Alternative Investments - Gold, Commodities, Bitcoin, etc.

Tag: Funanc1al Edge

Alexandria Real Estate (ARE): The Life Science “Dr. Frankenstein” Pivot — Rebuilding the Lab from the Floor Up

Alexandria Real Estate (ARE) is the king of life science labs—and one of the most punished REITs of the last five years. After a brutal dividend cut, asset write-downs, and a 75% drawdown, the founder just bought $1.3M of stock and the company is buying back shares. Is this a broken experiment—or a classic cycle-bottom setup?

Paulson Buys International Tower Hill Mines: Gold, Antimony & a $115M Fortress Bet

THM isn’t a stock — it’s a vault. With Paulson anchoring a $115M raise, gold-price convexity, and an antimony wildcard, International Tower Hill Mines is one of the most fascinating optionality plays of 2026.

$236.4M for a Portrait? Gustav Klimt Says ‘Hold My Gold Leaf’

Gustav Klimt’s Portrait of Elisabeth Lederer sold for a jaw-dropping $236.4M — the highest modern-art price ever and the second priciest artwork ever at auction. Bidding battles, art-world drama, gold leaf magic, and a portrait with more history than a Bloomberg terminal… all inside.

Coinbase (COIN): The Everything-Exchange That Institutions Keep Swiping Right On

Institutions keep swiping right on Coinbase ($COIN). Moat or mirage? We break down Base, USDC rails, derivatives, and risks—TL;DR included. Coinbase isn’t just an exchange—it’s building the on-chain OS. If the thesis plays out, premium multiples make sense. If not… bring Dramamine.

Insiders Are Buying Energy Transfer. Can the Stock Heat Up?

Insiders are loading up on ET shares, and the numbers (and pipes) keep growing. Is it time to transfer some energy into your portfolio? 🚛💰🔥

May Meritage Merit Better?

Insiders are buying, institutions are all in, and the stock sits 30% below its high. Meritage Homes may be facing a slowdown — but it's still building profits (and neighborhoods). 🏡 Could now be the time to buy in?

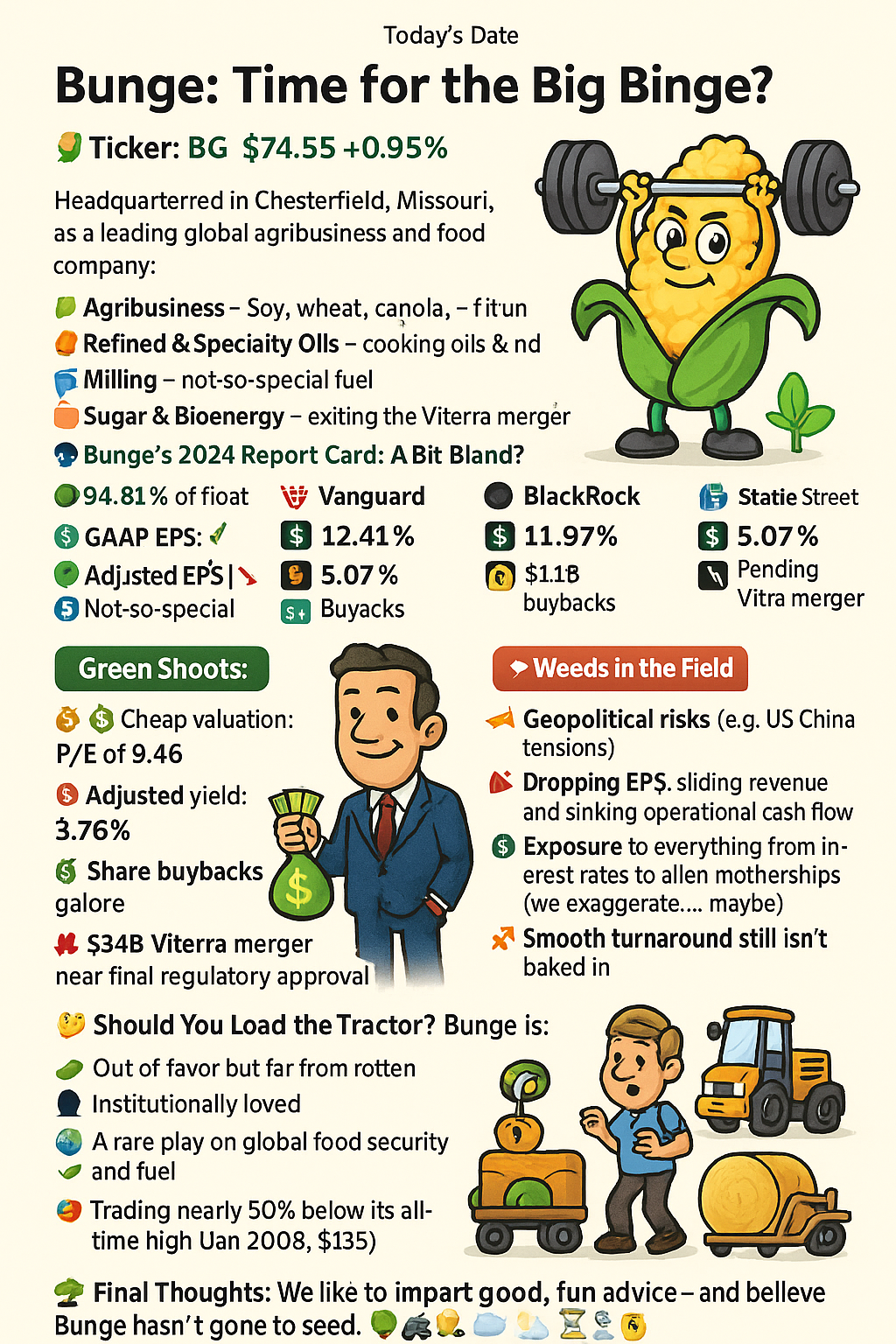

Bunge: Time for the Big Binge?

🛢️ Agribusiness giant Bunge is getting squeezed—but don’t count it out yet. With a massive merger on deck, insider and institutional support strong, and shares trading at low multiples, could it be time for a contrarian feast?

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.