Let's Find Opportunities Overseas

Tag: ValueInvesting

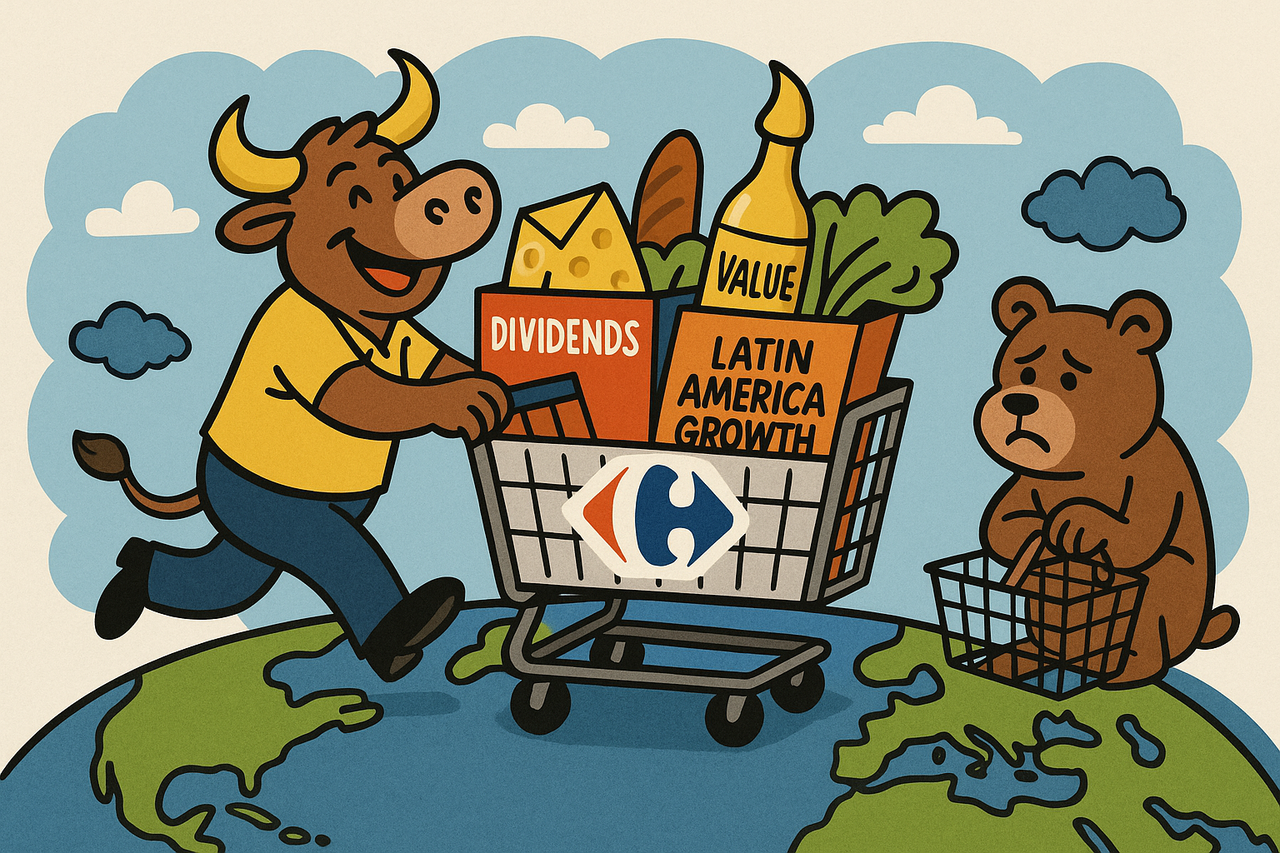

Can Carrefour Replace Checkout Lines with Bull Runs? Investors Hope So

Carrefour (CRRFY) isn’t just where you grab cheese, wine, and a pack of discount batteries. It’s a global grocery titan with 11,000+ stores, strong free cash flow, a 7% dividend yield, and bold bets in Latin America. But is it a shopper’s delight—or just another cart with a wobbly wheel?

Teva Pharma: The Funds Believe. Should You?

Hedge fund legend Stanley Druckenmiller just upped his stake in TEVA by 65%—and he’s not alone. With 9 straight quarters of growth, rising biosimilar momentum, and a “Pivot to Growth” strategy in motion, Teva might finally be ready for its rerating. We still like the sandals, but the stock may be worth more than a hike.

Coupang (CPNG): Another $37 Million Says... This E-Commerce Giant Isn’t Done Yet

Insiders and hedge funds are piling into Coupang (CPNG)—the Amazon of South Korea—but is it a smart buy or just an expensive gamble? With soaring revenue, strong growth in Eats, Play, and Fintech, and no debt, the company looks solid. But with thin margins, political unrest, and a sky-high P/E of 290, is the stock's future as promising as it seems? 🤔🚀

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.