The Fun Lens

Meta’s Response to TikTok Controversy: A Message of Appreciation to US Lawmakers

We Will Sell Airplanes, Satellites, and Mid-Flight Plunges

To our esteemed consumers, airline customers, shareholders, regulators, and all those willing to give us a chance,

We are excited to announce a bold new direction for our company (Boeing). It is high time we diversify and secure new sources of revenue. Moving forward, please be advised that we will continue to design, manufacture, and sell our traditional lineup of airplanes, rockets, missiles, and satellites. Additionally, we are thrilled to introduce an exciting array of new experiences, including mid-flight plunges, post-takeoff blow-offs, exotic safety episodes, and flight control jams.

Move Over, Swifties: Miley Cyrus's Flowers Is Pop, Disco, Rock, Funk, Flamenco, Country, Snubs, Reaffirmation of Political & Economic Dogma, A Powerful Reflection on America's World Standing, And an Essay on Eschatology

Move Over, Swifties: Miley Cyrus's Flowers Is Pop, Disco, Rock, Funk, Flamenco, Country, Snubs, Reaffirmation of Political & Economic Dogma, A Powerful Reflection on America's World Standing, And an Essay on Eschatology

Why You Shouldn't Be a Freaking Writer

Ideas for Evolving ID's

Game Changer:

From Landing New Goals to Inspiring New Lives

The Investor

Invest Smarter to Create Wealth

The Traveler

The World Is Yours

The Entrepreneur

Best Start-up's Gotta Be Yours

The Gourmet

Feasts, Fun & Follies

The Hobbyist

Do your Dream

The Creator

Foster the Artist in You

The Ethicist

Share & Honor our Planet, Cultivate Love

One Truth at a Time

Still fighting the temporary #inflation Powell so eagerly deemed temporary a couple of years back. Once entrenched, prices hold the throne more than Jerome does the Chair of the #FederalReserve of the United States. Nip it in the bud or soon the bought kills you.

Simple: It's Whatever Makes You Happy

No time for anything else, and be sure to share the joy.

How to Be Happy, Starting... Now

What It Takes to Be Happy

Investors, Insiders, Hunters

The Best Hedge Funds for Exceptional Investment Returns

Biohaven (BHVN), Voxx (VOXX), Asana (ASAN), and Carnival (CUK, CCL) Lead Insider Purchases the Week of 10/9/2023

Largest Insider Stock Purchases Belonged in Biotech and Energy the Week of 9/18/23

Veblen, Inflation, Hedges

Travelers, Explorers, Adventurers

São Jorge Castle, Belém Tower, Pastéis de Belém, Belcanto, The Four Seasons Ritz, Lisbon, Portugal

The Merrion, the Scones, Guinness, the Arts, Dublin, Ireland

Entrepreneurs & Game Changers

Start Your Own Business and Rock the Universe!

Gourmands & Epicureans

Duryea in Montauk, NY: The Lobster Roll and The Views Rock!

Modern Apizza Still Rocks!

Zuppardi's White Clam Pizza Puts Pepe's to Shame

Better than Ecstasy, Jacques Genin's Ganaches, Pralinés, Caramels, and Pâtes de Fruit

Better than Ecstasy, Jacques Genin's Ganaches, Pralinés, Caramels, and Pâtes de Fruit enchant and tantalize. Try any of the fondeur en cholocat's friandises, and you'll most likely become a regular.

Hobbyists & PassionBeasts

Gardening for the Clueless

Artists, Creators, Revolutionaries

The News Made Personal

Climbing Arrow Ranch Sold for $136 million AND CHANGE - DISCLAIMER

Underdeveloped but gorgeous nonetheless estate in Montana went for around $135 million. I was NOT one of the bidders...

Pleaeaease, stop asking.

Twelve Things to Do in Retirement

Numbers to Numb Us

72% of Shoppers Are Trading Down

President's Jets, Z'That Count as Inflation?

The Ethicist

Pair large text with an image to give focus to your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.

Fun on Stars to Learn & Shine

Elon Musk, Much Elan = Must Emulate

FAQ

What does FUNanc!al do?

What does FUNanc!al do?

Inform, Educate, Enrich, Entertain, Elevate, Dress, Cheer, Make Happy

How do you spell FUNanc!al?

How do you spell FUNanc!al?

FUNanc!al. But the domain name is funanc1al.com.

How does FUNanc!al make a living?

How does FUNanc!al make a living?

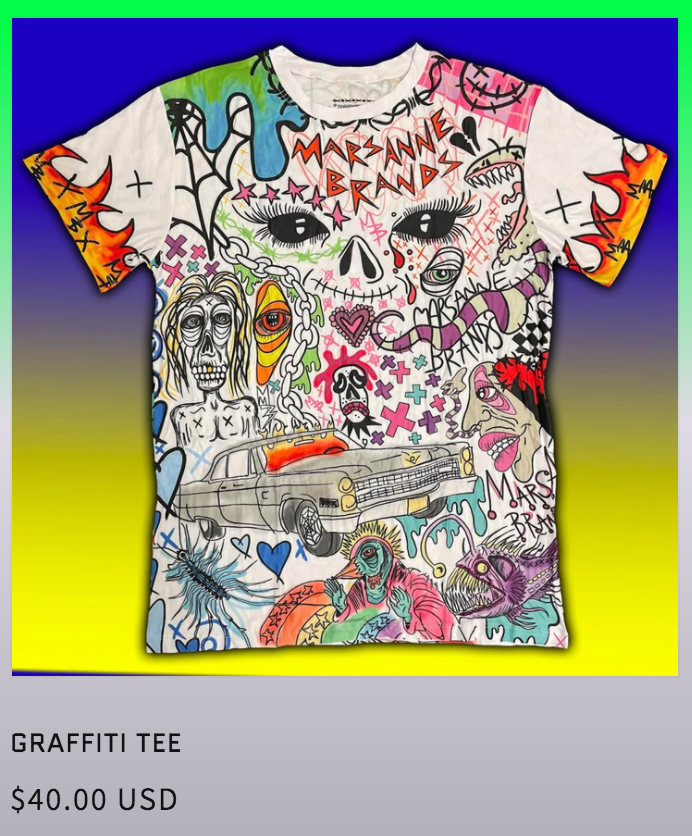

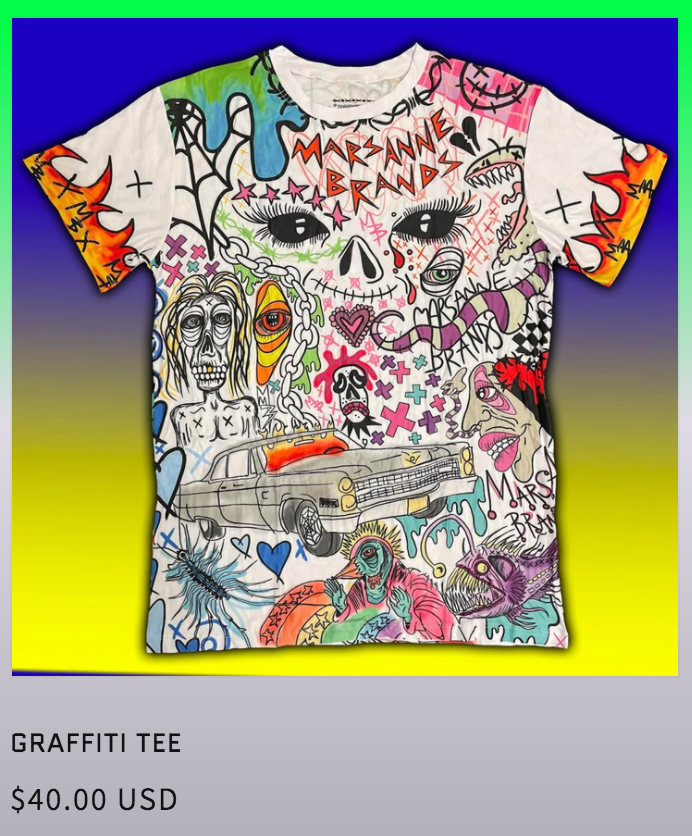

Sell subscriptions to various communities of users (investors, travelers, creators, etc.). Set up corporate portals for a custom-made FUNanc!al ecosystem stimulating similar communities at our Customers. Provide highly targeted advertising. Offer wonderful, branded garments to people who want to live the life. Promote writers, creators, and other revolutionaries. Foster synergies with affiliated websites and social media platforms (Cl1Q).

Who owns FUNanc!al?

Who owns FUNanc!al?

FUNanc!al Video Logo

Subscribe to our newsletter

New ideas, promotions, products, and sales. Directly to your inbox.

Quick links

Search

Privacy Policy

Refund Policy

Shipping Policy

Terms of Service

Contact us

About us

FUNanc!al distills the fun in finance and the finance in fun, makes news personal, and helps all reach happiness.