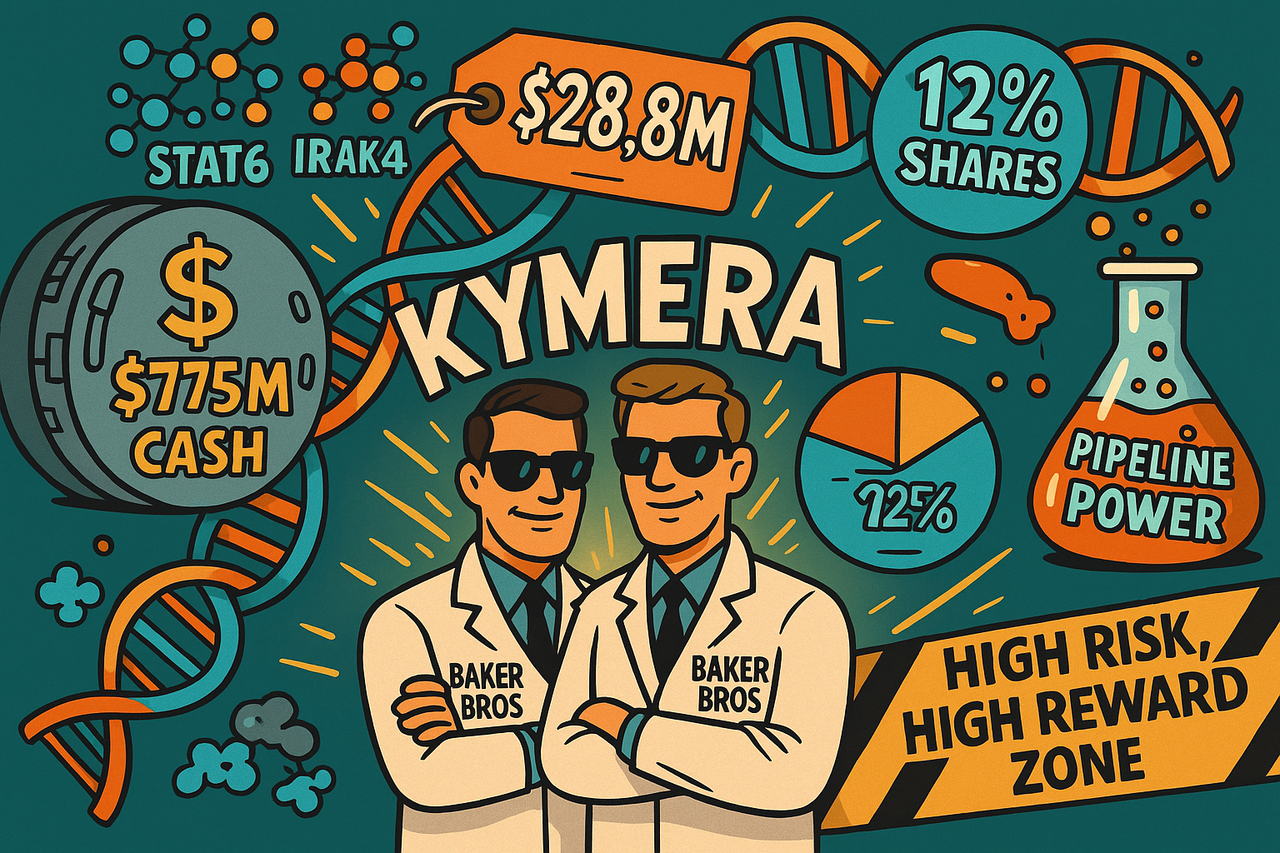

Baker Bros. Advisors Just Added to Kymera. Should You Buy the Stock?

🎯 Trigger Alert!

On June 30, 2025, Baker Bros. Advisors LP—a name biotech fans revere—bought 655,500 more shares of Kymera Therapeutics (KYMR) at $44.00, increasing their position by 12% to 6.1 million shares. That’s a chunky $28.84 million bet.

🤔 So the question is…

Should You Buy Too?

Let’s decode the signals—with humor, insight, and a dash of science fiction.

📍 Stock Snapshot

KYMR closed June 30 at $43.64, down slightly for the day (-1.09%). But it’s what’s behind the chart that counts.

📈 Institutional Backing? It’s a Party

Institutions own 114.75% of the float (hedgies, traders, arbs—oh my!). Check out this red carpet guest list:

| Holder | Shares | % Out | Value |

|---|---|---|---|

| T. Rowe Price | 6.7M | 10.29% | $292M |

| Avoro Capital | 6.46M | 9.92% | $282M |

| Wellington | 6M | 9.21% | $262M |

| Baker Bros. | 6M | 9.21% | $262M |

| Vanguard | 5.23M | 8.03% | $228M |

| BlackRock, BVF, Atlas Venture... | 🧠 | 💰 | 🧪 |

This is no meme-stock crowd—this is Wall Street’s biotech dream team.

🔍 For full Institutional Ownership breakdown, see here.

Baker Bros. Advisors LP’s latest portfolio

Summary of Baker Bros. Advisors LP’s latest portfolio snapshot, including the top 10 positions as of March 31, 2025:

🧠 Baker Bros. Advisors LP — biotech royalty based in New York — manages a high-conviction portfolio worth $9.48 billion spread across 95 positions. True to their style, they don’t diversify for the sake of it—they bet big on what they believe in.

📊 Top 10 Holdings (as of March 31, 2025):

| Company | Class | Value ($1,000s) | Change ($1,000s) | Change (%) | Shares Held |

|---|---|---|---|---|---|

| BEONE MEDICINES LTD | Sponsored ADS | 2,129,987 | -177,395 | -7.69% | 8,799,053 |

| INCYTE CORP | Common | 2,093,391 | +33 | +0.00% | 30,739,953 |

| ACADIA PHARMACEUTICALS | Common | 924,877 | Unchanged | — | 42,877,916 |

| MADRIGAL PHARMACEUTICALS | Common | 597,590 | Unchanged | — | 1,974,590 |

| INSMED INC | COM PAR $.01 | 541,506 | +37,616 | +7.47% | 5,380,626 |

| SUMMIT THERAPEUTICS INC | Common | 519,761 | Unchanged | — | 24,424,865 |

| RHYTHM PHARMACEUTICALS INC | Common | 354,147 | -30,316 | -7.89% | 5,604,483 |

| REVOLUTION MEDICINES INC | Common | 292,001 | Unchanged | — | 7,936,972 |

| KYMERA THERAPEUTICS INC | Common | 261,662 | Unchanged | — | 5,995,929 |

| ALKERMES PLC | Shares | 128,267 | +8,627 | +7.21% | 4,483,285 |

💡 Takeaway: Nearly 45% of Baker Bros.' total portfolio is concentrated in their top two bets—Beone Medicines and Incyte Corp. Despite Kymera Therapeutics being in their top 10, it represents just under 3% of total assets—a promising but smaller slice of the biotech pie.

🎯 High conviction + deep sector expertise = the Baker Bros. edge.

🧬 What Does Kymera Do?

They’re not selling jeans. They’re developing small molecule protein degraders—compounds that tag disease-causing proteins for cellular trash duty. Think biotech’s version of taking out the garbage—with science.

Current Pipeline:

-

IRAK4 Program (Phase 2): Hidradenitis Suppurativa & Atopic Dermatitis

-

STAT6: For allergic and atopic diseases

-

TYK2: Autoimmune inflammation

-

IRF5 & CDK2: In collaboration with Sanofi and Gilead

They’re going after conditions with high unmet need and blockbuster potential. But... it’s early days.

💰 Dilution? Oh Yes. But There's a Catch.

June 26: Kymera priced a $250.8M stock offering:

-

5,044,500 common shares at $44.00

-

655,500 pre-funded warrants (same price, minus $0.0001 exercise)

👉 And who snapped up the warrants?

Baker Bros., of course.

Yes, it’s dilution—but it also gives Kymera plenty of cash (pro forma, not too far from a nice, cool $1 billion), enough runway through 1H 2028.

🧪 Recent Pipeline Wins

✅ STAT6 Program (KT-621):

-

First-in-human trial = 🔥

-

90%+ degradation in blood

-

Comparable to Dupixent (the gold standard)

-

Well-tolerated, placebo-like safety profile

✅ Gilead Deal (CDK2 program):

-

Oncology focus

-

Option/license agreement inked in June 2025

✅ Sanofi Collab Update:

-

Advancing KT-485 (IRAK4)

-

$975M in potential milestones, double-digit royalties

That’s some strong pharma validation.

📊 Q1 Financials

-

Revenue? Not yet meaningful.

-

Net loss? Expected.

-

Burn rate? Manageable for now.

As indicated above, with dilution done, cash balance swells to around $1 billion—enough to advance pipeline aggressively.

Pre-offering: $775M + Gross proceeds: ~$250.8M ≈ Total: ~$1.025B (before offering costs)

That’s a very healthy war chest for a development-stage biotech 🧬—giving them ample runway into 2028, per their projections.

👉 Want the full picture? Dive into Kymera's financials here.

🧠 Why We Care About Baker Bros.

Founded in 2000 by brothers Julian and Felix Baker, the firm:

-

Manages ~$9.5B in assets

-

Holds 95 positions, but 50% of portfolio = 2 stocks

-

Typically holds investments for 3+ years

-

Specializes in biotech—and nothing else

Felix (Stanford PhD in Immunology) and Julian (Harvard grad) have served on boards of Seagen, Incyte, Acadia, Genomic Health, etc.

🧬 Translation? They really know what they’re doing.

⚠️ But Let’s Be Real

-

This is still development-stage biotech.

-

There’s no commercial product (yes, it's a repeat of 1, but 1 hurts, even if it's innovative and beautiful)

-

Valuation is frothy:

-

P/S: 57.27 (!) (that's Price/Sales)

-

P/B: 3.89 (that's Price/Book)

-

EV/Revenue: 45.53

-

💡 You're paying top dollar for potential—not profits.

💡💡 Curious about another deep oil exploration play?

Check our takes on UnitedHealth Group or even Oscar Health.

📣 Final Word

Baker Bros. just added nearly $29M worth of Kymera shares. That doesn’t mean you should bet the farm—yet.

✅ The platform is promising.

✅ The cash runway is long.

✅ The partners (Gilead, Sanofi) are legit.

✅ The talent (and shareholders) are top-tier.

But…

🚧 The stock is richly priced.

⚗️ The pipeline still needs to prove itself in late-stage trials.

💸 Bottom Line:

This is high-risk, high-reward biotech investing. Want in?

Start small, buy on dips, and consider this your speculative moonshot. 🚀

🚨 Disclaimer:

This is not financial advice. We don’t wear lab coats, and we’re definitely not Baker Bros. Advisors. (But we’d accept honorary PhDs in humor and sarcasm.)

🧭 Want More Like This?

- 🕵️ Insider Purchases Center

- 📣 Follow the Pundits Hub

- 📈 Young Guns & Turnaround Stocks — Track More Growth (and Growing-Pain) Plays

- 😆 Stock Market Humor & Serious-ish Plays

- 🌍 Explore International Investment Opportunities and value plays 💸 Cheap Stocks with (Maybe) Big Upside

- 🧟 Corporate Resurrection Series — Our special series on companies rising from the financial grave. 🎯 The “Turnaround or Toast” Series (If it still exists. We’re not sure. Ask the intern.) 📈 Biotech Bets & Innovation Radar

😂 Laugh, Learn, Invest: funanc1al.com | Funanc1al: Where Finance Meets Funny

Other articles:

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.

Got a thought? A tip? A tale? We’re all ears — drop it below.: