence, Organizational Development & Operations. The Loyola alum also holds an MBA from Harvard Business School.

- Scott Schroeder heads Business Development and the legal and regulatory aspects of the firm.

Funds:

- Atlas Macro Master Fund, Ltd. has $88.7 billion in AUM with a zero minimum investment requirement.

- The list of BAM's investment vehicles also includes Atlas Enhanced Master Fund, Ltd. (AUM: $26 bn, minimum: $5 million, now close to 2,000 beneficial owners), Atlas Master Fund, Ltd. (AUM: $4 bn, minimum: $5 million, Beneficial Owners: 236), and Atlas Private Holdings, LLC (AUM: $63 bn, Minimum: $25 million, Beneficial Owners: 3).

- The firm rarely lost money during its first 16 years of operations, delivering an annualized return of 12 percent. It managed to post gains throughout the dotcom crash and the financial crisis of 2008. However, in 2018, BAM posted significant losses, its AUM dropping from $12 billion to $6 billion; client investors withdrew their funds. BAM then cut 20% of its workforce, hired Alex Lurye (formerly chief risk officer and leader of global portfolio construction at Citadel), integrated risk management into the portfolio management process, and made new hires on the portfolio management and analyst teams to limit downside in a challenging environment for long/short equity.

h3>Portfolio: Top 15 holdings

Source: https://hedgefollow.com/funds/Balyasny+Asset+Management

- Highly diversified portfolio sees no position constituting more than 2.5% of total weight.

- The vast majority of holdings represent around 1% or significantly less of total weight.

- Many positions are familiar names (including big tech and other blue chips).

- Balyasny Asset Management's largest holding is iShares Russell 2000 ETF, itself a diversifying tool.

- The stocks differ, but the approach to portfolio construction is reminiscent of AQR's and the D.E. Shaw group's.

Minimum Investment

- Investors in BAM's funds must be accredited. The hedge fund provides investment advisory services to institutional clients and high-net-worth individuals through privately offered pooled investment funds.

- Investors include funds of funds, investment companies, trusts, estates, charitable institutions, sovereign wealth funds, high-net-worth individuals, family offices, foundations, municipalities, corporate pensions, endowments, profit-sharing plans, endowments, family offices, high-net-worth individuals, as well as other institutional clients.

- Some funds have a $5 million minimum investment requirement. Minimum investments vary by Fund - see above (Funds, section 2).

Fee Structure:

- BAM may charge fees to the Fund (not the client directly). Fees typically consist of an annual management fee based on AUM and an incentive portion calculated as a percentage of the portfolio's performance and consistent with SEC rules and regulations.

- Percentages vary depending on the Fund considered and the terms associated with the specific class of shares held.

- For information regarding actual fees charged to any specific Fund, it is best to consult the offering documents for that Fund.

What I Like/Dislike About BAM:

- Diversified portfolio can provide unique insight into defensive stakes in times of turmoil.

- Renewed emphasis on risk management.

- Resilient, quick to react and bounce back after Fund underperforms.

- As is the case for most, if not all, players mentioned in this list, Balyasny Asset Management does not have a perfect record (who does?). 2018 was a challenging year. But the Fund did outperform in times of severe market stress (dotcom crash, 2008 financial crisis).

Fund Updates:

- BAM continues expanding globally, including across Asia and the Middle East.

11. Tiger Global Management, LLC

Fred’s Take

Profile:

- Often referred to as Tiger Global, the fund was formerly known as Tiger Technology.

- Not to be confused with Tiger Management (now closed) or Tiger Asia Management.

- Chase Coleman III, who used to work under Julian Robertson, Tiger Management's leader, founded Tiger Global in March 2001.

- Headquartered in New York City, NY.

- The hedge fund manages $58 billion in AUM (September 2022).

Key Strategic Focus:

- Primarily focuses on internet, software, consumer, and financial technology companies.

- Tiger Global embraces two strategies that underpin approximately the same amount of capital: 1) The public equity offerings and 2) the private equity offerings.

- The public equity offerings leverage equity strategies to invest in publicly traded companies and outperform their benchmark. Tiger Global Investments is the firm's flagship long-short fund. Along with Tiger Global Long Opportunities (long-only), the funds constitute Tiger Global's two lead products and corresponding investment rationales.

- The private equity strategy seeks to identify leaders in their fields, i.e., high-quality companies that benefit from unique business models, cutting-edge technologies, powerful secular growth trends, and superior management. They are more likely to generate superior profitability and outperform their benchmark index.

Risk Management

- Tiger Global earned its investors $10.4 billion in 2020, a remarkable accomplishment.

- But in the first six months of 2022, the firm's lead hedge fund and its long-only fund had declined more than 50% and 60%, respectively. These losses may have eliminated as much as two-thirds of the profits generated by the hedge fund and the long-only fund since their inception. The hedge fund's loss is considered one of the largest ever incurred in the industry.

- The firm snapped a two-year losing streak with a 28.5% gain in 2023. But like many of its rivals, Tiger Global has struggled to perfect its processes and practices in risk management.

- After its 2022 underperformance, Tiger Global overhauled its portfolios, cutting stakes in pandemic beneficiaries and other speculative plays and reining in Tiger's legendary risk appetite. It trimmed high-risk investments, seeking more stable names, including big tech (Microsoft, Alphabet, Meta, etc.) and other marquis enterprises (Servicenow, etc.). Significant new positions have emerged in China, which has also underperformed for years. Tiger has also boosted its short portfolio (which profits when stocks sell off).

Founder (Lead): Chase Coleman III

- Founder and Partner of Tiger Global Management.

- Coleman started his career under Tiger Management's Julian Robertson in 1997.

- In 2000, Robertson closed his fund and entrusted Coleman with over $25 million to manage. Tiger Global is one of the 30 or more so-called "Tiger Cubs", i.e., hedge funds that Tiger Management helped launch.

- As of July 2023, Coleman's net worth is estimated at US$8.5 billion by Forbes (258th richest person in the world).

Funds:

- Tiger Global currently manages 20 pooled investment vehicles; seven are hedge funds.

- Tiger Global Investments, LP is the largest hedge fund in the family (AUM: $35 bn, beneficial owners: 750+).

- Other significant funds include Tiger Global Long Opportunities Master Fund, LP (AUM: $15 bn, beneficial owners: 450), Tiger Global, LP (AUM: $10 bn, beneficial owners: around 500), Tiger Global, Ltd., and Tiger Global Long Opportunities, LP.

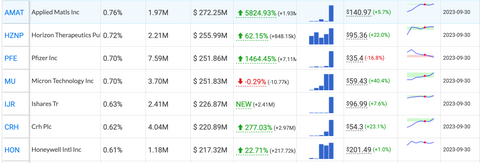

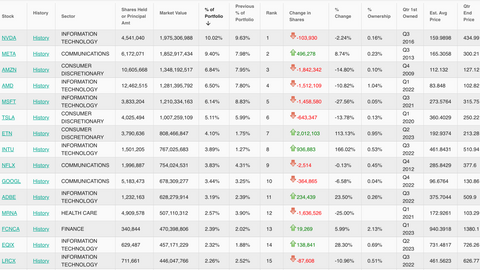

Portfolio: Top 15 holdings

Source: https://whalewisdom.com/filer/tiger-global-management-llc

- Highly concentrated portfolio, with top two positions (META, MSFT) constituting nearly 35% of total weight. The top 5 positions approach 55% of the overall portfolio.

- The vast majority of holdings are big tech or marquis names in internet, software, consumer, and financial technology.