Bunge: Time for the Big Binge?

As part of our series: Gold, Bitcoin, Commodities, and Agriculture: Diversification Is Key—But How Much and Where? 🌾

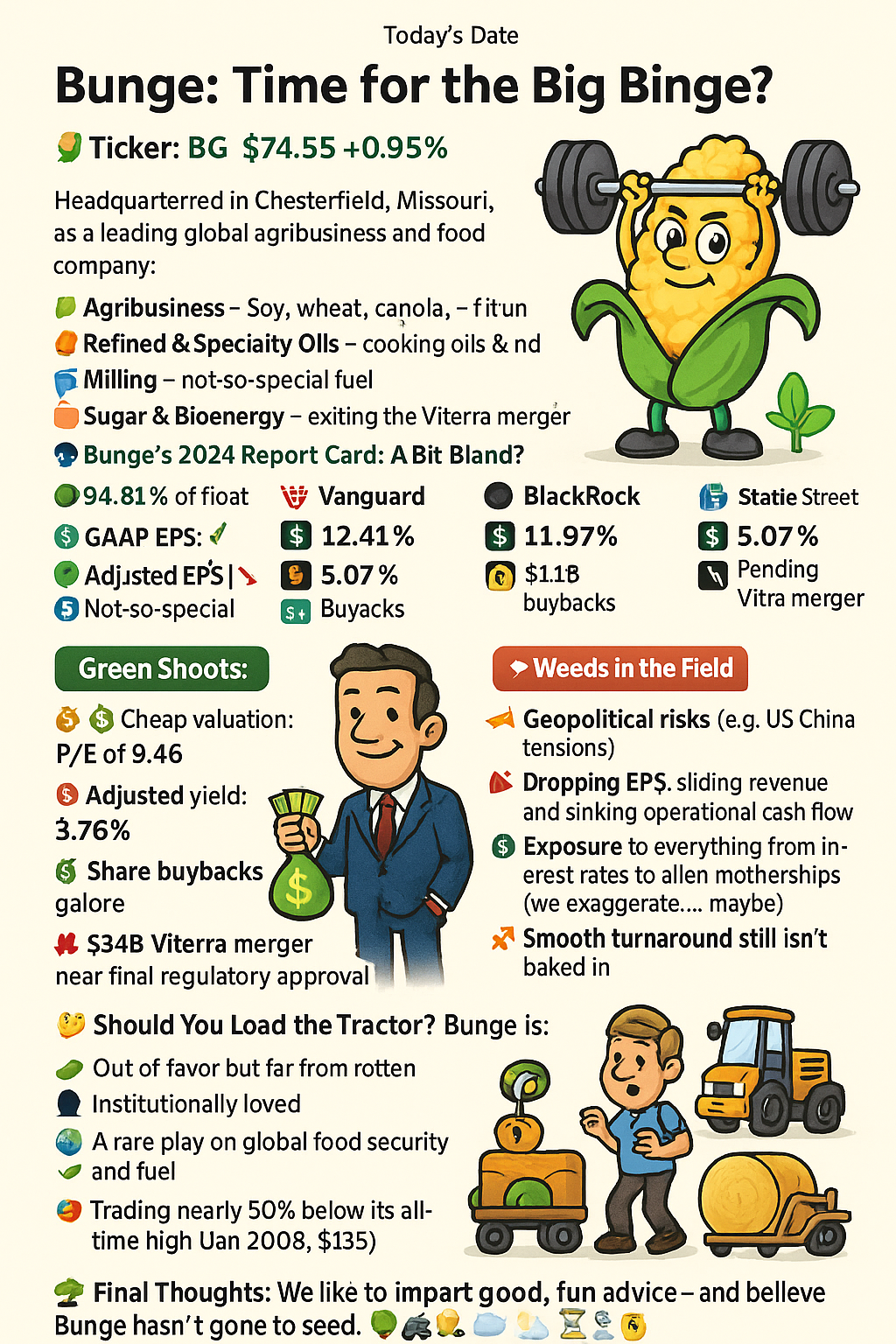

📍 Ticker: BG

💰 Price: $74.55

📈 +0.70 (+0.95%) as of Jun-06-2025, 4:10 PM ET

🚜 Meet Bunge: The Titan of Taters, Toast, and Tofu

Headquartered in Chesterfield, Missouri (that’s middle-of-the-map commodity capital), Bunge Global SA is one of the world’s leading agribusiness and food companies.

They don’t just do grains—they do grain empires.

Here’s the menu:

🥜 Agribusiness – Soy, wheat, canola… if it grows, they probably process it.

🧈 Refined & Specialty Oils – Cooking oils, shortenings, even renewable diesel feedstock (your fries and your fuel, in one).

🌾 Milling – Wheat into flour, dreams into bread.

🍬 Sugar & Bioenergy – Sweet deals and renewable spins (though they’re exiting this JV).

🐋 Big Fish Love This Grain Boat

🎯 94.81% of float is held by institutions—yes, the whales are grazing in this field.

Top Institutional Holders:

-

🏆 Vanguard – 12.41%

-

⚫ BlackRock – 11.97%

-

🧱 State Street – 5.07%

-

💼 Capital World, FMR, Geode, Invesco, DFA... the gang’s all here.

🔍 For full Institutional Ownership breakdown, see here.

So why does this stock feel so... undercooked?

🧾 Bunge’s 2024 Report Card: A Bit Bland?

Q4 & Full-Year 2024:

-

GAAP EPS: $7.99 (vs. $14.87 in 2023 😬)

-

Adjusted EPS: $9.19 (vs. $13.66 😐)

-

Agribusiness: Mixed bag – Merchandising up, Processing down

-

Refined Oils: Not-so-special in North America

-

Share Buybacks: 🤑 $1.1B in FY24

-

Viterra Merger: Still pending, but almost there

Q1 2025:

-

GAAP EPS: $1.48 (down from $1.68)

-

Adjusted EPS: $1.81 (was $3.04 😮)

-

Cash flow from operations: -$285M (vs. +$994M last year. Ouch.)

📌 Bunge’s CEO remains upbeat: “Resilient global footprint… delivering essential food, feed, and fuel.”

👉 Want the full picture? Dive into Bunge's financials here.

🌱 What's Growing, What's Withering

✅ Green Shoots:

-

🤑 Cheap valuation: P/E of 9.46, forward P/E 9.41. That’s a steal in a world full of tech bubbles.

-

💵 Dividend Yield: 3.76% – Your portfolio gets snacks.

-

🧃 Share buybacks galore

-

🤝 $34B Viterra merger near final regulatory approval. Global scale, cost synergies, and a buffet of potential.

❌ Weeds in the Field:

-

🌪️ Geopolitical risks, especially US-China tensions delaying Viterra deal

-

💸 Dropping EPS, sliding revenue, and sinking operational cash flow

-

⚖️ Exposure to everything from interest rates to exchange rates, weather events, tariffs, sanctions, and alien motherships (we exaggerate... maybe)

-

🔀 Bunge's been trying to pivot—but a smooth turnaround still isn’t baked in

Interested in another investment idea?

Check our take on UnitedHealth Group.

🤔 Should You Load the Tractor?

Bunge is:

-

🥦 Out of favor but far from rotten

-

🐘 Institutionally loved

-

🌍 A rare play on global food security and fuel

-

📉 Trading nearly 50% below its all-time high (Jan 2008, $135)

This could be a true contrarian gem—IF you have the patience and appetite for volatility.

👨🌾 Final Thoughts: Diversify Like a Farmer, Not a Gambler

In a portfolio filled with tech, biotech, and electric dreams, Bunge brings you back to Earth—literally. 🌾

Commodities and agriculture can hedge against inflation, market downturns, and bad decisions (well, some of them).

Just remember: the harvest takes time. 🌦️🌱💰

Disclaimer: We chew over data and spit out insight—but we’re not financial nutritionists. Eat your greens, do your homework, and always invest responsibly. 🥬📊

🧭 Want More Like This?

👉 Browse our Insider Purchases Center

👉 Explore our Follow the Pundits Hub: When Big Bets Matter or our Young Guns & Turnaround Stocks

👉 Dive into Stock Market Humor & Serious-ish Plays

👉 Gold, Bitcoin, Commodities, and Agriculture: Diversification Is Key—But How Much and Where? 🌾

👉 For even older brands on new missions, explore our Corporate Resurrection Series. Nope, doesn't exist anymore.

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: