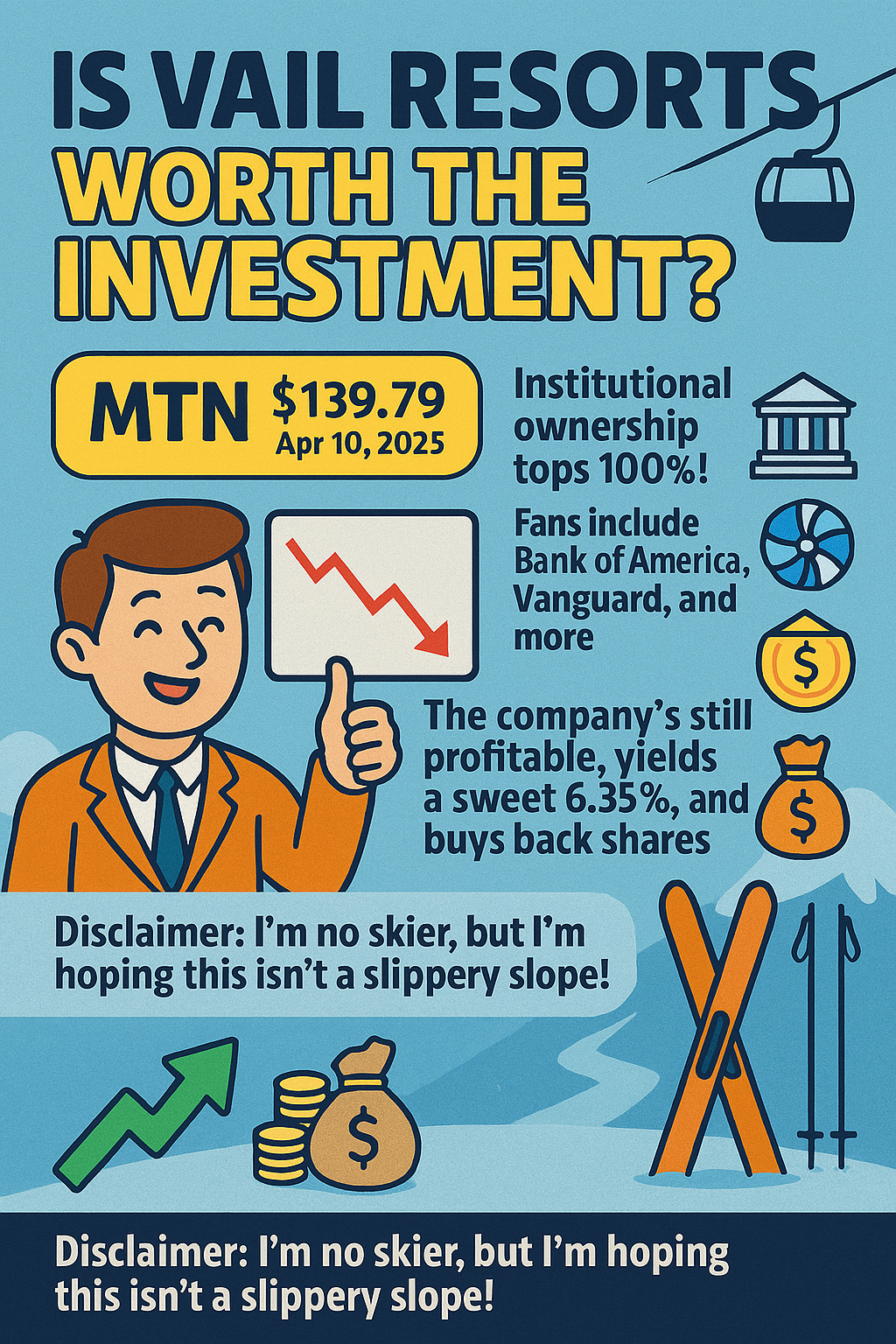

Vail Resorts (MTN): A Powder Day for Your Portfolio? Or a Slippery Slope? 🎿💸

As of April 10, 2025 - Vail Resorts (MTN) | $139.79

Let’s talk about Vail Resorts (MTN) – what if the ski giant suddenly is as much about your investment portfolio as it is about the slopes? Are these investors on a smooth ride, or is Vail’s stock just a black diamond downhill? 🤔 Let’s break it down and see if it’s a sweet spot for your portfolio—or if you’ll be slipping and sliding! ❄️🏔️

🏔️ Why So Many Investors Are Shredding for Vail

First off, Vail's institutional ownership is through the roof—but not in the way you might think. With 111% of its shares owned by funds, it’s like buying Vail stock means you are a fund! Why? Well, it’s all due to the quirky world of short sellers and reporting delays. But hey, who can argue with Bank of America owning 15%, and other giants like Vanguard, BlackRock, and Capital International Investors owning around 9% each? That's some serious confidence in those ski slopes! 🏦💰

🎿 Insiders: Not Much to See, But a Little Glimmer

Insiders have been a bit quiet—no dramatic buying or selling. But there is a silver lining! Vail's CFO, Angela Korch, has made small buys over the past year (about $160k in total at a price ranging from $160 to the mid-$170s). So, if anyone knows where this company is headed, it’s probably her. Could it be a good omen? Maybe! ⛷️

📉 From Peaks to Valleys: The Stock’s Wild Ride

Here’s the lowdown: Vail Resorts hit a peak of $376.24 per share in November 2021. But since then, it’s taken a nosedive, losing about two-thirds of its value. Ouch. But recently, the stock has been trying to show signs of life, bouncing back from a 5-year low of $129.85. The overall market is bearish, which sure doesn't help! Still, could this be the start of a bullish comeback? Let’s find out! 📈🎢

💰 The Financials: Not Too Shabby!

In Q2 FY 2025, Vail posted net income of $245.5 million (up from $219.3 million last year) and EBITDA of $459.7 million, showing an 8% increase. The resource efficiency transformation plan is expected to bring $100 million in savings annually by 2026. Throw in a 6.35% dividend yield and a share buyback worth $20 million, and it seems like Vail isn’t just skiing by—it’s sliding toward profitability! ❄️💸

⛷️ Vail's Top-Line Story: Slow and Steady Wins the Race

Vail isn’t exactly going to break the sound barrier in terms of growth. Sales have been increasing by just 3-5% year-over-year. Not blazing fast, but steady—kind of like a well-practiced skier. ⛷️ So, if you’re looking for explosive growth, this might not be your powder day. But if you want something steady and reliable, Vail could be the lift ticket you need. 🎟️

🏔️ Key Takeaways:

-

$100 million in cost savings by 2026 – they’re trimming the fat.

-

6.35% dividend that’s as steady as a well-packed ski slope. Share repurchase program – Vail is buying back shares at a decent clip.

-

As of January 31, 2025, the Company's total liquidity was approximately $1.7 billion. This includes $488 million of cash on hand. Net Debt was 2.5 times its trailing twelve months EBITDA. The balance sheet is healthy.

- The company has a P/E ratio of 20.5, so it's not outrageously expensive, but it's not exactly cheap either.

🎿 Risks You Should Keep in Mind:

-

Slow Revenue Growth: 3-5% is decent, but it’s not exactly going to the moon. 🚀

-

Weather Dependence: Snowstorms, blizzards, tsunamis, or the lack of them could make or break a ski season. Don’t even get us started on strikes! ❄️❄️

-

Competition: With plenty of other resorts around, Vail can’t rest on its slopes. Innovation is key! 🏔️

🏞️ Is Vail the Right Investment for You?

Here’s the deal: Vail Resorts isn’t booming like a powder day after a fresh snowfall, but it’s also not a wipeout. If you’re after steady dividends, a solid balance sheet, and cost-saving measures that could lead to long-term growth, Vail might just be a great fit for your portfolio. But if you’re looking for something with more zip (like a quick jump from one slope to the next), Vail might not be your high-flying stock. 🎿📊

🎿 Final Thoughts:

Don’t expect this stock to be the next big thing, but it’s no slush pile either. With its solid dividends, $100 million in cost savings coming down the slope, and a healthy balance sheet, Vail Resorts could be a safe bet for investors who want stability with a little bit of ski-lift fun. 🏔️

So, will investing in MTN be a smooth ride down or are we heading for a slippery slope? You’ll have to decide. We’re hoping for a sweet descent! 🎿💸

Disclaimer: This is not financial advice. Always do your research and consult your financial advisor before making any investment decisions. If you end up in a wild ride or face a bad snowstorm in your portfolio, please don’t blame us, and remember, we’re hoping investing in MTN is no slippery slope! 😜

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: